Table of Contents

Wealth & Personal Finance decided to try an experiment. With the help of the AJ Bell investment platform, we pitted six portfolios, each with a different popular strategy. For each, we asked this question: if an investor had put £10,000 in this portfolio ten years ago, how much money would he have made now?

The answer surprised Laith Khalaf, head of investment analysis at AJ Bell, who was handling the numbers, and it also surprised us at Wealth & Personal Finance.

Investors are incessantly searching for the winning strategy that will give them the edge. Everyone, from everyday investors to expert money managers, is searching for that holy grail: the formula that will grow their wealth a little more than everyone else’s every year.

Many believe they have found it. Some buy a wallet and keep it for years, no matter what. Others opt for so-called contrarian investing: buying anything they don’t like at that moment. Another group aspires to what seems cheap.

We wanted to know who is right. Our portfolios are not made up of individual stocks or funds. Instead, to be more representative, they are made up of investment sectors, such as UK company funds, North American funds, global funds and technology funds. These are all sectors defined by the Investment Association, an industry body. The six portfolios were:

Stand out from the crowd: Herd investors who blindly followed their peers performed worse over ten years than those who chased performance

1) Performance Hunters

In this portfolio, we imagine that, at the start of the ten-year period in 2014, the investor invested their £10,000 in healthcare, the sector that performed the best the previous year. Then, on January 1 of each following year, the investor moved his entire portfolio to the best-performing sector of the year just ended. In other words, they were always investing in last year’s winners.

2) Buy and hold global

This investor invested his £10,000 in a global fund, which rises and falls with the global stock market. They left it untouched for a decade.

3) Egg spreaders

Here, we imagine that at the beginning of the ten-year period, the investor would split their £10,000 equally between UK funds, US funds, European funds, Japanese funds and global emerging markets funds. In other words, instead of putting their eggs in one basket, they bought a little of everything and rebalanced them each year.

4) Herd of investors

This investor started with his £10,000 in the most popular investment sector in 2013. Then, each year, he moved his money into the sectors that most people bought the previous year, regardless of performance.

5) Contraries

For this portfolio, the investor did exactly the opposite of the gregarious investors. They put their £10,000 into the least popular sector from the previous year and did the same on January 1st for the entire ten-year period.

6) Bargain hunters

In this case, the investor invested his £10,000 in the worst performing sector from the previous year each year.

And the winner is…

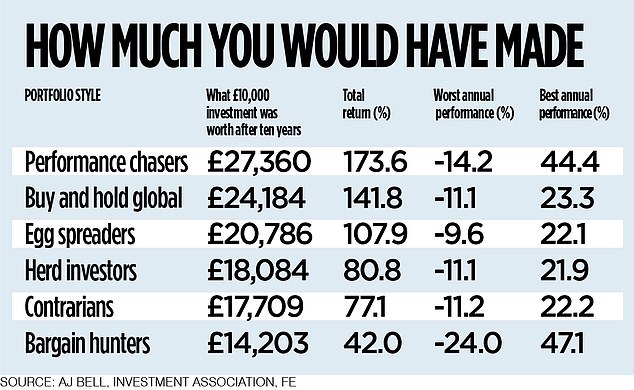

Performance hunters, and with a difference. After ten years, your £10,000 investment would be worth a staggering £27,360. Next best was the global buy-and-hold investor, with £24,184.

The biggest loser was the bargain hunter, turning the investment into £14,203. But even this portfolio managed to beat inflation: £10,000 in 2014 is worth £13,150 today.

Laith Khalaf says: ‘Everyone knows that chasing fund performance is foolish. Except for the fact that over the last ten years it has delivered fantastic results. Investors who each January had invested their money in the previous year’s best-performing fund sector would be in it, posting a return of 173.6 percent over the decade.

But was it a coincidence?

One could argue that the last decade has not been typical for investors. It was a period in which American technology companies – such as Meta, which owns Facebook, and Alphabet, which owns Google – drove much of the growth in global stock markets. His star continued to rise. Given that these drove growth year on year, it is perhaps not surprising that the yield-seeking portfolio has performed well over that period.

So, we asked AJ Bell to try the same experiment, using the same portfolio styles, over other ten-year periods. And he couldn’t find a single ten-year period in the last 30 years in which the yield seeker didn’t outperform a buy-and-hold strategy, which is what the investment industry typically recommends to ordinary investors. Furthermore, if you look further, you see that the technology sector performed the best in only two of the ten years, with India, healthcare and raw materials also performing twice as well.

So should you become a performance hunter?

Not necessarily, and for several reasons. First, past performance is no guarantee of future returns, even if a strategy has performed well for several years.

Jason Hollands, of Evelyn Partners’ investment platform Bestinvest, says: “Chasing profitability can work for a while and suddenly the top performers change. Unless you have a crystal ball, you can’t know when it will happen. It may catch you by surprise.

“If you chase performance, you are also much more likely to be exposed when bubbles arise. In the 1990s, when the dotcom bubble burst, investors who had been investing in these most popular stocks would have suffered greatly.’

Second, performance hunters have endured a stomach-churning journey. Over the past ten years, the biggest annual drop for performance seekers was 14.2 percent. But if we go back to 2000, yield hunters would have suffered a 31 percent drop, compared to a 5 percent drop experienced by global buy-and-hold investors.

Khalaf adds: ‘In 2008, a yield-seeking portfolio would have fallen 45 per cent, compared to a 24 per cent drop for a global buy-and-hold portfolio. In 2009, it would have fallen again – this time by 11 percent – while the global buy-and-hold portfolio would have recovered by 23 percent. Oh.

Third, it’s all very well to compare the performance of hypothetical portfolios. But it’s a little more complicated if you manage one of them. In the case of a buy and hold portfolio, you literally have to do just that. Simply buy a well-diversified portfolio of sectors and geographies and then wait, modifying it occasionally to rebalance or if your investment objectives or time horizon change.

But if you were to manage a portfolio of yield hunters (or one of the others, such as contrarian, pack or bargain hunter), you would have to determine which funds to buy and sell each year to stick to your chosen strategy, review your portfolio each year , and you will likely incur fees every time you buy and sell.

A commitment?

A global buy-and-hold portfolio works on the premise that global stock markets tend to go up over the long term, but that few of us effectively predict which sectors will perform best, so we might as well have a little of each and hope for the best.

For many investors – especially those who want less drama – this is probably a good starting point.

However, if you have certain beliefs (about a particular investment style or trend, or about a sector, geography, or company that you believe will do better than average), you can always modify a balanced portfolio to express them. Buy a little more of these investments, but don’t invest all your money in them in case you make a mistake.

- What is your investment style? Email rachel.rickard@mailonsunday.co.uk

Some links in this article may be affiliate links. If you click on them, we may earn a small commission. That helps us fund This Is Money and keep it free to use. We do not write articles to promote products. We do not allow any commercial relationship to affect our editorial independence.