Table of Contents

More than four million people in Britain have chosen to be their own bosses thanks in part to the flexibility and freedom it offers.

But the self-employed are on the verge of a pension crisis and face a “second-class” retirement, a report by Interactive Investor reveals.

It found that many self-employed workers lacked the savings needed for even a basic retirement.

>How to set up a pension fund if you are self-employed and why it is important

Caught in a trap: the self-employed on the verge of a pension crisis

Around 38 percent of self-employed workers do not have any pension savings, a figure that increases to 50 percent among those under 35 years of age, according to the survey of 718 people by the investment platform.

Self-employed workers do not benefit from automatic enrollment in a workplace pension and often overlook saving for retirement.

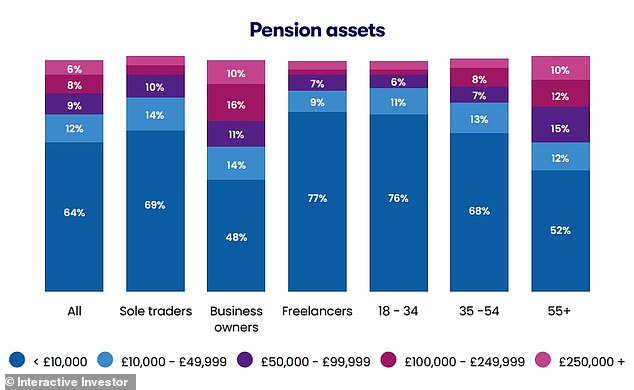

Almost two-fifths of self-employed workers do not contribute to a pension, while up to 90 per cent of self-employed workers aged 55 and over are on track for a simple retirement, with less than £250,000 in savings.

Three in five self-employed people have less than £10,000 in pension savings.

Interactive Investor’s Myron Jobson says the data “underscores the perilous financial situation many self-employed workers find themselves in.”

Second category retirement: 38% of the self-employed do not have any pension

Harsh reality: 15% of the self-employed do not have cash savings

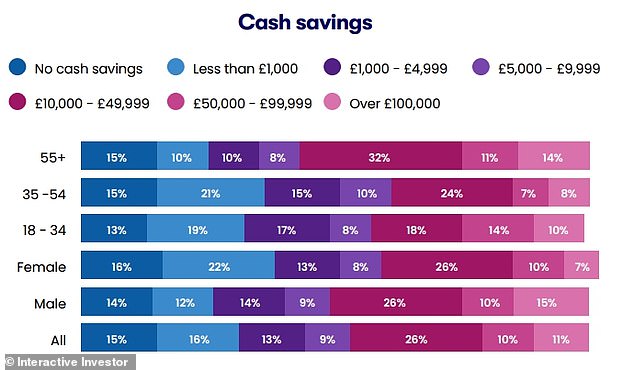

The report found that the self-employed are dangerously financially exposed and have critically low cash reserves.

About 15 percent of self-employed workers have no cash savings. Even those with cash savings might not last long in an emergency, and less than half have more than £10,000 saved.

The majority of those who are self-employed are on low incomes, with half earning less than £30,000.

They’re also older than average: Interactive Investor found that two in five self-employed workers are over 54 years old.

The result is that when it comes to retirement planning, data reveals that many self-employed workers are freezing their retirement plans or are unsure when they will be able to stop working.

More than a third of older self-employed workers will continue working into their 70s, while another 15 percent are still unsure when they will be able to retire.

Interactive Investor is calling for better pension education and the implementation of an auto-subscription model linked to self-assessment tax returns to increase pension contributions in response to the findings.

Richard Wilson, chief executive of Interactive Investor, said: “Many self-employed people and workers are on track to achieve a second-class retirement.

“A concerted effort is needed to integrate the self-employed into the pensions conversation, offering them a comprehensive level of support and resources in the same league as those available to salaried employees.”

SAVE MONEY, MAKE MONEY

Investment boost

Investment boost

5.09% on cash for Isa investors

5.05% solution after one year

5.05% solution after one year

Prosperous momentum for Al Rayan

free share offer

free share offer

No account fee and free stock trading

4.84% cash Isa

4.84% cash Isa

Flexible Isa now accepting transfers

Trading Fee Refund

Trading Fee Refund

Get £200 back in trading fees

Affiliate links: If you purchase a This is Money product you may earn a commission. These offers are chosen by our editorial team as we think they are worth highlighting. This does not affect our editorial independence.