Table of Contents

Ken Brown is worried he will be forced out of his home if his home insurance premium continues to rise.

The 71-year-old retiree who lives near Rapid City, South Dakota, has seen his annual coverage with American Family skyrocket nearly 110 percent in the past year: from $1,665 to $3,490.

Ken has a fixed retirement income, while his wife Valeria, 68, still works to help cover the insurance bill and a host of other rising costs.

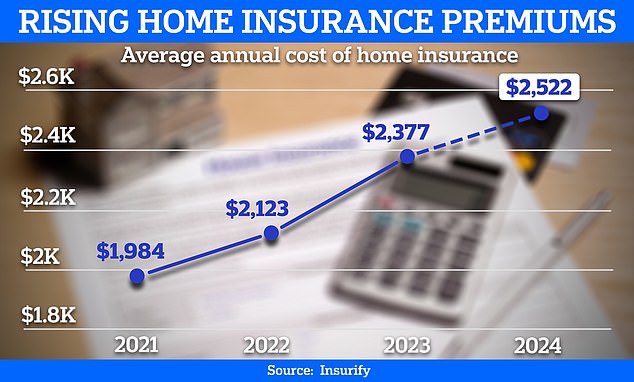

Grim new forecasts say U.S. home insurance rates will hit a record high this year, with the typical annual premium rising 6 percent to $2,522 by the end of 2024.

But for Ken, and many others like him across the country, the reality is much worse: they are the hardest hit by an industry in crisis.

To see the average price increases in your state, hover your mouse over a computer or point your finger at a smartphone in the chart below…

Your browser does not support iframes.

The shock increases

In recent years, home insurance premiums have increased across the United States.

This has been driven largely by escalating natural disasters, insurers withdrawing from certain states – reducing competition – labor shortages and higher rates for home repairs.

Rising costs mean coverage is becoming increasingly unaffordable for many Americans, and Ken worries it may ultimately be unsustainable.

“I’m worried about next year, because they talked about the increases being equivalent to this year’s,” he told DailyMail.com.

‘If there is no relief in sight and they don’t take it seriously, they are going to force me to leave my house. We could get an apartment, but it would only be temporary and rents are going up too. “We just don’t know what we’re going to do.”

The couple built the house for about $212,000 in 2004, and it has now been assessed for value at about $417,000. South Dakota is seeing an influx of wealthy residents from Colorado and California, Ken said, which is driving up home values in the state.

He hasn’t filed claims for the past year and said American Family has also reduced what it will cover for hail damage to his home.

“What bothered me most about the price increase is that there was no notice, they never sent me an email,” he added.

Ken believes there needs to be some level of control over the extent to which companies can increase premiums due to catastrophes.

‘Why should I pay more for my insurance when there are people who live on the Gulf Coast and suffer losses year after year? “There has to be some level of control over the percentage increases per year or the government will have to get involved and cover a portion of their losses,” he stated.

“Because otherwise people will be forced to go out into the streets.”

The typical annual premium will rise to $2,522 by the end of 2024, according to predictions from insurance comparison platform Insurify.

Insurers withdraw from the states

Jeff Waack also believes that higher authorities will have to intervene if premiums continue to rise.

‘I hate that everyone’s insurance goes up, but I think people need to pay more reasonably for their probability of suffering a disaster. If you build next to a place that floods every year, then you should pay more insurance for that,” he told DailyMail.com.

‘I pay a little more to help everyone, it’s okay. But not this madness that has happened.”

Jeff is the treasurer of the board of directors of a condominium in West Hollywood that has 54 owners living in it.

This year, the construction insurance quote increased from approximately $23,000 to $116,000, a monumental 400 percent increase.

“Our management company sent proposals to 12 different insurance companies this year and all of them refused to give us a policy, including LIO Insurance, which we have been with for the last four years,” Jeff said.

In California, as well as Florida, insurers have withdrawn from the state, while others have refused to renew existing policies.

Jeff Waack said he “almost fell off his chair” when he saw how much the insurance premium had increased this year for a condo building in West Hollywood.

Jeff said the West Hollywood building is not in an area at particular risk from wildfires, hurricanes or flooding.

State Farm, California’s largest insurance company, announced last month that it would stop offering insurance to 72,000 households due to the increased risk of natural disasters and the effects of inflation.

“It’s very disturbing and feels like a slap in the face,” he said.

‘I don’t understand why they suddenly say you’re not a good risk. We have paid our dues every year on time. If you wanted to increase our rates by 5 or 10 per cent, we could have dealt with that.’

West Hollywood is an urban area and is not at particular risk for wildfires, hurricanes or flooding, Jeff added. He has lived in the building for decades and says the last complaint he remembers was filed with the board 18 years ago.

As a last resort, the condo was forced to purchase coverage from a company not admitted in California, meaning it sells policies that are not backed by the state.

“I practically fell off my chair when I saw the price,” Jeff said. ‘It seems as if they randomly chose a number high enough to improve their results. They know that they have us on the brink of the abyss and we have to try.

‘They could have said $200,000 and what would we have done? We had no other option.

An industry in ruins

While premiums are rising across the country, some states are worse off than others.

In particular, Florida’s home insurance crisis has intensified in recent years as costly natural disasters have made it difficult for insurers to remain profitable in the state.

More than a dozen home insurance companies have filed for bankruptcy since 2019, major insurers have said they will not renew thousands of policies, and Farmers Insurance pulled out of the state entirely last year.

Hurricane Ian caused $109.5 billion in damage in 2022. This was the third costliest disaster to hit the United States and the most destructive in Florida history, according to the National Oceanic and Atmospheric Administration (NOAA).

To fill the gap left by major companies refusing to provide coverage, state insurers of last resort are increasingly becoming the only option. In Florida, the state-run Citizens Property Insurance Corporation is now the largest in the state.

“Higher-risk areas may become uninsurable,” said Betsy Stella, vice president of carrier management and operations at comparison platform Insurify.

‘However, when there is demand, a supplier usually appears. The question will be: at what price?

Financial guru Suze Orman told DailyMail.com earlier this year how she waived coverage on her seaside condo in Florida after her insurer quoted her $28,000 a year.

The financial advisor and author owns her Florida condo outright, meaning she was able to give up the cover.

She said: ‘I’m not going to pay $28,000 a year when the insurer will probably contest any claim they receive anyway. Luckily I have money to self-insure. $28,000 for a 2,100 square foot condo. Are you kidding me?’

According to a recent report According to the Consumer Federation of America, more than six million homeowners do not have homeowners insurance, equivalent to about $1.6 trillion of unprotected value.

Jewell Baggett, 51, sits in a bathtub in the rubble of her home in Horseshoe Beach, Florida, which Hurricane Idalia reduced to rubble in August 2023.

What can you do to reduce your premium?

The cost of coverage has increased due to the losses insurance companies have experienced due to hurricanes, wildfires, tornadoes and floods, explained Greg McBride, chief financial analyst at Bankrate.

Under the way insurance is regulated, insurers generally have to get state approval to raise premiums, but when massive disasters occur, that usually means insurers take on large losses first and then have to raise premiums to recoup them. , said.

There are steps you can take to potentially lower your premium, said Greg McBride, chief financial analyst at Bankrate.

But there are steps you can take to potentially reduce your premium.

McBride recommends comparing several insurance companies to compare prices and see if you can get a better deal.

“Keep in mind that ‘better deal’ may still mean a higher premium than what you paid last year, but not as high as your current provider,” he said.

Increasing your deductible could help mitigate the increase somewhat, he added.

A deductible is a set amount of money you pay out of pocket for damage to your home before your insurance pays the rest.

Most homeowners insurance policies have a minimum deductible of $1,000.

But McBride cautions that unlike auto insurance, where raising the deductible can have a more noticeable impact on premiums, with homeowners insurance you often need to take on a lot more risk before seeing a big impact.

“Be sure to notify your insurance company if you have recently made improvements that may reduce the risk of loss: a new roof or impact glass windows in hurricane zones, for example,” he added.