London has regained its crown as Europe’s largest stock market after political turmoil in France sent shares in Paris tumbling.

In a big boost for the City, data compiled by Bloomberg showed UK shares are valued at £2.51 trillion.

That’s more than the collective £2.47 trillion valuation of those listed in France after a rout last week that saw Paris’ Cac 40 index fall more than 6 per cent.

It was one of the biggest weekly falls in more than two decades and means London is back in first place, having lost its crown to Paris 18 months ago.

However, the figures highlight the difference between the main European stock markets and the United States, where Apple and Microsoft are valued at almost £2.6bn each.

Capital assets: In a big boost for the City, data compiled by Bloomberg showed UK shares are valued at £2.51 trillion.

The largest company in the London market is AstraZeneca, worth £193bn, while in Paris, LVMH, owner of Louis Vuitton, is the largest at £320bn.

Stocks in Paris have been hit since President Emmanuel Macron last week called for snap elections following a blow in European polls that saw his Renaissance party defeated by Marine Le Pen’s far-right Rassemblement National (RN).

Analysts warned that the outcome of the impending elections remained highly uncertain. Investors are worried that RN’s big spending plans could trigger a French debt crisis.

Shares of French banks Societe Generale, BNP Paribas and Credit Agricole – all large holders of government debt – fell more than 10 percent last week.

Sterling is also trading around its highest levels against the euro in almost two years, as Macron’s decision continues to ripple through financial markets.

“We are in a period in which there are no certainties for three or four weeks and, unfortunately, the market could become more unstable,” said Alberto Tocchio, fund manager at Kairos Partners.

By contrast, the outcome of the UK election appears much more certain, as evidenced by Labour’s lead in the polls.

London overtaking Paris will be seen as another positive sign that the City is fighting back amid growing concerns about its status as a major global financial centre.

The UK stock market is considered widely undervalued, leaving companies vulnerable to foreign bidders looking for a bargain, while other companies look to list elsewhere, such as New York.

But there are signs the tide is starting to turn and shares in computer maker Raspberry Pi have soared more than 55 per cent since it listed in London last week, valuing it at almost £850m.

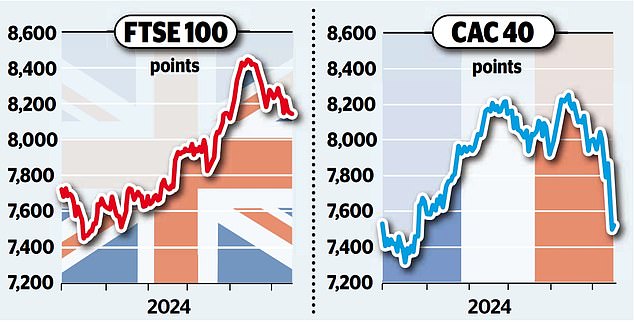

The FTSE 100 index hit a series of all-time highs last month.

The Cac 40 also hit all-time highs earlier this year, but has given back its gains and is now virtually flat since early 2024.

Russ Mould, investment director at AJ Bell, said Macron’s electoral “gamble” could be “counterproductive, given that the far right is gaining ground in the polls.”