Table of Contents

The annual pension allowance limits the amount of tax relief people can take on their retirement funds, but the lifetime allowance was abolished in April 2023.

We explain how the annual allowance works and how the legacy of the lifetime allowance could affect you.

Annual limits explained: How much can YOU save into your pension tax-free?

Everyone can save for retirement from what is effectively tax-free income up to a fairly generous level each year, including top earners.

That is the underlying principle of pension tax relief, and it is the key thing to remember before you start analyzing all the reliefs and rules that come with it.

The way pension tax relief works is that you receive refunds, or a Government top-up paid to your pension, based on your income tax rate of 20 per cent, 40 per cent or 45 per cent.

These put you back to the position you were in before income tax.

But there are limits on how much you can save without incurring a penalty, although the annual rules were made much more generous in the 2023 Spring Budget, and the current lifetime limit of around £1.1 million was removed.

What is the annual allowance?

The annual allowance is the standard amount you can put into your pension each year and qualify for tax relief on what you saved.

It is currently £60,000, or up to 100 per cent of your annual income if less.

The annual allowance includes your own and your employer’s contributions to a pension, as well as your own tax relief.

The rules are more complicated for higher earners, whose annual allowance is now reduced to £10,000, which is much more generous than the old level of £4,000.

The annual allowance begins to be gradually reduced for people with an adjusted income level – which includes pension contributions – of £260,000.

It is reduced by £1 for every £2 of ‘adjusted income’ above that figure, but only up to the new amount of £10,000.

The threshold income level, where people’s annual income begins to be calculated for the purposes of pension tax relief, is £200,000.

What are the deadlines to use the annual allocation?

A very important advantage of the annual allowance is that you can still benefit from what you have not used during the previous three tax years, under certain conditions.

It is necessary to have been a member of a pension plan during the years from which you intend to “transfer” the annual allowance, although it is not necessary to have contributed anything.

This often surprises people, such as the self-employed, who have neglected retirement planning and are trying to build up a pension from scratch.

You must also first use your entire annual allowance for the year you want to transfer, and you must go back to the first of the three years and use the allowance from that point forward first.

The transfer has become even more valuable now that the lifetime allowance is removed, because if you can afford it, you can catch up on your savings to a greater extent.

It is often used by people who earn much more in the future, or who inherit money and want to save it tax-efficiently, and perhaps want to pass on their defined contribution pensions free of inheritance tax too.

Beneficiaries pay no taxes on what is left in a defined contribution pension plan if the owner dies before age 75, or their normal income tax rate if they are age 75 or older.

The Treasury also considered imposing income tax on younger savers’ inherited pension withdrawals, but this idea was ultimately abandoned.

What happens if the annual allocation is exceeded?

This is not illegal, but you will effectively not get any tax relief for any excess pension contributions, because that amount will be added to your taxable income and subject to income tax.

This is known as the annual allowance charge.

You can ask your pension provider if they will allow you to use a ‘Scheme Pays’ system, meaning the charge would come out of your pension.

It is also possible to use handover to eliminate or mitigate the load.

What is the ‘Money Purchase Annual Allowance’ or MPAA?

This subsidy aims to discourage people from recycling their pension withdrawals to benefit twice from the tax relief.

It prevents anyone who has made a withdrawal, above their 25 per cent tax-free lump sum, from benefiting too much from valuable tax relief on contributions thereafter.

The new reduced annual allowance savings limit has been raised to £10,000 from £4,000 from 6 April.

Pensions industry experts argued that the lower figure, in place since 2017, was a barrier to retirement savings for people who want to return to work and boost their pensions while doing so.

The MPAA originally cost £10,000 when it was introduced in 2015, along with pension freedoms that made it much easier to access pensions from age 55.

What does the elimination of the lifetime subsidy mean to you?

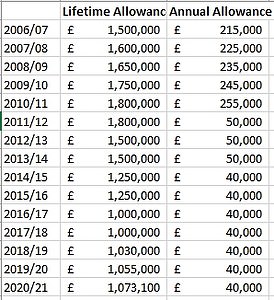

Chancellor Jeremy Hunt removed the total £1,073,100 limit that people can have in their pension pot without facing tax penalties from April 6 this year, but there are still important legacy rules in place so it’s not as simple as that.

Hunt had been expected to increase the limit to £1.8 million rather than abolish it entirely, making it an eye-catching but controversial move to keep higher earners in the workforce.

Pension experts predict a flood of new pension money from the richest now that the lifetime allowance has been removed, but warn that professional advice should be sought to avoid problems.

On the one hand, the Labor Party has promised to restore the lifetime allowance if it wins the next election, which should be taken into account if this could affect its retirement plans.

The lifetime subsidy included both savers and their employers paid into pensions and any growth over the years.

As with the annual allowance, you could continue to save above it, but you faced charges that clawed back any tax relief: a 25 per cent charge on income and 55 per cent on a lump sum.

The 25 per cent charge was abolished, but the 55 per cent lump sum tax charge was replaced by a marginal rate income tax.

There are other rules to think about, such as a new limit or allowance for the tax-free lump sum you can deduct from your pensions.

There is a limit to this, which is £268,275, a quarter of the old lifetime allowance limit.

That is unless you have a ‘fixed shield’, which allowed people to freeze their lifetime allowance at older, higher limits (see box to the right) as long as they stopped making further contributions.

In that case, the higher tax-free lump sum may apply, even if you start paying your pension again.

There is another allowance which relates to tax-free lump sums after death, which is £1,073,100 and includes previous tax-free lump sums and critical illness lump sums collected while the pensioner was alive.

And there is an allowance for overseas transfers, which also amounts to £1,073,100 and covers pensions transferred to “qualified recognized overseas pension schemes”, known as QROPS.

It is worth stressing again that if you already have a large sum saved in a pension, it is sensible to pay for financial advice on the lifetime allowance to ensure you do not make costly mistakes.

This is especially the case for tax-free lump sums, how the transfer rules might affect you, any “fixed protection” you already have, pension transfers abroad and whether you have already started receiving your pension.

Some links in this article may be affiliate links. If you click on them, we may earn a small commission. That helps us fund This Is Money and keep it free to use. We do not write articles to promote products. We do not allow any commercial relationship to affect our editorial independence.