Suddenly, the UK’s economic mood is brighter, even cheerful. Following what one analyst called a “robust rebound” in first-quarter output, global banks have raised their projections for the outlook.

Such is the growing optimism surrounding UK markets that investment professionals are looking for bargains in the domestically focused FTSE 250.

This index is full of British companies that “trade at significant discounts to their global peers”, as Simon Doherty, head of managed portfolio services at Quilter Cheviot, puts it.

The view that some of these companies may be ripe for acquisition is gaining ground, thanks to the £34bn bidding battle for mining giant Anglo American.

This appears to have highlighted the value of smaller, much cheaper companies, without political baggage.

Flying the flag: The FTSE 250 is full of British companies ‘trading at significant discounts to global peers’

There are many such opportunities, companies that have been “hiding in plain sight”, according to Thomas Moore, manager of Abrdn Equity Income Trust.

Stuart Clark of Quilter Investors highlights the rich mix of components of the FTSE 250. He says: ‘The index contains companies that have fallen on tougher times. But they have large assets or intellectual property that would be attractive to larger competitors. The index also includes smaller companies that are growing successfully and would be attractive to larger companies wishing to accelerate their expansion.’

FTSE 250 enthusiasm has been further boosted by this month’s offering by engineering group John Wood. His Lebanese suitor, Sidara, offered a 25 percent premium above John Wood’s share price. This proposal was rejected, but Sidara could return with a more generous figure.

Last month, cybersecurity group Darktrace was acquired by Chicago private equity firm Thoma Bravo, in a deal seen as a harbinger of further FTSE 250 “acquisition activity”.

The expectation that the UK’s most promising actors will succumb to foreign predators is disheartening.

But not all FTSE 250 names will face this fate and here are the routes to make the most of what looks to be their brightest future.

Share

Natalie Bell, manager of Liontrust’s UK Smaller Companies and UK Micro-Cap funds, highlights the two ‘niche champions’ of the FTSE 250: Moonpig, the online greetings card and gift retailer, and Rotork, a product maker. of ‘flow control’. that is, valves and actuators (components used in electrical and hydraulic processes).

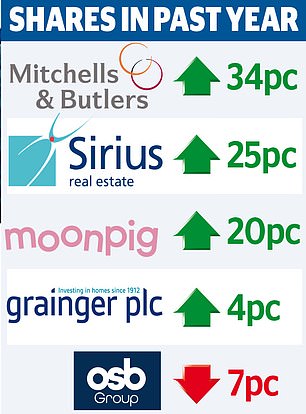

She says: “Moonpig has between 65 and 70 per cent of the UK and Netherlands market share.” Founded in 2000, this company takes its name from founder Nick Jenkins’ hated school-day nickname. The shares have risen 16 per cent over the past year to 156p, but remain 63 per cent below their level three years ago. Deutsche analysts have set a target of 180p.

Bell likes Rotork’s strong growth levels and strong profit margins. And he adds: “The company is based on a spirit of continuous innovation, quality and reliability.”

Rotork shares have risen 8% this year to 336p, with some analysts now targeting 430p. Alexandra Jackson, manager of the Rathbone UK Opportunities fund, lists two of the possible winners in the property sector.

“This sector should be at the forefront if rates are lowered this summer,” he says.

‘Sirius Real Estate owns business parks in Germany and the United Kingdom. The company has experience converting suboptimal and underutilized spaces for which there is strong demand.

“Sirius has now achieved its 10th consecutive year of rental listing growth of more than 5 percent.”

Thanks to these attributes, the analyst consensus rates Sirius Real Estate a “buy.”

Grainger is the UK’s largest private landlord and also the biggest name in build-to-rent developments. Jackson likes its low-risk business model, its balance sheet that can withstand a 50 percent drop in home prices and its plan to double earnings per share by 2026. Once again, analysts rate Grainger like a purchase.

Moore’s property of choice is OneSavings Bank, the UK’s largest professional buy-to-let lender, which is also benefiting from the country’s increasing reliance on the private rental sector.

Money

The easiest way to get broad exposure to the index is through a tracking fund like the Vanguard FTSE 250 ETF. But if you’re looking for a longer-term option, Quilter Cheviot’s Doherty points to the fund Janus Henderson UK Smaller Companies.

It says: ‘This fund invests in companies such as Bellway, the housebuilder, and Mitchells & Butlers, the pub operator. These companies should do well as the UK emerges from recession, interest rates are cut and consumer confidence returns after the cost of living crisis.’

Let’s hope for such a result.

Some links in this article may be affiliate links. If you click on them, we may earn a small commission. That helps us fund This Is Money and keep it free to use. We do not write articles to promote products. We do not allow any commercial relationship to affect our editorial independence.