Nowadays, when it comes to unforeseen events in the financial markets, all roads usually lead to China. And the same goes for the rise in the price of gold.

In a week when most British eyes were focused on the Budget, the market herd was chasing the “barbaric relic”, as economic alchemist John Maynard Keynes once described the precious metal.

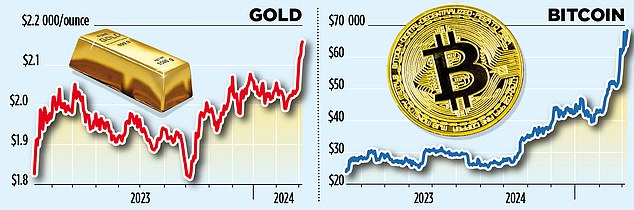

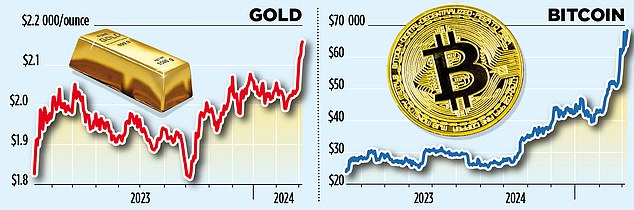

But it’s not just gold – which has been hitting record highs – that is benefiting from the search for assets beyond stocks (currently hitting new highs in New York) and government bonds.

Gamer instinct is alive and well in cryptocurrencies, with Bitcoin scaling new heights.

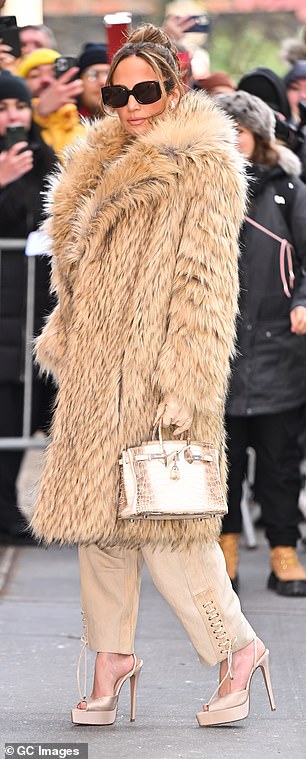

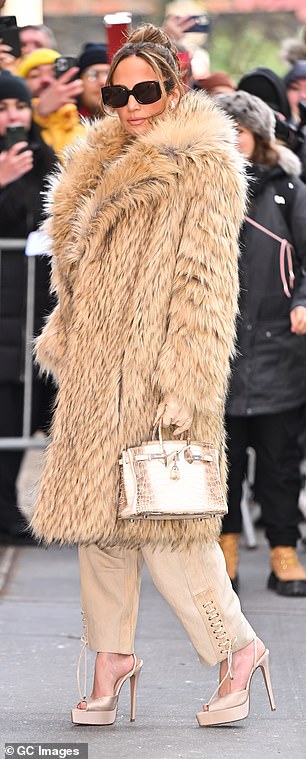

Fashion lovers will know that prices for the Birkin bag and its rivals Dior and Prada are also soaring amid insatiable demand.

All that glitters: The market herd has been chasing the “barbaric relic,” as economic alchemist John Maynard Keynes once described gold.

There is one resident in Scotland who, it is suspected, will not celebrate the return of the bullion this year.

It is unfortunate for former Prime Minister Gordon Brown that the current revival, fueled by geopolitical twists, comes a quarter of a century after he dumped 50 per cent of the UK’s gold reserves.

The United Kingdom’s treasure chest had been kept in the vaults beneath the Bank of England, although during the Second World War our gold holdings were flown to Canada for safer storage.

Brown’s sales were eventually completed at an average price of $276 (£215) per troy ounce, yielding $3.5 billion and converted to dollars, euros and yen.

If then-Chancellor Brown had held on to his bullion and sold it last week, at the peak price of $2,185 per troy ounce, the Bank would have had an asset valued at $27.7 billion.

This could have funded much more than the twopence of National Insurance announced in the Budget. The strategic forces that are driving gold to its current peaks are very different from those driving Bitcoin’s rally.

Laura Lambie, senior investment director at Investec Wealth & Investment (UK), described it as a contrast between the “sublime and the ridiculous”. She told the BBC: “Bitcoin is not an authorized investment in the UK, while gold is.”

The World Gold Council reports that the current gold rush is being driven not only by speculators but also by central banks.

The largest buyers are the Central Bank of the Republic of Turkey, the People’s Bank of China and the Reserve Bank of India.

The National Bank of Kazakhstan, which used to hold part of its stake in a bullion pile under the Bank of England, has also been a buyer.

Two main factors are driving enthusiasm for gold holdings. Private buyers in China are looking for more tangible assets. Faith in the property collapsed amid the bankruptcy of Evergrande, the region’s largest real estate empire, and a similar crisis in Country Garden.

Central bank purchases are driven by security fears.

The terrifying conflagration in the Middle East, along with Russia’s war against Ukraine, the growing military presence in the South China Sea and the perceived threat from Beijing to Taiwan have contributed to this.

China and countries such as Turkey and India have learned from recent experience the need to be cautious in maintaining reserves.

When governments in the Group of Seven’s richest democracies want to punish combatants, their first weapon of choice is sanctions.

The West holds many of the financial cards, as demonstrated by the seizure of some $300 billion of Russian reserves after its brutal attack on Ukraine.

A large part of Russia’s wealth is held in various European and global banks in the form of US bonds and other instruments. Only gold, which is located in the Central Vault of the Bank of Russia in Moscow, has proven to be safe.

The long-term danger of a Western confiscation has been exposed by the current – sometimes heated – debate in the G7 over the use of some of the sanctioned funds to pay for reconstruction and new weapons systems for Ukraine.

Celebrity appeal: actress Jennifer Lopez with a Birkin bag

Foreign Secretary David Cameron is among those advocating such measures. But he has raised profound questions of legality.

It has also raised questions about whether rising rich powers such as China and India can trust the West as they build up foreign exchange reserves in dollars and other Western currencies.

With cash and bonds potentially permanently seized, it’s no surprise that gold is shining again. In the past, when sanctions regimes were eased, as in the case of Iran and Libya, the seized funds (and accrued interest) were returned, usually as part of a peace agreement.

The problem for gold investors is that it does not earn interest. In fact, if it is held in one of the Western depositories, such as the Swiss National Bank, there is a charge for its custody.

For private investors, gold is only attractive – as in the current circumstances – when the price is rising.

Clandestine ways to make gold profitable include investments in derivatives and exchange-traded funds that invest in bullion-related assets, such as mining stocks.

The clamor for Bitcoin, which was trading at $69,000 last week, is a completely different game.

The demand is a mania similar to the Dutch tulip bulb bubble of the mid-17th century.

The U.S. Securities and Exchange Commission lit up the blue paper when it reluctantly approved the first cryptocurrency exchange-traded funds in January, sparking global demand for a previously unregulated asset.

The market for Hermès bags, including the Birkin, is also in full swing. The Wall Street Journal reports that in the last week Hermes increased the price of its ten-inch bag by 10 percent to $11,400 (before sales tax), and the price of the alligator version rose 20 percent. . Buyers of luxury bags see them as a hedge against inflation, as the market for previously used items is also booming.

Enthusiasts now consider what was once simply a fashion accessory as good as gold.

Some links in this article may be affiliate links. If you click on them, we may earn a small commission. That helps us fund This Is Money and keep it free to use. We do not write articles to promote products. We do not allow any commercial relationship to affect our editorial independence.