Pensioners facing the choice between staying on the road or giving up driving due to rising insurance costs are being urged to renew at the “sweet spot” to reduce the cost of cover.

While most drivers have faced higher renewal quotes in recent years, retirees on tight budgets could be tempted to stop driving altogether if the increases are too large to manage and, as such, lose some of his freedom.

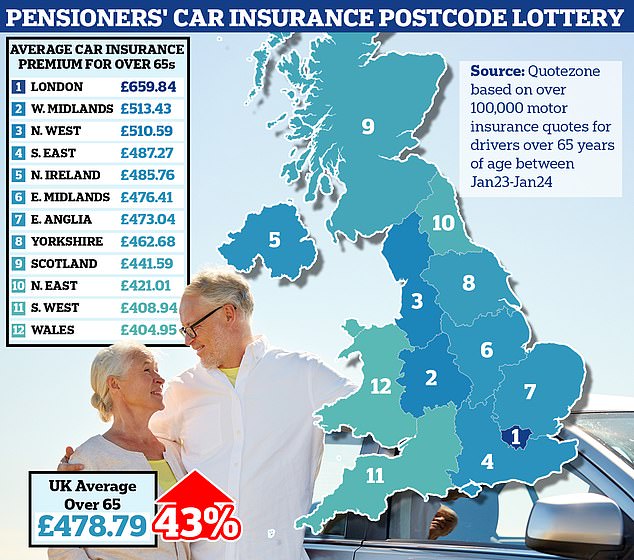

The average price of car insurance quoted for over-65s has shot up 43 per cent in the past year to reach £478.79.

However, according to comparison website Quotezone, drivers – including those over 65 – can save up to 45 per cent on premiums by renewing at the right time to eliminate some, if not all, of the recent increases.

Some drivers over 65 are charged £255 more a year than others because of where they live. Here’s a map of the retiree auto insurance ZIP code lottery that could leave older drivers facing costs so high it’s forcing them off the road altogether.

He says most drivers renew at the worst possible time: in the days before their existing policy is about to expire, and more than three and five make this mistake.

But shopping for a new policy 15 to 24 days before your existing one expires saves drivers an average of 33 to 45 percent.

This is particularly important for older drivers, as some may not go online to find better, cheaper deals.

Greg Wilson, CEO of Quotezone, says buying at the worst time is one of the The most common and costly mistakes drivers make, although allowing policies to renew automatically and not comparing prices is the biggest mistake of all.

It says: ‘Drivers usually receive notification a month before the policy is about to expire, and that’s the perfect time to start comparing prices and different providers.

“Even if they stick with their current insurer, getting quotes from other companies can help them save money by giving them the tools to negotiate and helping them verify that they are not over- or under-insured.”

Quotezone says pensioners face a car insurance price lottery.

Analysis of car insurance quotes over 12 months shows that some areas are up to 63 percent more expensive than others.

London, the West Midlands and the North West of England are among the most expensive places for older drivers to insure their cars.

Data based on a random sample of 100,000 quotes provided to drivers through comparison website Quotezone between January 2023 and the same month this year shows that pensioners face a 43 per cent increase in premiums.

The £478.79 quote is lower than the average comprehensive policy quoted for drivers of all demographics, which the website says has peaked at £956.

However, some older drivers pay much less than others depending on where they live, says the insurance comparator.

Their analysis showed that London has by far the most expensive quoted premiums for drivers over 65, at £659.

Drivers in the capital are quoted around £145 more on average than drivers elsewhere.

Pensioners in the West Midlands and the North West of England receive, on average, annual car insurance prices of £513 and £510 respectively.

By contrast, people over 65 living in Wales are quoted premiums of £405. That’s £254 cheaper than London.

| UK REGION | Premium Avenue |

|---|---|

| LONDON | €659.84 |

| WEST MIDLANDS | €513.43 |

| NORTHWEST ENGLAND | €510.59 |

| SOUTHEAST ENGLAND | €487.27 |

| NORTH IRELAND | €485.76 |

| EAST MIDLANDERS | €476.41 |

| EAST ENGLAND | €473.04 |

| YORKSHIRE | €462.68 |

| SCOTLAND | €441.59 |

| NORTHEAST ENGLAND | €421.01 |

| SOUTHWEST ENGLAND | €408.94 |

| WELSH | €404.95 |

| AVERAGE IN THE UK FOR OVER 65S | €478.79 |

| Source: Quotezone data based on over 100,000 car insurance quotes for drivers over 65 between January 23 and 24. | |

Londoners face the most expensive quoted premiums for drivers over 65, £659, the analysis revealed.

“People aged 65 and over face greater financial pressure as car insurance premiums soar 43 per cent across the country, from £334 to £478 in just 12 months – that’s £144 extra,” says Greg.

‘These older drivers are predominantly living off pensions which are coming under pressure due to cost of living side effects such as rising energy bills and food costs, making this additional pressure a concern. real.

“Although car insurance is typically at its lowest level for this particular age group and well below the average premium, car-related expenses such as fluctuating fuel costs and increases in repair bills and maintenance, are creating a challenge for seniors to keep up with the cost of driving.”

The latest official industry figures on car insurance costs show a slower rise in premiums than those offered to drivers through Quotezone.

These figures are based on the premiums drivers paid, not quotes.

The Association of British Insurers (ABI) says the average car insurance policy has risen from £478 in the first quarter of last year to £635 for the same period in 2024, an increase of 33 per cent.

The ABI says its members who are unable to offer motor cover to an older driver due to their age should automatically refer them to an alternative provider who can help them.

Jonathan Fong, general insurance policy manager at ABI, told This is Money: ‘Insurers appreciate the independence and freedom that driving can bring to their customers and, despite facing significant cost pressures, are determined to maintain the price of car insurance as competitive as possible.

“Insurance is risk-based and our data shows that the average cost and frequency of claims are higher for younger and older drivers, which may affect premiums for people in those age groups.”

Under an ‘age agreement’ in place with ABI members, insurers and brokers who cannot offer motor cover to an older driver due to their age should automatically refer them to an alternative provider who can help.

“As an industry, we are aware of the pressure that insurance costs put on household budgets and recently launched a roadmap outlining ten steps aimed at tackling insurance costs for all drivers, such as cutting or reducing the rate premium tax, which is currently 12 percent,” Fong added.

Have you stopped driving due to rising costs? Contact: editor@thisismoney.co.uk

Some links in this article may be affiliate links. If you click on them, we may earn a small commission. That helps us fund This Is Money and keep it free to use. We do not write articles to promote products. We do not allow any commercial relationship to affect our editorial independence.