This is an inflationary budget, make no mistake. Big spending with big tax cuts, which are being put not only in the hands of the needy but also the rich.

It is not the kind of targeted spending that Labor usually favours.

Do not be fooled by the illusion of a surplus, announced at 9.3 billion dollars. It’s as fake as the sugary brochures that fill budget giveaways.

Yes, it is a surplus, but it only applies to this financial year. Just for another month and a half.

Budgets usually focus on the next financial year, that’s where all the spending and tax cuts are applied.

Jim Chalmers tried to have his cake and eat it: highlighting the current financial year’s surplus but focusing attention on next financial year’s spending and tax cuts, without really dwelling on the deficit that will pay for it all.

The next financial year will also be when we fall into deficit again, to the tune of a whopping $28.3 billion. The situation worsens and reaches $42.8 billion the following year.

So enjoy the surplus while you can; You have about six weeks left before four years of deficits align year after year.

All that debt will have to be paid someday. Meanwhile, it will stoke inflation and prevent cost-of-living pressures from easing.

It will also increase the national debt, thus increasing the cost of paying interest on that debt in these times of high interest rates.

To be clear, don’t pay the debt, just pay the interest.

Treasurer Jim Chalmers (pictured) delivered his third budget on May 14.

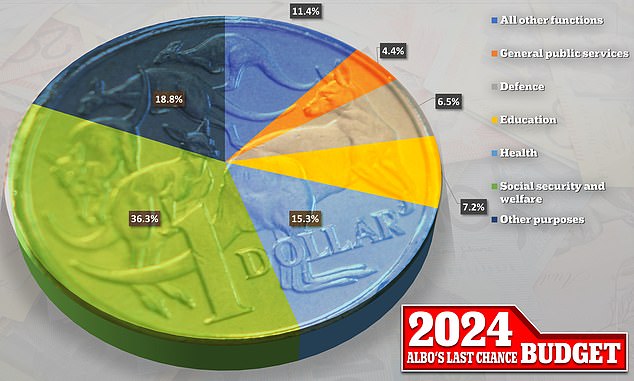

The 2024 budget shows a surplus this financial year, but deficits in subsequent years

Chalmers began his budget speech with characteristic confidence, smiling and laughing at the podium before formally reading his notes. But that’s where political overconfidence should have begun and ended.

The overall shortfalls in all future Budget estimates, along with the risk of new spending driving interest rates higher, should be enough to weigh on any Treasurer’s mind.

If Chalmers had this in mind, his confidence hid it from view.

Australia is living beyond its means, but most voters are struggling to make ends meet. How does a novice treasurer create a budget in such difficult economic times?

Many Australians feel we are already in a recession. That’s because we really are! Excluding the economic activity generated by record levels of immigration, Australia is in what is called a “per capita” recession.

Immigration may be masking a recession, but it is also putting more pressure on an already troubled real estate sector. The additional demand drives up prices and rents at a time when there is already a shortage of housing supply.

Federal Treasurer Jim Chalmers kisses his wife Laura after his budget speech

This is a problem made worse because hundreds of thousands of newcomers also need accommodation. That’s why billions of new dollars were invested in the construction sector and rental assistance in the 2024 budget.

The Treasurer also reminded the public that immigration rates will be halved next year.

There are some short-term successes in this year’s budget, designed to help struggling families make ends meet. For example, a $300 rebate for each household on energy bills costing $3.5 billion.

But the danger is that beyond this financial year and perhaps next, increased spending through the final years of the Budget will stoke inflation and put the brakes on any reduction in interest rates. In the worst case, rates would rise further before falling again.

The Albanian government hopes that you do not realize these risks or simply do not care about them, content with what they have put in their pockets now ahead of the next elections.

Treasurer Jim Chalmers delivered the budget Tuesday night, boasting a $9.3 billion surplus driven by a strong labor market and rising commodity prices.

Remember that the elections will be held in 12 months and could even be called before the end of this year. The government will worry about what the wider economic challenges will be if they remain in government AFTER the next election.

The redesign of the stage three tax cuts (aka a broken election promise in the eyes of some) delivers an average income tax cut of $36 a week for almost 14 million Australians. Money that will arrive in salary packages after July 1.

But the exact amount you receive varies greatly depending on your income. If you make $65,000 a year, you’ll get a $25 per week tax cut. If you make $150,000, it’s more like $70 a week.

The changes Labor made mean more of us will get a bigger tax cut than we would otherwise have under the tax cuts the Coalition legislated when it was in government.

It’s also true that these tax cuts will stoke inflation, with the risk of keeping prices (and interest rates) high for longer.

But we already knew all this, although the Treasurer described the tax cuts as the “cornerstone” of this his third budget. Go figure.

Let the sales pitch begin! Premier Anthony Albanese (pictured right) and Treasurer Jim Chalmers (pictured left) on the budget campaigns.

One important thing we didn’t know before tonight was the extent of the debt and deficits projected for the coming years, beyond this financial year’s $9.3 billion surplus.

The return to deficits and more debt – in a high interest rate environment – will become increasingly costly over time. Which means that future generations, or any of us young enough to be alive in the coming decades, will one day face a day of reckoning.

What could it look like? You don’t want to know. Less spending and higher taxes will probably be the inevitable recipe at some point. The Labor Party has calculated that devising such an unedifying solution now could lead to its political demise.

That’s why he has avoided doing it.

An economic miscalculation, perhaps, but politically realistic. So let’s get back to what else is in this budget.

In the run-up, the Education Minister announced changes to the way HECS payments are calculated, backdating the adjustment by 12 months.

So that anyone struggling under cost-of-living pressures who haven’t gone to university doesn’t feel like they’re funding concessions for the elites, more energy bill help was announced for everyone, as mentioned. There was more money in the budget for cheaper drugs that cost $3 billion. Superannuation was added to parental leave payments to address the gender imbalance.

Treasurer Jim Chalmers (pictured) bets on tax cuts and new spending to win over voters

When you look closely at this year’s budget, there are some advantages designed to win over voters, which is not surprising given that this is almost certainly the last budget before the next election.

But no amount of freebies can hide the fact that the Budget risks stoking inflation. In reality, they are just another reason.

If prices of everything from food and retail goods to energy bills continue to rise, almost certainly faster than any rise in wages, Chalmers risks taking the blame.

It’s not hard to see why some economists worry that the extra money the Budget puts in people’s pockets (which is likely to be spent given the financial pressures on Australians) will fuel inflation, making it harder for the Bank of Book lower rates sooner.

The Albanian government is crossing its fingers and hoping that possibility simply won’t happen. At least not before the elections.