Table of Contents

Shares in Imperial Leather owner PZ Cussons fell after Nigeria’s currency plunged.

Shares fell 15 per cent, or 15.7 pence, to 87.5 pence after the consumer goods firm posted a £96m loss for the 12 months to the end of May, compared with a £62m profit a year earlier. The Manchester firm was hit by a 70 per cent fall in the naira against the dollar in that period.

Group revenue fell by a fifth to £528m and the annual dividend was halved.

Trading in the UK personal care sector improved as growth for Carex hand soap picked up. The company said it was making progress on selling its St Tropez tanning brand and may offload its African division.

Nigeria woes: Shares in PZ Cussons fell 15% after the owner of the St Tropez tanning brand posted a £96m loss for the 12 months to the end of May, compared with a £62m profit a year earlier.

The FTSE 100 fell 0.7 per cent, or 56 points, to 8,254 and the FTSE 250 fell 0.5 per cent, or 109 points, to 20,835.

Morgan Stanley is helping Reckitt Benckiser with negotiations to sell home care assets including Air Wick and Cillit Bang that could be worth 6 billion pounds or more, Bloomberg said, in a deal expected to be completed next year.

Reckitt declined to comment on “market rumours or speculation” yesterday. Its shares closed up 1.24 per cent, or 57 pence, at 4,667 pence.

Legal & General has agreed to sell homebuilder Cala Homes to US-based private equity firms Sixth Street Partners and Patron Capital for £1.35bn. Shares in L&G fell 3 per cent, or 6.5p, to 222p.

AstraZeneca’s Fasenra has been approved in the United States to treat a rare organ-damaging disease.

But its shares fell 0.9 percent, or 112 pence, to 11,856 pence. Rival GSK settled two more lawsuits in California claiming its discontinued drug Zantac causes cancer.

It also reported positive results from a trial in which its vaccines against shingles and respiratory diseases were administered together. But the shares still fell 0.3 percent, or 5.5 pence, to 1,604 pence.

Deutsche Bank recommended clients buy shares in IT services provider Kainos despite warning last month that weaker stock prices would hit annual spending. However, the shares fell 0.5 percent, or 4 pence, to 876 pence.

Analysts at HSBC have downgraded precision instrument supplier Spectris to hold from buy, cutting their target price by 650 pence. The shares fell 4.6 per cent, or 130 pence, to 2,676 pence.

Online card retailer Moonpig warned that consumers were continuing to hold back on spending, sending its shares down 1 percent, or 2p, to 200.5p.

M&C Saatchi was boosted by higher advertising spending in the United States, Europe and the Middle East and the sale of loss-making subsidiaries, which helped the company return to a profit of 11.3 million pounds after a loss of 5.1 million pounds. Shares rose 1 percent, or 2 pence, to 193.5 pence.

But foreign exchange firm Argentex posted lower sales as lower volatility in currency markets affected customer spending.

Group revenue fell 4% to £23.9m in the first half of 2024, with the company posting a loss of £1.7m, after a profit of £4.8m a year earlier. Shares fell 5%, or 1.75p, to 34p.

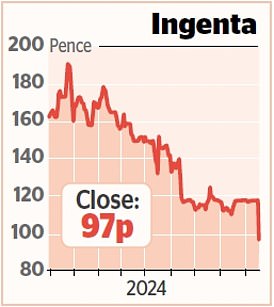

Christie’s, which provides professional business services, issued a profit warning due to delays in completing trading. The shares fell 11 percent, or 12.5 pence, to 97.5 pence.

Creo Medical has sold a 51 per cent stake in its European subsidiary for £25m to Chinese firm Micro-Tech.

The medical device supplier will use the proceeds to bolster its finances. The shares rose 13 percent, or 3.75 pence, to 32.50 pence.

DIY INVESTMENT PLATFORMS

AJ Bell

AJ Bell

Easy investment and ready-to-use portfolios

Hargreaves Lansdown

Hargreaves Lansdown

Free investment ideas and fund trading

interactive investor

interactive investor

Flat rate investing from £4.99 per month

Saxo

Saxo

Get £200 back in trading commissions

Trade 212

Trade 212

Free treatment and no commissions per account

Affiliate links: If you purchase a product This is Money may earn a commission. These offers are chosen by our editorial team as we believe they are worth highlighting. This does not affect our editorial independence.