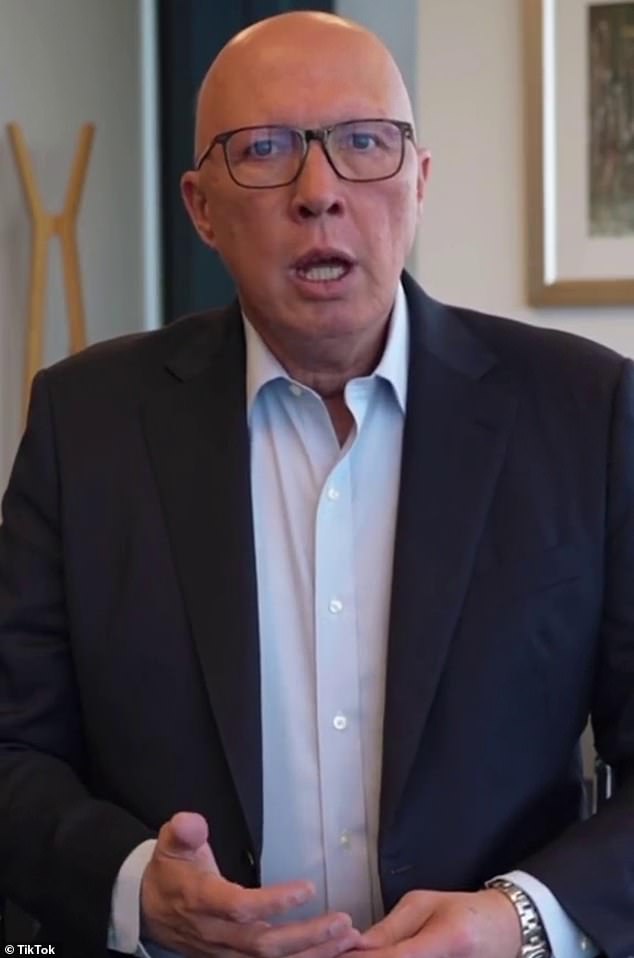

Opposition Leader Peter Dutton has revealed his plan to help increase the supply of residential property for Australians amid a national housing shortage.

The Liberal MP took to social media this week to declare he would ban foreign buyers from purchasing real estate in Australia for two years.

‘Picture this: you work hard, you stay home while everyone goes out so you can save a little more and you finally have enough to buy your first house, so you make a good offer only to be outbid by someone else. Even living in this country,’ he said.

‘It’s a situation many first home buyers are facing at the moment and that’s why if I’m the next Prime Minister I will work to ban foreign investors and temporary residents from buying existing homes for two years.

‘This will give young people a fair chance to buy their first home. It’s time to prioritize Australians who are working hard to enter the market.

“We will ensure the homes go to those who need them most, Australians.”

Around 1.2 million new homes need to be built over the next five years to meet demand, according to targets agreed by the federal and state governments.

But JLL Research and Housing Australia predicts this target will not be met with a shortfall of around 197,847 homes by 2027.

Opposition leader Peter Dutton wants to ban foreign investors from buying property in Australia for two years (file image)

Dutton said doing this would make more properties available to Australians.

The video received a flood of comments from many who agreed with Dutton that it would increase the bid, but others argued it would have minimal effect.

“Well done Pete, do ten years and you’ll be a winner,” one person said.

“Make it permanent, Australia for Australians,” added another.

“Foreign ownership should never have been allowed in the first place,” said a third.

“We need a tough leader, I hope he is the next Prime Minister,” said a fourth.

But others said the small number of foreigners buying homes was not contributing to the housing shortage.

“You try to divide it along nationalist lines by saying ‘Australians’, but it’s really about class lines: the rich with their investment properties while the young have none,” argued one.

‘We just need to build more homes. Increase supply,” said another.

“Negative leverage should be limited to a single property,” said a third, referring to the tax breaks real estate investors receive.

‘In Queensland, the problem is Sydney and Melbourne buyers bidding 20 to 30 per cent more and buying multiple homes after selling them there. Interstate shopping should be restricted,” said a fourth.

A fifth argued that banning foreign buyers would make auctions less competitive and those selling their homes would be disadvantaged.

Australian Tax Office figures show foreign buyers made a total of 5,360 purchases worth $4.9 billion in 2022-23, up from 4,228 worth $3.9 billion in 2021-22.

Buyers from China, Hong Kong and India led the pack and the average purchase price was $914,000.

However, foreign buyers only account for around 1 percent of all residential property purchases, according to official figures.

Foreign buyers are already subject to more rules than citizens when purchasing a property

The figures also show that the nationally agreed target of building 1.2 million additional homes by July 2029 appears to be in danger of falling woefully short.

Housing approvals fell 6.1 percent in August.

In September, Master Builders Australia forecast that only 1.03 million of the planned 1.2 million homes would be built, and found that all states were behind their individual targets.

The peak building and construction body said if the pace experienced over the past year continued, Australia would be short 365,000 homes.

According to Australian Bureau of Statistics data released on Tuesday, approvals for single-family homes rose just 0.5 per cent nationally, but other homes – including apartments – pulled the overall figure down with a 16.5 per cent drop. .

MBA chief executive Denita Wawn said a “strong and consistent” supply of high-density housing was key to solving the housing crisis.

“With higher density building approvals now than a year ago, the data reinforces the need for serious anti-inflationary action to encourage new home ownership and more private investors in the market to bring urgently needed new homes “, said.

New South Wales and South Australia recorded the biggest drops, with both reporting an 11.5 per cent drop in approvals.

All states saw a decline of at least three percent, month over month.

Slow planning systems, which NSW Premier Chris Minns has routinely blamed for lackluster progress in his state, along with “apartment-killing taxes”, were driving the decline, according to the Council Australian Property.

In August, only 1,200 apartments were approved in blocks of nine or more floors, compared to 2,500 in July.

“We need to increase the number of homes approved and ensure a strong supply of apartments to move towards our housing targets at scale,” said the council’s Matthew Kandelaars.

“But the reality is that it has never been more difficult and expensive to get apartments off the ground.”

All Australian states are lagging behind nationally agreed housing targets, new modeling has revealed (pictured, builders in Sydney)

Maree Kilroy, senior economist at Oxford Economics Australia, said the data suggested the worst was over for independent housing approvals, but apartments were another story.

Housing construction is forecast to increase by six per cent this financial year, he said.

“Mortgage rate cuts will help release pent-up housing demand, while traction on the housing policy front will become increasingly obvious…however, industry capacity will act to limit the speed of recovery,” Mrs. Kilroy said.

Approvals for detached homes increased in NSW by 3.9 per cent, in WA by 1.9 per cent and in Victoria by 1.4 per cent.

But they fell in South Australia by four per cent and in Queensland by 3.9 per cent.