The property market is declining again according to surveyors and real estate agents, as buyers bide their time in hopes of interest rate cuts later this year.

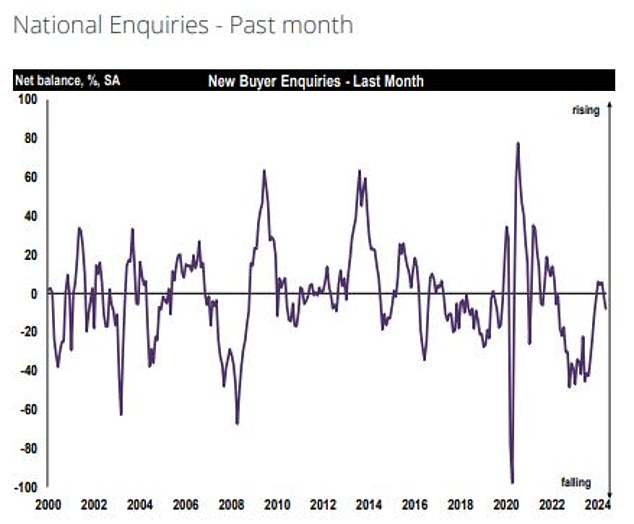

Inquiries from new buyers fell further into negative territory last month, according to the latest survey by the Royal Institution of Chartered Surveyors (Rics), the lowest level since November.

This means that more Rics members reported fewer buyer inquiries in May than those who reported an increase in inquiries.

According to the Rics survey, new buyer inquiries saw a drop alongside a general weakening of reported momentum across the sales market.

The closely watched monthly survey takes the temperature of Rics members and offers a snapshot of what is happening in the property market across the country.

He said his members were seeing buyer demand and the number of sales faltering even as more homes came to market.

This comes at a time when mortgage rates have been rising and a general election is looming.

The Bank of England has kept the base rate at 5.25 per cent since August last year. Earlier this year, markets were predicting that the first base rate cut would come in March.

However, disappointing inflation figures, both here and in the US, have caused the Bank of England to hold rates on hold for longer than expected.

The general consensus now is that the first base rate cut will come in August, six months later than previously expected.

This has led to mortgage rates rising rather than falling for much of this year. The cheapest fixed mortgage rates have increased by about 0.5 percentage points since January.

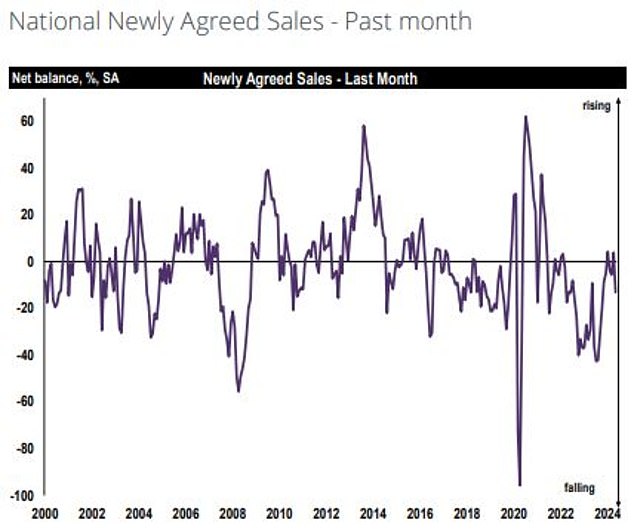

As a result, there have been fewer buyer inquiries and fewer sales in recent months, despite the number of homes on the market reaching an eight-year high.

Tarrant Parsons, senior economist at Rics, said: “The recent recovery across the UK housing market appears to have reversed of late, with buyer demand slightly losing momentum due to the upward moves seen in mortgage rates in recent years. months”. .

Regionally, according to Rics, the most notable decline in buyer inquiries was in the south-east and south-west of England.

Guildford-based Rics member Tony Jamieson said: “The market has reached a state of inertia and everyone wants an interest rate cut from the Bank of England and the outcome of the general election.

“Even competitively priced homes don’t spark as much interest as one might expect.”

John Frost, a member of Slough-based Rics, added: “The market has been difficult as many potential buyers are waiting for mortgage deals to become more competitive, which has affected the number of deals agreed.”

However, buyer interest appears to be waning not only in the south of England but also in many parts of the country, with agents struggling to agree sales.

Rics partners also report a drop in the number of sales agreed during May

Neil Foster, a member of Rics based in Hexham, Northumberland, said: “The pace of sales appears to be slowing with the impact of higher borrowing costs, now coupled with pending political uncertainty ahead of the general election.”

‘It is more common for offers to be negotiated than to be added to the guide price. Balance? Kilometers of distance.’

Leeds-based Rics member Bruce Collinson said: “The market is holding its breath with the election and interest rates stubbornly stagnant.”

Meanwhile, Colin Townsend, Rics member in Malvern, said: ‘It looks as if the market is stagnating. New instructions increase but sales decrease.

“Chains are proving to be a challenge and the time required to carry them out is increasing significantly.”

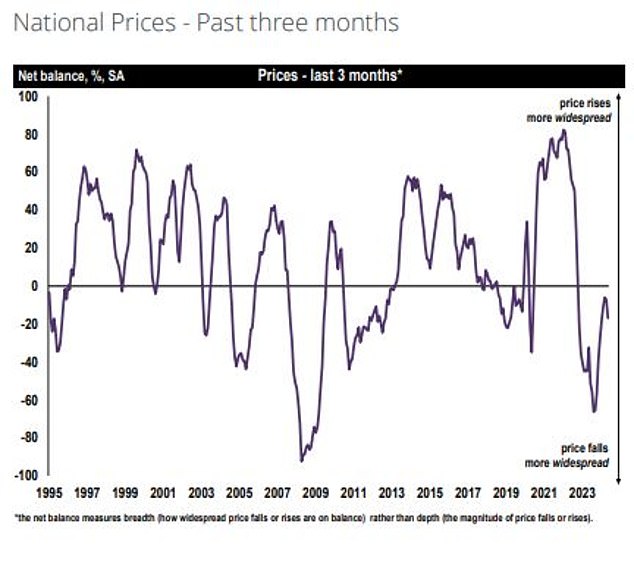

Are prices falling? Having remained virtually stable in both March and April, the latest reading from Rics suggests that house prices fell slightly during May.

Having remained broadly stable in both March and April, the latest reading from Rics also suggests that house prices fell slightly during May.

Looking ahead, the general consensus is that house prices are more likely to fall than rise in the coming months.

Southend-based Rics member Trevor Brown added: ‘Despite some recent upbeat articles, the number of trading instructions and surveys is low for this time of year.

‘Prices appear stable as this is the busiest time of any year. I anticipate a slight drop in values later this year. Nothing will change until interest rates do.”

Some of those cited in the latest Rics survey also reported downward valuations from mortgage lenders.

This is when a mortgage lender values a property below what the buyer agreed to pay. This could mean the buyer will be offered a lower mortgage amount.

James Watts, a member of Bradford-based Rics, said: ‘Sales figures remain strong and prices are holding up well, especially for houses up to £250,000 in our area.

“There are still a large number of downgrades from lenders, so caution is advised when pricing homes realistically.”

Other Rics members report that there are too few buyers to keep up with the glut of homes coming to the market.

South Devon-based Rics member Roger Punch said: “At the moment, stock levels are outstripping willing and able buyers, which, combined with the usual moderating effect of the run-up to the general election, means “cautious pricing is essential for success.”

Simon Cooper, a member of Wellington-based Rics, added: ‘The sales market remains difficult. An increasing level of instructions but a lack of viable buyers means that agreed sales are difficult to generate, although we have a much larger pipeline than last year.

‘Competitive prices are the key. With the general election called, it is likely to be a quiet June.”

Some of the additional homes on the market come from homeowners who decide to sell.

The Rics survey suggests this may be the case particularly in cities such as London and Bristol.

Howard Davis, a member of Bristol-based Rics, said: “It is a price-sensitive market with increased stock of one and two-bedroom flats coming from landlords who no longer wish to rent.

David Parris, Rics member in London, added: ‘Pre-election hesitancy is hitting the market. There has been an increase in investor owners looking to exit due to interest rates and a possible change of government.’

And Len Stassi, a member of Rics also based in London, added: “Rise in interest rates has influenced investors to get rid of smaller flats, leading to a slight reduction in their value.”

Some links in this article may be affiliate links. If you click on them, we may earn a small commission. That helps us fund This Is Money and keep it free to use. We do not write articles to promote products. We do not allow any commercial relationship to affect our editorial independence.