Table of Contents

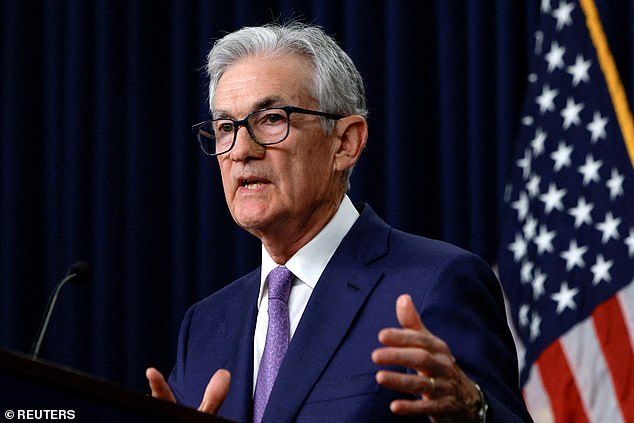

US Federal Reserve Chairman Jerome Powell last night opened the door to a reduction in US interest rates starting next month.

Powell said the U.S. economy was getting closer to justifying a rate cut, but cautioned it was not there yet.

The US central bank voted unanimously to keep its benchmark interest rate at a range of 5.25 percent to 5.5 percent, a level it has maintained since last July.

Inflation fears: US Federal Reserve chief Jerome Powell (pictured) said the US economy was getting closer to justifying a rate cut

A spokesman for the Federal Open Market Committee, which sets interest rates, said last night that there had been “some additional progress” toward the central bank’s 2 percent inflation target but that “greater confidence” was still needed.

US inflation has been falling steadily, approaching the Federal Reserve’s 2 percent target for several months.

At the same time, the labor market has cooled and the unemployment rate has risen by about half a percentage point this year, to 4.1 percent.

Speaking to reporters, Powell said: “A policy rate cut could come as early as September.”

Rate cuts could help the Fed achieve a “soft landing,” in which high inflation would decline without causing a recession.

But the decision to hold the referendum was already widely expected.

Federal Reserve Board member Christopher Waller said last month: “While I don’t think we’ve reached our final destination, I do think we’re getting close to the point where a cut in the policy rate is warranted.”

Omair Sharif of analyst firm Inflation Insights said the statement was “a small step on the path to a rate cut in September.”

The Fed’s decision last night comes ahead of a Bank of England meeting, where officials are also expected to keep rates unchanged.

The nine-member Monetary Policy Committee (MPC) will meet today to vote on whether to cut interest rates for the first time in four years.

The bank faces a close vote, with Governor Andrew Bailey, who chairs the group, likely to make the final decision.

Analysts at investment bank Citigroup expect the rate to fall by a quarter point to 5 percent, which would be a big relief for millions of homeowners.

Powell is expected to speak at the annual central bank conference in Jackson Hole, Wyoming, later this month.

The Fed’s September meeting will be the last before the November presidential election. Former president and Republican candidate Donald Trump has already said the Fed should not cut rates before the election.

DIY INVESTMENT PLATFORMS

AJ Bell

AJ Bell

Easy investment and ready-to-use portfolios

Hargreaves Lansdown

Hargreaves Lansdown

Free investment ideas and fund trading

interactive investor

interactive investor

Flat rate investing from £4.99 per month

Saxo

Saxo

Get £200 back in trading commissions

Trade 212

Trade 212

Free treatment and no commissions per account

Affiliate links: If you purchase a product This is Money may earn a commission. These offers are chosen by our editorial team as we believe they are worth highlighting. This does not affect our editorial independence.