The owner of the London stock market is facing a backlash from investors over his plans to more than double his boss’s salary.

London Stock Exchange Group (LSEG) wants to increase chief executive David Schwimmer’s maximum salary from £6.25 million to £13 million.

Investors will vote today on whether to allow the almost £7m pay rise at the annual general meeting amid soul-searching in the City over the health of the stock market chaired by Schwimmer.

Analysts warn that a “relentless” wave of takeover activity, equivalent to a “feeding frenzy” on undervalued British shares, has left the stock market facing a “death by a thousand cuts”.

But the London Stock Exchange (LSE) is just one part of the wider group, with LSEG’s data and analytics division now accounting for around 70 per cent of its revenue.

Pay vote: London Stock Exchange Group wants to boost chief executive David Schwimmer’s (pictured) top earnings from £6.25m to £13m

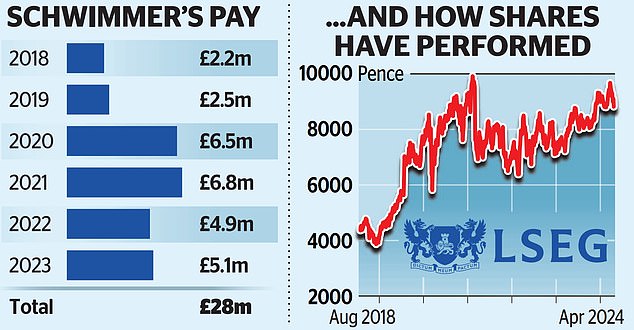

And Schwimmer supporters say the stock price has doubled since he took office in August 2018.

However, it is the LSE that remains the public arm of the company.

And moves to double the CEO’s salary have raised eyebrows.

AJ Bell investment analyst Dan Coatsworth said: “The reputation of the UK stock market needs to improve and London needs to be a more attractive place for a company to want to list its shares, much of which depends on Schwimmer finds solutions.

‘Much of the proposed deal is tied to future performance, so Schwimmer will have to work hard to achieve it. That job is not going to be easy.” Shareholder advisory firm Glass Lewis says the increase is “excessive.”

This year a number of companies have agreed to acquisitions that will force them to leave the market.

Proposed deals so far include a £5.8m bid for packaging group DS Smith, Nationwide’s £2.9bn takeover of Virgin Money, Barratt Development’s £2.5bn bid for builder More small Redrow and the £762m purchase of haulier Wincanton by a US rival.

Several have jumped ship, including CRH and Ferguson, which moved its shares to New York, and Tui, which moved to Frankfurt.

Shareholders of gaming giant Flutter, which owns Paddy Power, will vote on moving its listing to New York next month.

And Nasdaq, the largest U.S. stock exchange, is speculated to be weighing a bid for London’s junior alternative investment market.

Schwimmer has earned £28m since taking over at LSEG. Last year it was paid £5.1m out of a maximum £6.25m, a figure which LSEG says lags US rivals such as Nasdaq and data companies such as S&P Global.

It comes amid a wider discussion about whether bosses at British companies are underpaid.

Others seeking big raises include AstraZeneca boss Pascal Soriot, Tesco boss Ken Murphy and Deepak Nath of industrial group Smith & Nephew.

Julia Hoggett, from LSEG’s securities division, has said low executive pay was making it harder for British companies to attract “global talent”.

LSEG said: “We are focused on securing and retaining the caliber of talent required in a highly competitive global market, while ensuring strong performance is rewarded.”