The typical first-time buyer will pay £150 less a month on their mortgage today than someone who bought a year ago, new research from Rightmove reveals.

The property portal said the average monthly mortgage payment for first-time home buyers is almost £150 lower than the peak in July 2023.

On average, the mortgage payment for a typical first-time buyer is now £949 a month, compared with £1,096 in July 2023, when rates peaked.

Someone buying with a 20 per cent deposit can get a typical rate of 4.76 per cent today, compared with a whopping 6.12 per cent last year, the property portal claims.

A sea change? Mortgage payments for first-time buyers are almost £150 lower on average than when interest rates peaked last year, according to Rightmove

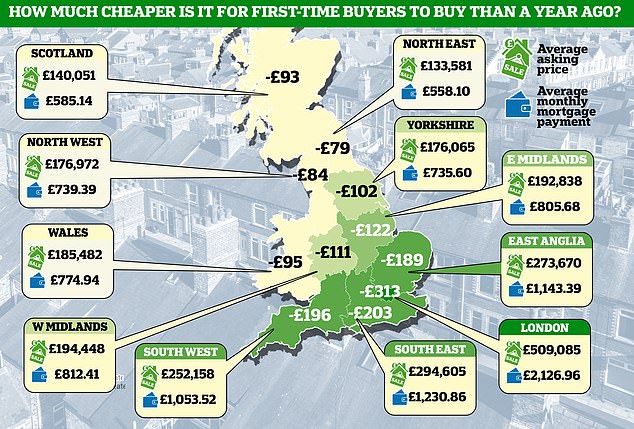

This means that depending on where in the country someone buys, they could see even greater savings on their monthly mortgage costs compared to if they had purchased last year.

For example, first-time buyers of a £500,000 property in London with a 20 per cent deposit will need a £400,000 mortgage.

At a rate of 4.76 per cent and repaid over 25 years, that would equate to £2,283 a month.

At this time last year, that same first-time buyer would have secured an average rate of 6.12 per cent and would have been paying £2,607 a month – a monthly saving of £324.

However, those already on fixed contracts are warned not to refinance their mortgage to a cheaper one unless they are comfortable paying the early repayment charge on their current mortgage.

According to Rightmove, while first-time buyers in London will experience the biggest cash savings, those living in the South West will see the biggest proportional drop in spending.

The South West of England was the only region where property sales prices for first-time buyers are now lower than in July 2023.

In the South West, the average asking price for a first-time home buyer is £227,191, according to Rightmove.

According to Rightmove, first-time buyers are paying £1,053 a month to buy a typical home in the area. This is £196 a month less than last year or 16 per cent less in percentage terms.

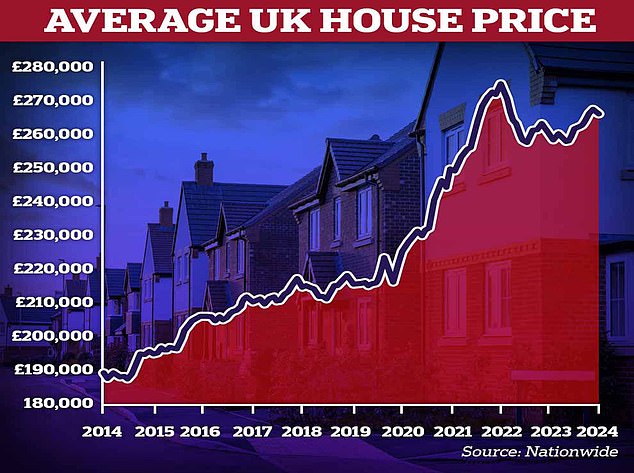

Ups and downs: House prices fell 0.2% month-on-month in August, after adjusting for seasonal effects, but annual house price growth continued to increase slightly

Some first-time buyers across the UK may also be feeling a little wealthier than they did at this time last year.

Average wages have risen 4 percent since July 2023, outpacing the rate of inflation, which rose 2.2 percent in the 12 months through July.

Average wages have also outpaced average house prices. The median house price rose 2.4 per cent in the 12 months to August, according to the latest figures from Nationwide.

Tim Bannister, property expert at Rightmove, said: ‘It’s early days, but the acceleration in mortgage rate falls since the Bank Rate cut at the start of the month means that home-movers are starting to see some tangible improvements in affordability, particularly compared to the peak rate period of just over a year ago.

‘A saving of almost £150 on monthly spending for a first-time buyer compared to last year is significant, and while there will be many hoping for even further reductions soon, we are heading in the right direction ahead of the autumn season.’

Are more first-time buyers looking to buy now?

It seems that falling mortgage rates are encouraging many to take the plunge, many of whom are likely to be first-time buyers.

At the beginning of the year, mortgage rates were at a similar level to the current one, and although they rose again briefly between February and May, they never reached the levels recorded in 2023.

Mortgage approvals for home purchases rose from 60,611 in June to 61,985 in July, according to the latest data from the Bank of England.

This brings mortgage approvals to their highest level since September 2022, the month the disastrous mini-budget was unveiled under former Prime Minister Liz Truss.

Paul Dales, chief UK economist at Capital Economics, said: ‘Although the mortgage stock is still only 0.6 per cent higher than a year ago, it is clear that earlier falls in mortgage rates are supporting demand.

‘The rise in mortgage approvals for home purchases suggests that mortgage lending will continue to grow in the coming months.’

First-time buyers snapped up a record 48 percent of homes sold in London in the first half of this year, according to property firm Hamptons, up from 41 percent in 2023 and 28 percent a decade ago.

Hamptons says the lower rates have saved them £273 a month on mortgage payments than if they had bought in the first half of 2023.

In addition to falling mortgage rates, first-time buyers will also be tempted by the fact that some lenders are relaxing their lending criteria.

More recently, Halifax announced it will make £2 billion available to first-time buyers who need to borrow up to 5.5 times their annual income.

To be eligible for what Halifax calls its “first-time buyer boost,” buyers will need a total household income of £50,000 or more, which will need to come from employment.

They will also need to purchase a property with a deposit of at least 10 percent.

Some links in this article may be affiliate links. If you click on them we may earn a small commission. This helps us fund This Is Money and keep it free to use. We do not write articles to promote products. We do not allow any commercial relationships to affect our editorial independence.