Table of Contents

My daughter spent hours queuing online to buy tickets to see Oasis next year. When she finally got to the final screen, the tickets were more than double the advertised price.

He panicked and bought two, but now he is overdrawn and regretting his decision. Will he be able to get his money back?

SW, via email.

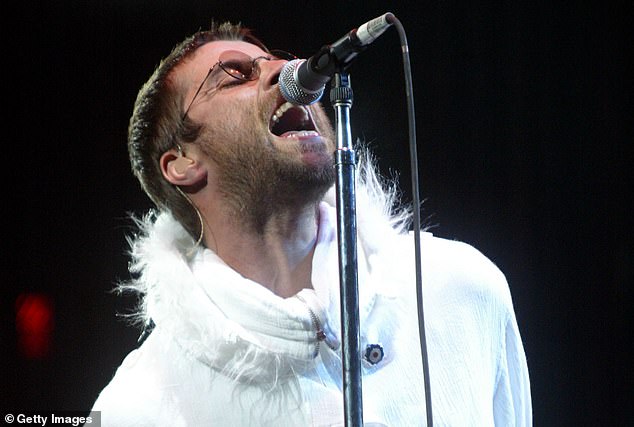

Surge: A reader’s daughter was caught up in ticket-buying chaos when so-called “dynamic pricing” caused advertised ticket prices to double.

Dean Dunham responds: In 2022, Ticketmaster, the official ticket seller for Oasis concerts, introduced “dynamic pricing,” which sees the cost of tickets rise with the level of demand. So if, as we saw with Oasis, thousands of fans buy tickets online, prices go up.

In the past, Ticketmaster has defended this practice by saying that it was introduced to stop scalpers and ensure that a greater percentage of the money goes to the artists. While this may be true, it is my view that this practice is potentially contrary to consumer law.

The Consumer Protection Regulations against Unfair Commercial Practices (more commonly known as the Consumer Protection Regulations) set out a number of practices that are prohibited or could be classified as “unfair” to the consumer.

“Bait advertising”, where a trader advertises goods or services at a certain price to attract the attention of consumers knowing that they will ultimately sell them at a higher price, is one of the practices classified as potentially unfair.

This is what happened here with Ticketmaster’s dynamic pricing model. Your daughter and many other Oasis fans clearly saw an advertised price (or perhaps a price range) for tickets and decided that amount was affordable or acceptable, so they began the long online journey to make a purchase.

Then, at the last minute, when he reached the end of the online queue, he was presented with the opportunity to purchase tickets, but at a much higher price.

So if your daughter regrets her decision enough to want a refund, she could ask Ticketmaster to cancel the ticket order and give her her money back, arguing that the contract is “unfair.”

If that doesn’t work, you could file a chargeback claim, if you paid with a debit card, or a Section 75 claim (under the Consumer Credit Act 1974) if you paid with a credit card. In either case, you’ll have to say you want a refund, as the contract is unfair.

Taxi bill for cancelled buses

My local bus company often cancels a service, meaning I have to wait an hour for the next one or otherwise take a taxi into town. What are my rights? Can I send the company the taxi fare?

A. Finch, Newmarket.

Dean Dunham responds: When a flight is delayed or cancelled, you are potentially entitled to compensation under UK261 and have similar rights under the Consumer Rights Act 2015 for train and ferry delays.

However, bus passengers do not have the same protection in relation to local travel, as unfortunately the Consumer Rights Act does not cover compensation rights when it comes to bus delays.

or cancellations. Instead, your recourse is to complain directly to the bus operator.

If applicable, request a refund of the taxi fare and point out that you had to bear the cost due to the delay or cancellation of the bus.

Be prepared for them to say no, as merchants (including bus operators) will often avoid paying for what we call consequential losses, such as a taxi fare incurred.

If you purchased a ticket in advance, the bus operator will refund the amount.

The Traffic Commissioners are the regulators of the bus industry and the registrars in their Traffic Areas of all local bus services (as defined in Section 6 of the Transport Act 1985). They have powers under that Act to take action against operators who consistently provide late services.

Penalties range from fines to the maximum penalty of revoking a bus operator’s franchise to operate a bus service.

For this reason, it is worth mentioning in your complaint to your bus operator that if they do not refund your taxi fare, you will make a formal complaint to the Traffic Commissioners, as this will likely be very persuasive.

SAVE MONEY, EARN MONEY

Boosting investment

Boosting investment

5.09% cash for Isa investors

Cash Isa at 4.92%

Cash Isa at 4.92%

Includes 0.88% bonus for one year

Free stock offer

Free stock offer

No account fees and free stock trading

4.84% cash Isa

4.84% cash Isa

Flexible ISA now accepting transfers

Transaction fee refund

Transaction fee refund

Get £200 back in trading commissions

Affiliate links: If you purchase a product This is Money may earn a commission. These offers are chosen by our editorial team as we believe they are worth highlighting. This does not affect our editorial independence.