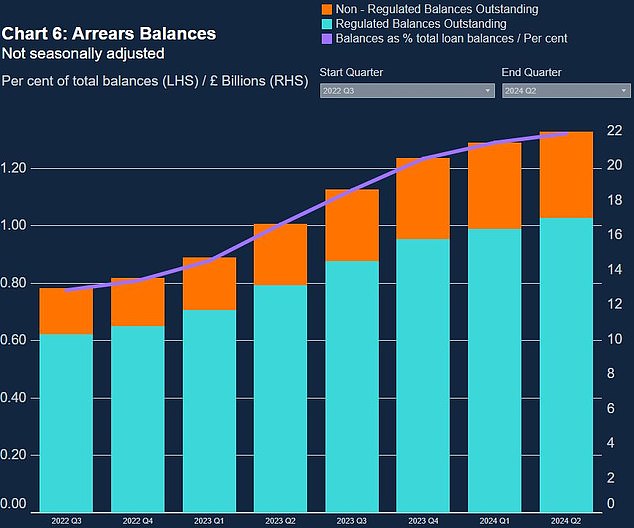

- The value of outstanding mortgage balances in arrears is now £21.9 billion

The level of mortgage defaults has reached a 10-year high, according to the latest figures from the Bank of England.

The value of outstanding mortgage balances in arrears rose 2.9 percent in the three months through June, compared with the previous three months, according to the central bank.

Mortgage arrears occur when people fall behind on their mortgage payments. It has become more common since mortgage rates began to rise in 2022.

Total arrears rose to £21.9bn, up 32 per cent from a year ago and the highest level since 2014.

> Step-by-step guide for first-time buyers

Struggle: With higher interest rates, mortgage borrowers have come under increasing pressure and this has resulted in the value of outstanding mortgage balances in arrears increasing.

However, while the value of arrears has increased, the number of new arrears cases has fallen, according to the Bank of England.

In June this year, the number of mortgages in arrears was 5.3 percentage points lower than the level recorded in the same period last year.

The Bank of England data is in line with that of trade association UK Finance, which also found that bad debt cases fell slightly from 109,900 at the end of March this year to 109,700 at the end of June.

It is also worth noting that the level of non-performing loans is much lower than in the period after the financial crisis. In 2009, the number of mortgages in default was about twice as high as it is today.

> Best Mortgage Rates for First-Time Buyers: How Long Should You Lock Them In?

Tom Cuppello, chief risk officer at independent consultancy Broadstone, believes the worst is over.

“The impacts of significant increases in mortgage rates continue to resonate throughout the secured lending market,” Cuppello said.

‘As more borrowers have left cheap fixed rates in recent years and faced a significant increase in their mortgage payments, it was inevitable that we would see an increase in arrears in the system.

‘Almost two years on from the ill-fated Mini Budget, we are likely to be reaching the end of the road for homeowners facing these issues, especially given the time taken to prepare and the recent decline in rates.

‘This is reflected in the slowdown in the volume of arrears and the decline in the number of new cases of arrears.’

A repossession is when a lender takes control of a property after a borrower has defaulted on their mortgage, in order to sell it.

Eric Leenders of UK Finance added: “It is particularly encouraging to see that the number of households in mortgage arrears is stabilising, and the ‘payment shock’ for those exiting fixed-rate mortgage deals appears to have peaked, with savings levels starting to rise again.

“However, we know this will not be the case for all households and it is important to note that anyone who may be experiencing difficulties can contact their lender for assistance.”

The Bank of England also revealed that the number of new foreclosures between April and June fell by 5.6 percent compared with the previous three months.

A repossession is when a lender takes control of a property after a borrower has defaulted on their mortgage, with a view to selling it. This is a last resort after other options have been explored.

In the three months to June there were 1,980 foreclosures, a third more than the previous year.

The trade association says that while arrears levels remain low by historical standards, it expects the numbers to continue to rise this year.

Cupello warns that there is still no room for complacency among banks and mortgage lending companies.

“Lenders must continue to ensure that they support the long-term financial interests of their customers, especially as the economic and fiscal environment remains volatile,” Cuppello added.

‘The Government’s Mortgage Charter, the arrival of the Consumer Levy and other additional FCA rules demonstrate that the legislative direction is aimed at protecting borrowers in uncertain economic times.’