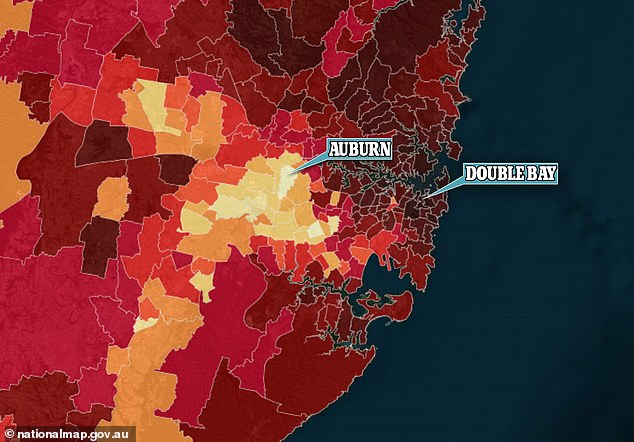

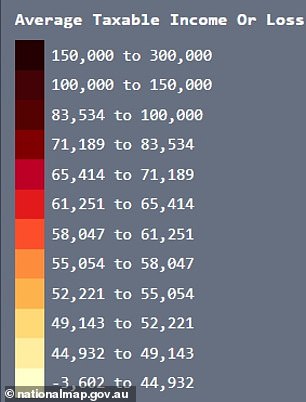

Elite professionals living in Australia’s wealthiest postcode typically earn six times what workers do in a much poorer suburb just 25km away.

The wealth gap is particularly stark in Sydney, where Double Bay’s average rateable income is $266,381 – more than doubling in just seven years in an area with a blue-green MP.

In this part of the eastern suburbs, on Sydney Harbour, professionals in the 2028 postcode are in the top 1.5 per cent of Australian taxpayers.

They also earn more than six times what workers do in Auburn, in the city’s west, where $44,109 is the average taxable wage in the 2144 zip code — or a level below the full-time minimum wage of $45,906.

It is also less than half of Australia’s average full-time salary of $98,218, with public welfare benefits classified as taxable income.

Elite professionals living in Australia’s richest postcode typically earn six times what workers do in a much poorer suburb just 25km away

The wealth gap is particularly stark in Sydney, where Double Bay’s average rateable income is $266,381 – more than doubling in just seven years in an area with one blue-green MP

Between 2014 and 2021, Double Bay’s median taxable income more than doubled from $130,873, but in Auburn, similar income levels increased by a smaller 21.6 percent from $36,273.

During that time, Australia’s average full-time salary grew from $75,613 to $90,329 – or 19.4 per cent.

In just seven years, Sydney’s richest suburb went from earning 3.6 times what a poorer suburb did to a multiple of six, data from the Australian Taxation Office showed.

Professor of labor economics Mark Wooden, from the Melbourne Institute of Applied Economic and Social Research, said wealthier people also had income from investments such as property as well as high wages, leading to a widening gap between the rich and the welfare-dependent poor.

“There’s this growing gap in terms of where people live,” he told Daily Mail Australia.

‘For high incomes, their portfolio is a bit more mixed.

‘For people on low incomes, it’s only two things: wages and public benefits – they’re also taxable income.

‘As you earn more, you try to get out of your low-income area and move somewhere more expensive, and of course housing drives that – low-income areas are the places people don’t want to live.’

HAVE AND HAVEN’T

When it comes to house values, Double Bay is significantly more expensive, with an average house price of $6.726 million compared to $1.198 million in Auburn – or 5.6 times less than the Sydney Harbour’s mid-market home.

The Covid pandemic has widened the gap between the haves and have-nots, with those who owned a house seeing a big jump in their wealth, new CoreLogic data has revealed.

“It probably has a lot to do with this widening gap between home owners and non-home owners,” Professor Wooden said.

“A distinction is made between those who have things and those who don’t.”

Between March 2020 and February 2024, property values in Australia have increased by 32.5 per cent, adding $188,000 to the median value of an Australian home, with house prices in particular rising.

The market peaked in April 2022 before falling 7.5 percent as interest rates rose.

But since February 2023 house prices have risen 9.5 per cent as a record net immigration intake of 518,000 over the last financial year boosted demand despite the Reserve Bank raising interest rates 13 times in 18 months to a 12-year high of 4.35 per cent

“As inventory dried up and migration boomed, home values began a new growth cycle in February 2023,” said CoreLogic Asia Pacific research director Tim Lawless.

The population increase saw Sydney’s median house price rise 11.7 per cent in the year to February to $1.396 million.

In Sydney’s Double Bay in the affluent eastern suburbs, professionals in the port 2028 postcode are in the top 1.5 per cent of Australian taxpayers

They also earn more than six times what workers do in Auburn (pictured), in the city’s west, where $44,109 is the average taxable wage in the 2144 zip code — or a level below the full-time minimum wage of $45,906

This would buy a house in Wentworthville, where $1.368million is the mid-point price and where $64,599 was the average taxable income in the 2020-21 financial year.

This was slightly below Australia’s median salary of $67,600 in August 2023.

Prime Minister Anthony Albanese’s home suburb of Marrickville in Sydney’s inner west has a median rateable income of $79,417, with a greater number of renters in a suburb with a median house price of $1.996 million.

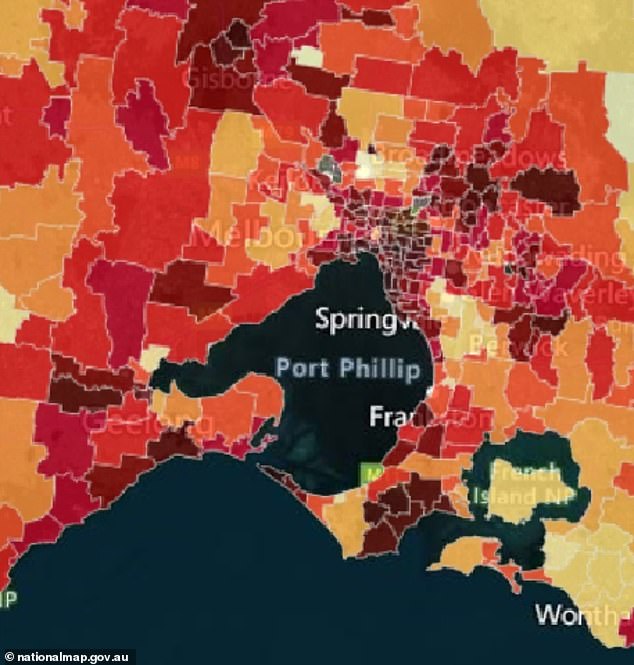

WHAT ABOUT MELBOURNE?

A similar divide exists in Melbourne between the richest and the poorest.

Toorak, the city’s richest postcode (3142) and the fourth richest in Australia, has an average taxable income of $222,967 – placing it in the top 2.3 per cent nationally.

By comparison, Broadmeadows, 33km away in Melbourne’s north, has a similar salary of $44,038 – or five times less.

Until 2016, the 3047 postcode was the suburb where Ford manufactured the Falcon sedan and Territory SUV on the production line of the factory, which has since been shut down.

Between 2014 and 2021, Toorak’s average taxable income has increased by 33 per cent from $167,407, while Broadmeadows has seen a smaller 17.2 per cent from $37,552.

The income gap between Melbourne’s richest and poorest has widened from 4.5 to 5.1 – a less dramatic gap than Sydney.

A similar divide exists in Melbourne between the richest and the poorest

Toorak, the city’s richest postcode (3142) and the fourth richest in Australia, has an average taxable income of $222,967 – placing it in the top 2.3 per cent nationally

But the difference in median house prices is much more marked, with Toorak having a median house price of $5.872 million – or 10 times the Broadmeadows median of $568,026.

Media personality Eddie McGuire grew up in Broadmeadows but lived in Toorak when he rose to fame, while his older brother Frank McGuire became the state Labor MP for their childhood area.

Unlike Sydney, one of Melbourne’s poorest suburbs is at least affordable for an average income earner.

With a 20 per cent mortgage, it is possible to buy a typical house on a salary of $87,383 and take out a mortgage of $454,421 on one income – something not possible in Sydney.

Melbourne’s median house price of $942,779 has risen by less than 4.4 per cent over the past year.

This would nearly buy a house on Reservoir in the city’s north, where $958,682 is the median home price and $58,975 is the median taxable income in the 3073 zip code.

The difference in median house prices is very significant, with Toorak having a median house price of $5.872 million – or 10 times the Broadmeadows median of $568,026 (house image)