A trendy Melbourne nightclub has been criticized for the “ridiculous” surcharge it adds to all EFTPOS transactions.

Brown Alley nightclub on Lonsdale St in the CBD charges a whopping five per cent (more than double what most establishments charge) to use bank cards.

The customer who posted about the charge on Reddit said he had referred the nightclub to the Australian Competition and Consumer Commission (ACCC).

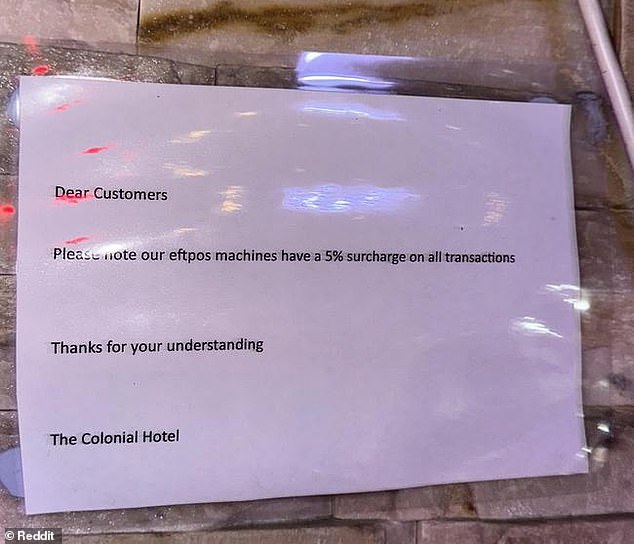

Alongside an image informing revelers of the high charge, the sign read: ‘I discovered that Brown Alley nightclub now charges a ridiculous 5 per cent surcharge… for all card payments. Wow.’

The sign reads: “Dear customers, please note that our EFTPOS machines have a 5 percent surcharge on all transactions.” Thanks for your understanding.’

Brown Alley nightclub (pictured) on Lonsdale St in the CBD charges a whopping 5 per cent (more than double what most establishments charge) for using bank cards.

The customer wrote: ‘I expressed my disapproval to one of the managers at Brown Alley, very politely.

“And yes, he was just dismissive and rude, stating that it’s our club, we can do whatever we want.”

According to the ACCC, “businesses can charge a surcharge for paying by card, but under the Competition and Consumer Act, the surcharge must not be higher than what it costs the business to use that type of payment.”

“If a company charges a surcharge for card payments, it must be able to demonstrate the costs on which it is based and follow the rules on the display of the surcharge.”

Last week, a consumer expert revealed how customers are hit with hidden surcharges for using their debit cards, costing them up to $140 in fees each year.

Finder head of consumer research Graham Cooke told WhatsNew2Day Australia that many restaurants, bars and retail businesses do not disclose their rates to customers.

“People are using more credit and debit cards due to the greater availability of EFTPOS machines,” he said.

Earlier this month, a cash support movement launched Cash Out Day, which saw queues of residents outside banks waiting to withdraw money.

The most popular way to pay by card is tap-and-go, which accounts for 95 percent of in-person transactions and is the most expensive.

While inserting a card into an EFTPOS machine typically costs the merchant less than 0.5 percent per transaction, using contactless payments with Visa and Mastercard can amount to between 0.5 and 1 percent each time for debit cards and between 1 percent and 3 percent for credit cards. .

On a $100 purchase, the average added cost is 28c for EFTPOS, 52c to use the Mastercard network, 47c to use Visa and a whopping $1.88 for digital payments provider Square.

While some larger businesses absorb these costs into the price of their goods and services, many smaller businesses include customers with banking fees.

Even some larger companies charge for using plastic.

While supermarkets Coles and Woolworths absorb fees into their prices, discount retailer Aldi charges a small standard fee on all card transactions.

Cooke said it was “almost impossible to use plastic in Australia and not have to pay one of these fees”.

The nightclub, which is part of the Colonial Hotel, published a note detailing its charges

Some commenters on the Reddit post about the Brown Alley club, which is part of the Colonial Hotel, said they doubted the ACCC would do anything, but the original poster said that wasn’t the case.

‘Every report I have done has been followed up, I understand that sometimes it is easy to think that big government oversight is not working, but the ACCC is not.

“These things take time though, if you really want to know if they do something or not, check back later.”

WhatsNew2Day Australia has contacted Brown Alley for comment.