Table of Contents

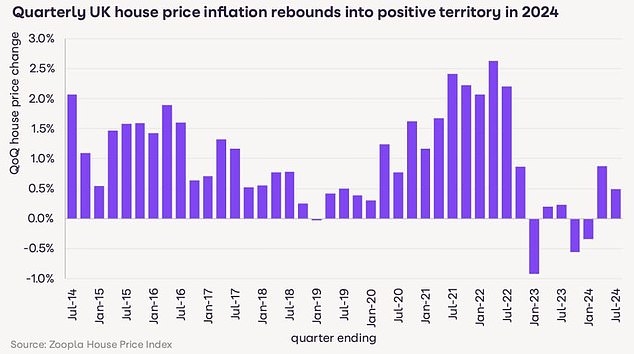

House prices are on track to end the year 2.5 per cent higher than they started, according to Zoopla, but sellers are still being warned not to aim too high with their asking prices.

This is a more optimistic forecast from the property portal, which had predicted prices would fall by 2 percent earlier this year.

The real estate website revealed that home prices rose 1.4 percent during the first seven months of 2024, compared with just 0.1 percent during the same period last year.

Falling mortgage rates are helping to revive the housing market.

Positive outlook: House prices have risen in the first six months of 2024, says Zoopla

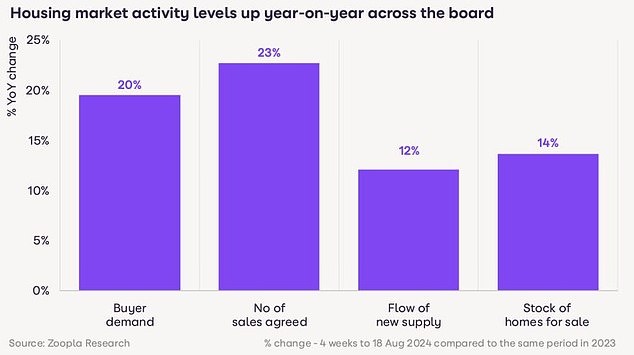

Zoopla says that now that some buyers can get a five-year fixed mortgage at a rate below 4 per cent, there are 20 per cent more buyers looking compared with this time last year, when the lowest five-year fixed mortgage rates were above 5.25 per cent.

Zoopla says this has, unsurprisingly, translated into an increase in sales. The number of sales agreed has increased by 23 per cent compared to last year.

But while activity has picked up somewhat, a glut of homes on the market coupled with mortgage rates that are still higher than many are accustomed to are helping keep prices in check.

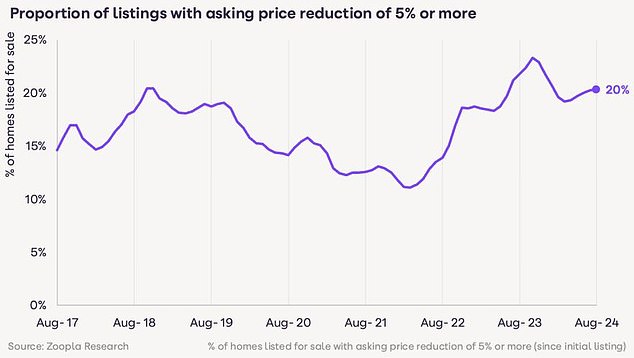

Sellers are still being advised to be sensible with their asking prices, with one in five having to reduce their asking price by 5 per cent or more in August.

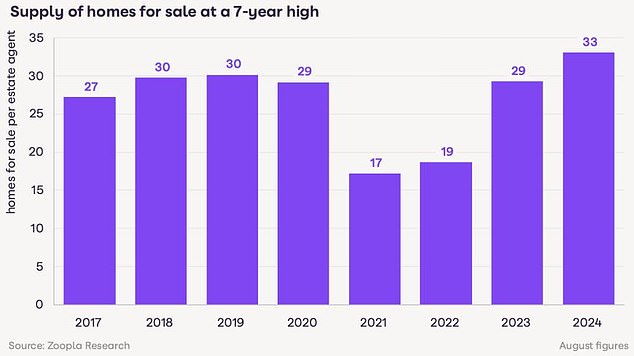

According to Zoopla, the number of properties for sale has risen to a seven-year high, with the average estate agent having 33 properties to sell.

This means it remains a buyer’s market.

One in five sellers is reducing their asking price by 5 percent or more, and properties take twice as long to sell if they are priced too high.

Zoopla experts expect increased supply for buyers to keep house price inflation in check throughout 2024 and 2025.

Active market: buyer demand is increasing, but so is the number of homes for sale

Richard Donnell, chief executive of Zoopla, said: ‘The sales market continues to grow as mortgage rates fall and more and more sellers gain the confidence to put their home on the market.

‘Buyers have a much greater choice, which will support sales figures, but will also keep price increases in check.’

Mortgage rates have buyers looking for a bargain

While home prices are rising slightly, buyers remain price sensitive given that mortgage rates remain high.

This is slowly being offset by faster income growth, but there is still much work to be done to fully repair affordability, according to Zoopla.

This explains why one in five homes in August had their sales price reduced by 5 percent or more to attract greater buyer interest.

Homes that require a price reduction take more than twice as long to sell as homes without a price reduction.

Well stocked: Realtors have an average of 33 homes for sale right now

Properties that have been discounted are also twice as likely to see their sales fall and are more likely not to sell at all, according to a separate analysis of sales over the past five years by Rightmove.

Like Zoopla, Rightmove says many sellers continue to ask for much more than their home is actually worth.

Zoopla’s Richard Donnell adds: ‘We find it takes around 28 days to agree a sale where there has been no reduction in the asking price, but sales take 73 days on average where the asking price has been reduced by 5 per cent or more to attract demand.

‘Getting the selling price right from the start is essential to enable serious sellers to secure a timely sale.

“If you need to reduce the sales price by 5 percent or more, your home will take twice as long to sell or may not sell at all.”

Reduced Price: More and more homeowners are reducing their asking prices to secure a sale

The gap in housing prices between the North and the South continues

The improvement in house prices so far this year is being felt in most parts of the country, according to Zoopla.

However, a North-South divide remains, and prices in the North are rising.

In the 12 months to July, house prices rose in eight regions, but fell in four regions.

Average house prices fell by 0.9 per cent year-on-year in the East of England, 0.7 per cent in the South East and 0.6 per cent in the South West.

Prices in London and the East Midlands are virtually unchanged compared to 12 months ago.

House prices are rising faster than the national average in lower-value, more affordable housing markets, often in proximity to England’s largest cities.

Prices in Wolverhampton are up 3 per cent year-on-year, in Oldham they are up 2.8 per cent and in Wakefield they are up 2.7 per cent.

In Scotland, house prices are rising even faster: in Dumfries and Galloway they are up 4.4 per cent year-on-year, while in Galashiels and Falkirk they are up 3.1 per cent.

What will happen to housing prices?

Zoopla is not alone in predicting that house prices will end the year higher than they started.

Real estate firm Knight Frank also predicts that house prices will end in positive territory.

Tom Bill, UK director of residential research, said: ‘The simple equation for the housing market this autumn is that buyer demand will increase as mortgage rates continue to fall.

‘As core inflation comes under control, more mortgages appear below 4 per cent and a further rate cut is expected before Christmas, we think UK house prices will rise by 3 per cent this year.

‘Financial pain will continue to enter the system as buyers and sellers abandon favourable rates and there is uncertainty around the October Budget, meaning the scope for price exuberance is low.’

Some links in this article may be affiliate links. If you click on them we may earn a small commission. This helps us fund This Is Money and keep it free to use. We do not write articles to promote products. We do not allow any commercial relationships to affect our editorial independence.