<!–

<!–

<!– <!–

<!–

<!–

<!–

When UK investors think of US stocks, their thoughts often turn to the big US technology companies that continue to thrive on a global scale while (in most cases) delivering exciting shareholder returns.

This year, the share prices, in dollar terms, of Amazon, Nvidia and Meta – all members of the ‘Magnificent Seven’ gang of leading US stocks – have risen 22, 85 and 46 percent respectively.

Yet there are investment experts who believe the time is right for investors to think outside these major global leaders and look for value elsewhere. Among them is Maryland-based investment house T Rowe Price.

With rate cuts on the horizon and inflation falling, this independent asset manager – with more than $1.4 trillion (£1.1 trillion) of funds under its belt – argues it’s time for investors to consider the appeal of smaller companies .

Simply put, it believes that some of the country’s tech giants are overvalued in the stock market, while many smaller companies are unloved, undervalued and poised for a share price recovery.

“In some ways we are where the US market was in 1973,” says Michele Ward, US equity portfolio specialist at T Rowe.

‘Back then we had inflation problems, rising energy prices, war in Vietnam and political instability at home – and the stock market took a big hit when expectations about what big companies could deliver became exaggerated.

‘But it resulted in US smaller stocks continuing to outperform over the next decade. It feels like we’re on the same ground now.”

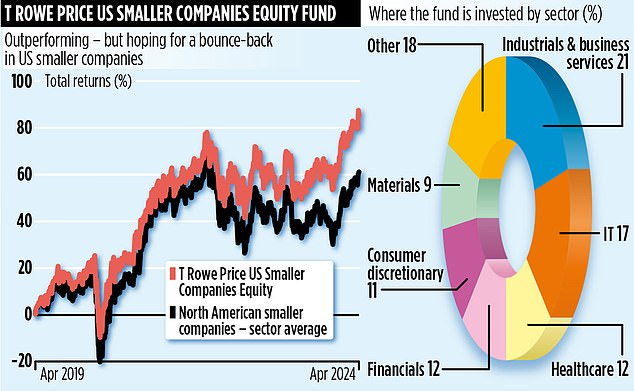

The T Rowe Price US Smaller Companies fund invests primarily in US companies that are part of the Russell 2500 – an index made up of smaller and mid-cap stocks. “It’s where companies like Tesla and Starbucks started,” Ward says. ‘There are many opportunities for asset managers to achieve alpha (excess) returns.’

If a stock’s market value means it is outgrowing the Russell 2500, the fund will continue to hold the stock, provided there remains an opportunity to make money on the investment. “We have owned the Vulcan Materials aggregates company for eight years,” Ward said. “It has a market cap of $36 billion, double the largest component of the Russell 2500.

“But it remains a quality company with quarries in 22 states and enormous pricing power. We’re going to hold out for a while.”

The fund currently has approximately 175 positions and is deliberately invested across all major sectors of the market. Individual investments rarely exceed two percent of the fund’s assets, and when they do, profits are taken.

For example, Molina Healthcare represented 2.4 percent of the portfolio at the end of 2022, but its importance has now been reduced so that the company is among the top 15.

Over the past one, three and five years, the fund has easily outperformed the average of its peer North American smaller companies, with returns of 19, 19 and 80 percent respectively. Ward says the company’s ability to deliver “alpha” is partly a result of “50 pairs of feet on the street” (analysts) looking at investment opportunities.

“Collectively,” she adds, “they held more than 2,300 meetings with companies last year, gaining deep insight into which companies to buy, sell or avoid.” The £266m fund has competitive annual charges totaling 0.95 per cent. No dividend is paid.