Table of Contents

Is the unloved UK stock market finally having its moment in the sun?

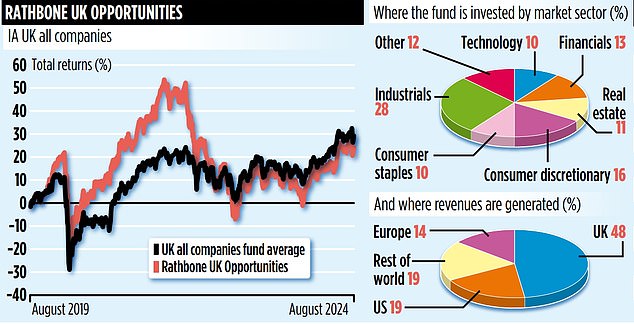

Bank of America’s influential fund manager survey names the UK as the preferred investment region for the next 12 months, and Alexandra Jackson, who runs the £46m Rathbone UK Opportunities Fund, hopes it will finally be a chance to shine.

“It’s a sea change,” he says. “Since 2016, the UK has been in disgrace – Brexit, successive crises including Covid-19, the war in Ukraine and rising inflation. No wonder global investors collectively thought ‘why bother?’ That sentiment is now decisively changing.”

Jackson has stood by the UK through tough times. She began her career at Rathbones’ flagship fund, the Global Opportunities Fund, and in 2014 became co-head of the new UK Opportunities Fund, which she took the reins of three years later.

She says she applies the same standards to the UK fund as she does when investing globally.

“We identified factors common to stocks that outperformed across economic cycles,” he says. “Applying these factors to the UK market raises the bar for the companies we invest in – they are not just ‘good for a UK company’, they are world class.”

With just 53 holdings and few restrictions on investment options, Jackson can afford to be choosy. He says he has plenty of good options, even with a significant number of companies relisting in the US or going private.

“If we had 200 or 300 stocks in the portfolio, I’d be nervous. But 50-60 high-quality companies is still very achievable,” she explains, describing the spate of foreign acquisitions of UK shares as a sign that companies here are “grossly undervalued”, and that the recent successful IPO of computing company Raspberry Pi is “a great first step” towards positive sentiment in the UK.

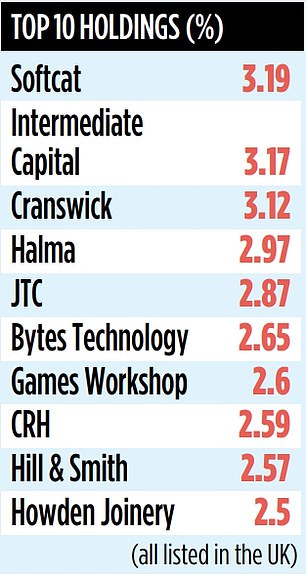

Jackson’s holdings are eclectic. Among his top ten are bespoke kitchen company Howden Joinery, IT infrastructure firm Softcat and fantasy role-playing expert Games Workshop.

He recently reduced his exposure to AI-related software stocks as he believes the tech boom has come early. He has, however, taken a position in online greeting card provider Moonpig, hoping to unlock value in the company’s offering of “experiences” – vouchers for gifts and spa days – that can be marketed to its 500,000-strong subscriber base.

Jackson’s approach offers UK-oriented investors something different, including a strong tilt towards mid-caps. It’s a fund for those who believe British companies could grow, but it’s less likely to appeal to income seekers as it yields just 2%.

The fund’s performance is likely to be different to the full index of UK companies because it does not own entire sectors. For example, it does not own banks, tobacco companies, oil companies, mining companies, utilities or telecoms companies.

“It’s not an ideological issue,” Jackson explains. “It’s a result of not finding stocks in the sectors that fit our process. We’ll keep looking, though.”

As the shares are based in the UK, revenues are global. Only 48 per cent of the fund’s revenues are generated in the UK, 19 per cent in the US, 14 per cent in Europe and another 19 per cent in the rest of the world.

“We like the geographic diversification this division offers in volatile geopolitical times,” Jackson says.

UK Opportunities is up 14 per cent this year, just above its benchmark UK All Companies index, but is down 11 per cent in three years and up 23 per cent in five.

- Rathbone UK Opportunities has an ongoing charge of 0.63 per cent and its stock code is B77H7W3.

DIY INVESTMENT PLATFORMS

AJ Bell

AJ Bell

Easy investment and ready-to-use portfolios

Hargreaves Lansdown

Hargreaves Lansdown

Free investment ideas and fund trading

interactive investor

interactive investor

Flat rate investing from £4.99 per month

Saxo

Saxo

Get £200 back in trading commissions

Trade 212

Trade 212

Free treatment and no commissions per account

Affiliate links: If you purchase a product This is Money may earn a commission. These offers are chosen by our editorial team as we believe they are worth highlighting. This does not affect our editorial independence.