- The country faces high debt, weak growth and high interest rates

- The UK needs “a much tighter fiscal policy than usual if we are to reduce debt”

- Britons face high taxes and looming cuts to public services

<!–

<!–

<!– <!–

<!–

<!–

<!–

The spring budget failed to address Britain’s toxic cocktail of economic problems and politicians of all stripes are refusing to acknowledge fiscal reality, the head of an influential think tank has warned.

Chancellor Jeremy Hunt delivered a Budget which he acknowledged was constrained by the Government’s fiscal rules and deteriorating key economic data.

The Spring Budget included a 2p cut in National Insurance contributions, the launch of a British Isa and another fuel tax freeze among its efforts to boost growth, while the Chancellor was forced to avoid further cuts in areas such as inheritance and income tax.

But the director of the Institute for Fiscal Studies, Paul Johnson, said on Thursday that Britain could suffer a “rude awakening” after the next election, when hitherto ignored tough spending and fiscal choices become “inevitable.”

IFS: ‘The government and opposition are joining a conspiracy of silence by failing to recognize the magnitude of the choices and trade-offs we will face after the election.’

“The combination of high debt, low nominal growth and high interest rates means we need to pursue much tighter fiscal policy than usual if we are to reduce debt,” he added.

Johnson said Britons are on course to be worse off than at the start of this term, while the country’s debt-to-GDP ratio is “at its highest level in 70 years and shows no signs of falling.”

He also highlighted the impact of rising interest rates on the cost of servicing that debt, which is “close to record highs”, while a “worrying rise” in the number of Britons having to apply for health and disability benefits is putting even more pressure on the Treasury.

GDP: OBR expects economy to grow 0.8% this year

Meanwhile, individuals face near-record levels of personal taxes and looming cuts to public spending, coming at a time when public services are under significant pressure.

“All of that was true on Tuesday and remains true today. “In all likelihood that will still be true come the general election,” Johnson said.

The Office for Budget Responsibility on Wednesday delivered a slightly more positive forecast for the British economy, which is now expected to grow 1.9 percent next year, up 0.5 percent from its autumn forecast.

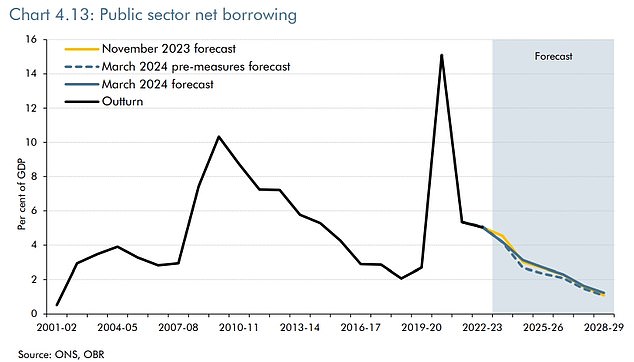

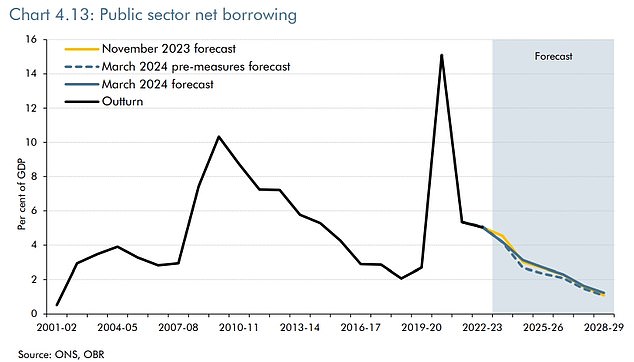

Debt: Debt looks set to increase in coming years, OBR said

Debt: Public debt, excluding Bank of England debt, is expected to reach 91.7% of GDP this year.

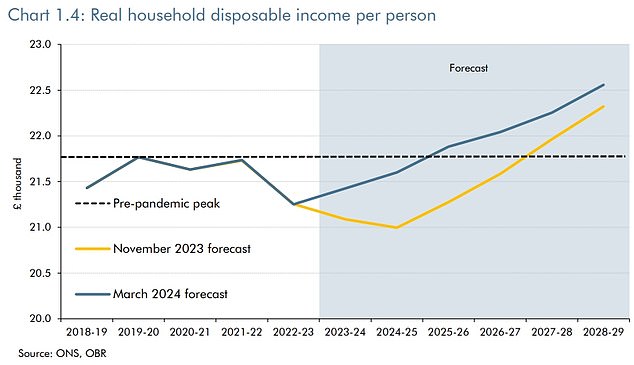

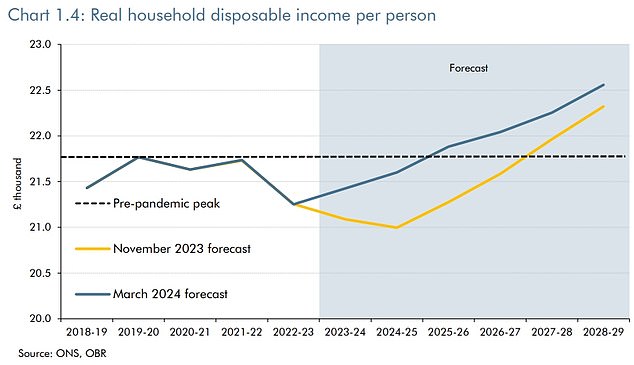

The OBR also expects household incomes to finally return to pre-pandemic levels by 2025-26, two years earlier than previously thought.

“It’s a welcome improvement, but it still means that median household incomes this fall will likely be lower than they were in fall 2019,” Johnson said. “It’s not a happy prospect.”

And forecasters expect debt to rise slowly through 2028, before falling again as a share of national income.

Johnson said: “But that requires (Hunt) to assume a whole series of improbable or undesirable things.”

The Chancellor decided the Government’s plans would not be revealed until after the next election, but Johnson said this could result in a dramatic £18bn-a-year cut in real terms.

He said: ‘If I am skeptical about Mr Hunt’s ability to deliver on his current spending plans, I am at least as skeptical of (shadow chancellor) Rachel Reeves presiding over big cuts to spending on public services.

‘The government and opposition are joining a conspiracy of silence by failing to recognize the magnitude of the choices and trade-offs we will face after the election. They and we could be in for a rude awakening when those decisions become inevitable.”

Disposable cash: Real disposable household income is now expected to grow on average 1% a year over the forecast period, the OBR said.