Pundits, analysts, pundits and even cartoonists have seized on last week’s massive outage of the CrowdStike technology service to argue that it shows the dangers of ditching physical cash, but some experts still say a functionally cashless society is inevitable.

Banks, businesses, airlines, broadcasters and government agencies were thrown into chaos when a flawed software security patch issued by US firm CrowdStrike crashed Microsoft operating systems in Australia and around the world.

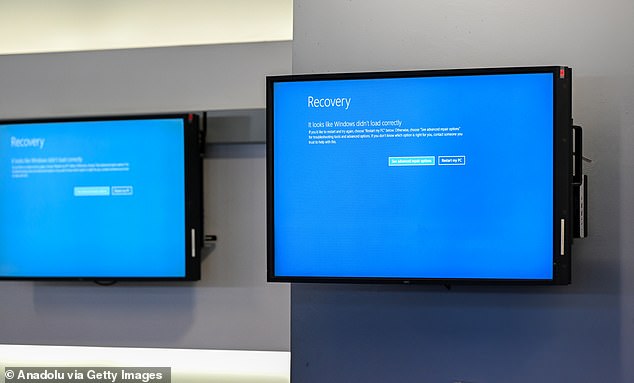

Denied the option of digital payments, supermarkets, as well as retail and hospitality businesses, were forced to accept cash only, while “blue screens of death” even forced some establishments to close on July 19.

Swinburne University electronic payment systems professor Steve Worthington told 7News the outage highlighted the need for cash to remain a backup option even though its use is declining.

“Cash cannot collapse,” he said.

‘I don’t think he’s still king, but he’s in the royal family of the country, so to speak.

‘The global service outage reminds us of the fragile nature of the modern IT world and its interconnectivity. Someone pulled a brick out of the wall and the wall simply collapsed.

“The cashless society is a mirage, really. It always seems to be on the horizon, but when you get close to it, it disappears again.”

Last week, a global technology outage plunged Australia’s banking, retail, travel, broadcasting, hospitality and government sectors into chaos.

Sky News commentator Caleb Bond argued in an opinion piece that “if ‘Whenever you needed an argument against a cashless society, you saw it last week.’

“Today there is no quicker way to paralyze a society than to cut off its banking and Internet systems,” he wrote.

Bond said a malicious hack or other service disruption “could bring a country – or even the entire world – into total submission.”

Those who have ‘total control of the flow of money through electronic means have total control of the world,’ he said.

“Our governments and banks know this,” he wrote.

‘That’s why they like the idea of a cashless society.

“But foreign powers and criminals also like the idea because it makes it much easier to wage war.”

He argued that under these circumstances “inaugurating a cashless society would be signing our own death warrant.”

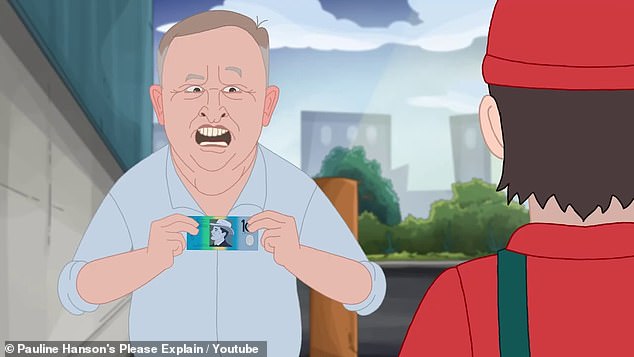

The theme of cash as a means of control was also taken up by the weekly cartoon ‘Please Explain’ published by One Nation as a satirical and advocacy commentary.

In Friday’s episode of the cartoon, Anthony Albanese wanted to buy a sausage from Bunning’s, but was told he could only do so with a card and that there would be an extra charge.

Momentarily determined to stop this outrage, Mr. Albanese – like Jack climbing the beanstalk in the fairy tale – entered the huge castle-like “lair” of the four big banks, which are depicted as literal giants dressed in banking garb.

The towering figure representing the Commonwealth Bank picked up the Prime Minister to give him a seat “right here in the palm of my hand”.

One Nation’s weekly cartoon also focused on the dangers and political temptations of a cashless society.

Mr Albanese remained determined to stop the slide towards a cashless society until the giants told him it was really a question of power.

“If you don’t use cash, you lose total control,” said the figure representing ANZ.

“There is no economic privacy, we can see and stop any transaction,” the NAB giant said.

“Whoever controls the money controls the world and that could be you,” the Commonwealth giant told an increasingly convinced Albanese.

Mr Albanese returned to Bunnings and says he is happy to pay for a sausage with his card, even if it means a surcharge, but then the CrowdStrike service outage occurs.

Sky News pundit Caleb Bond argued that CrowdStrike’s service outage showed that not paying in cash would be like “signing a death warrant.”

“Why didn’t we keep the cash as an emergency measure?” asked one of the panicked people waiting in line.

Following the CrowdStrike outage, many on social media also took to it to point out the need to conserve cash.

On the Facebook page ‘Cash is King’, one user posted an image of supermarket cash registers closed and displaying the ‘blue screen of death’.

“So when it suits them, cash is fine,” the user commented with shrug and laugh emojis.

“Well, I’ll be damned… once again it proves that cash is king,” another user responded.

“I just got home from work… My wife is already asking me for money, I don’t remember her asking me for it in a long time,” said another.

“What a joke! And they want to get rid of cash!” was another response.

Swinburne University professor Steve Worthington said the disruption showed that while cash may still necessarily be “king”, it remains part of the “royal family” of payments.

RMIT University finance academic Angel Zhong still expects Australia to become functionally “cashless”

“Everyone who had cash today is laughing because the banking system has collapsed,” read another post.

“The banks and government will hate this, they are banging their heads against the wall because it proves we are right,” said another.

Reserve Bank of Australia Governor Michele Bullock warned in December that declining cash circulation was putting pressure on the economics of ATMs and the physical movement of notes and coins.

He even suggested that companies could start passing those costs on to consumers by charging extra for using cash.

RMIT University finance academic Angel Zhong has previously suggested Australia will become a functionally cashless society by 2030, ahead of the Commonwealth Bank’s forecast of 2026.

Functionally cashless, he explains, means that digital payments account for more than 90 percent of total payments, although cash would retain its value and not disappear.

Its calculation is based on data on consumer preferences from the RBA.

The latest survey for 2022, published in June 2023, shows that cash accounted for 13 percent of total payments, up from 69 percent in 2007 and 27 percent in 2019.

Dr Zhong said the CrowdStrike service outage, which came on the heels of the Optus service outage in 2023, did not change her outlook but highlighted digital vulnerabilities.

“These outages and incidents are the reason we are not making the transition overnight,” he said.

“We are not ready to become a 100% cashless society. This will undermine consumer confidence in digital payments.”

Dr. Zhong urged financial institutions to use the latest disruption as an opportunity to shift from reactive to proactive risk management by improving system resilience.