Millions of older Americans face a financial challenge that could threaten their retirement plans: outstanding student loan debt.

While many may consider student debt a problem faced primarily by younger workers, there are 2.2 million people over the age of 55 with outstanding loans.

If they still owe student loans when they retire, they risk having the government take up to 15 percent of their Social Security retirement payments at source if they default on their debts.

Social Security retirement payments vary, but average $1,907 a month, according to officials. Losing 15 percent of that would be $286.

Having the burden of student debt on older workers is hindering their ability to retire comfortably, according to new insights from the New School’s Schwartz Center for Economic Policy Analysis.

The burden of student debt is hindering older workers’ ability to retire comfortably

Indebted older workers face paying off their student loans well into their old age, according to report found.

On average, workers ages 55 to 64 take nearly 11 years to pay off their student loans, while those 65 and older will need 3.5 years, Federal Reserve data shows.

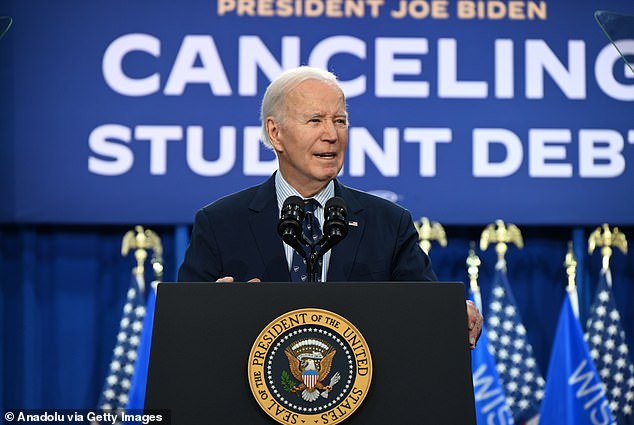

While the Biden administration has so far forgiven $167 billion in student loans for 4.75 million Americans, that help is only for certain groups, such as those who work in the public sector.

Millions of seniors still have student debt. In fact, the report found that middle-income workers ages 55 and older make up the highest proportion of all student loan borrowers.

“Older debtors lack the characteristics of younger debtors: they have more years of work left in the “optimal age” (to earn a salary), more time to save for retirement, making it difficult for them to reach the ” “promised” returns on your investment,” the report says.

The debt burden also falls disproportionately on lower-income people.

The Schwartz Center found that half of all debtors over age 55, who are still working, earn less than $54,600.

This means it may be harder for them to save since they still have to put money toward loan repayment and they may have to rely more on Social Security once they reach retirement age.

Others may not be able to retire at all, joining the millions of Americans over 65 who are still working.

About 14.9 percent of these workers over age 55 have not completed the degree for which they applied for loans, according to the report.

This means that not only do they have to repay the loans, but they must do so without having benefited from the increased income expected from completing a degree.

“These older workers face the double effect of debt and lack of greater purchasing power, which makes them especially precarious,” the report reads.

President Biden has forgiven $167 billion in student loans, but many Americans are still in debt.

When a borrower defaults on a student loan, the report adds, the loan becomes “delinquent.”

Delinquent federal student loans are one of the few conditions that cause Social Security benefits to be garnished, reducing retirement income, he said.

The report’s authors want new laws to prevent this from happening.

It suggests that policy interventions, including eliminating Social Security garnishments and improvements to the student loan forgiveness program, could ease the debt burden of older workers and help them save for retirement.

He highlights the Biden administration’s Savings on a Valuable Education (SAVE) Plan, which shortens the timeline for debt relief and means borrowers only make monthly payments when their income exceeds a certain threshold.

The report comes as Americans increasingly question the value of a college degree and whether the potential cost of an education is worth it.