There has been a lot of talk about the wealth that millennials and Generation Z will inherit in the coming years.

But there is another generation that has been largely ignored.

Over the next decade, Generation X will be the biggest beneficiary of the $84 trillion they will inherit.according to a new study.

Those under 43 are more likely to receive a windfall from their grandparents during that period. These legacies will be smaller than if they were from their parents.

Instead, it will be members of Generation X, ages 44 to 59, who will inherit from their parents in the short term, according to a report from Wealth-X.

Just over 46 is the average age at which wealthy Americans should inherit fortunes from their parents worth $5 million or more, it found.

Members of Generation X, between 44 and 59 years old, will receive a short-term windfall from their parents

When it comes to the ultra-rich, Americans who are on track to inherit more than $30 million will receive these funds at an average age of 47.6.

Most of the so-called ‘Great Wealth Transfer’ of $84 trillion, which will take place over the next two decades, will be among the richest families.

Separate figures from the Federal Reserve and wealth management firm Cerulli Associates estimated earlier this year that 68 percent of the wealth transferred between 2020 and 2045 will come from American households with at least $1 million in investable assets.

For starters, only 6.9 percent of households in the United States have this type of wealth.

According to Wealth-X, 1.2 million people worldwide worth $5 million or more will inherit more than $31 trillion to their families.

Of that total figure, 64 percent will come from the ultra-wealthy, defined as those with a net worth of $30 million or more.

Those worth more than $100 million, whom he defines as the “super rich,” will account for almost half of the total wealth transfer.

Meanwhile, billionaires will inherit around $5 trillion, he concluded.

The study suggested that while wealth management firms and real estate companies have largely focused on people in their 20s and 30s, they should consider seeking out Generation X clients.

“There is often a lot of talk in the media about millennial and Gen Z heirs, but in fact, Gen X will be the first to inherit from their wealthy parents,” the report reads.

Not only this, but it suggests that wealth managers should consider the difference in priorities of younger generations when it comes to investments, which focus more on the environment and healthcare, for example.

Baby boomers, those who are over 60 today, are famous for benefiting from great social mobility when housing prices were low and working conditions were strong.

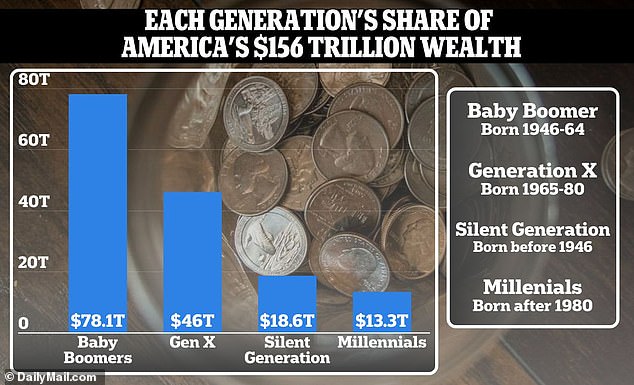

According to Cerulli Associates, American households own $159 trillion in assets.

Of this, boomers own $78.1 trillion, while Generation X owns $46 trillion and millennials own $13.3 trillion.

Over the next two decades, a gigantic transfer of wealth will occur in the United States and around the world.

Baby boomers, those who are over 60 today, are famous for benefiting from great social mobility when housing prices were low and working conditions were strong.

This wealth disparity is largely attributed to rising real estate prices, which have skyrocketed about 500 percent since 1983, when boomers were in their 20s and 30s and were just climbing the housing ladder.

This has meant that people over 60 have been able to build up substantial equity through home ownership.

But for the average household, the crushing cost of senior health care could mean that many families don’t inherit as much as they might expect, even if their relatives seem wealthy today.