Utilico Investment Trust Emerging Markets offers shareholders a combination of dividends and return on capital.

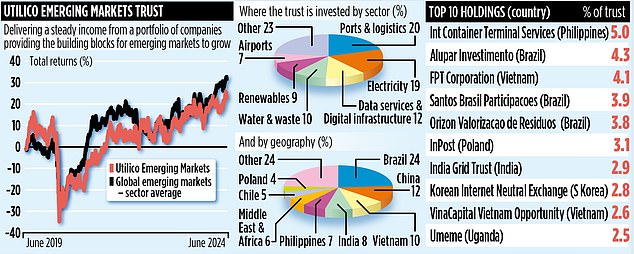

To do this, it invests in companies that provide the infrastructure necessary for the world’s developing economies to continue growing: from power lines and railways to ports and data centers.

It’s an unusual investment approach, but it has served investors well since the trust was launched almost 19 years ago, especially in terms of income.

Apart from 2015, when it maintained its annual dividend, the trust has increased income payments each year.

Encouragingly, in the current financial year, which ends at the end of March, the three quarterly dividends it has paid so far are slightly higher than the previous year, indicating that another year of dividend growth is expected.

In terms of overall investment performance, three-year returns of 19 percent compare favorably with its global emerging market peer group of 14 percent.

Over the past year, it underperformed: a return of 5.3 percent versus a group average of 10.6 percent.

Utilico Emerging Markets is listed on the London Stock Exchange and has assets valued by the market at £431 million. It is run from London by Charles Jillings of asset manager ICM, with the help of two colleagues.

Four investment themes underpin the portfolio: the need for emerging markets to embrace the energy transition (towards wind and solar), improve social infrastructure (especially as economies urbanize), increase exports (e.g. of raw materials and food) and become digitalized (through construction). of data centers and Internet networks).

Eighty percent of the 78 companies it invests in provide the trust’s income.

The companies are located around the world, with almost a quarter of assets in Brazilian companies (the trust will invest no more than 35 percent in any country).

“Brazil benefits from improved infrastructure,” says Jillings. “It is the world’s leading producer of soybeans, the third largest producer of coffee beans and is rich in resources such as iron ore and oil.”

And he adds: “Many of these goods end up being exported and, as exports increase, better infrastructure is needed, such as trains and ports.”

Among the trust’s top 20 holdings are port operator Santos Brasil Participacoes and railway company Rumo.

Jillings is also excited about investment opportunities in Mexico, sparked in part by a recent visit to the country.

It says it is benefiting from a ‘nearshoring’ boom: many companies supplying the US market now prefer to have closer commercial locations in Mexico, taking advantage of the country’s cheap labor and avoiding geopolitical risks in other parts of the world.

The trust’s largest Mexican holding company is logistics firm Grupo Traxión. “We invested in it three years ago,” says Jillings.

“The management team is entrepreneurial and the business will grow.”

The trust has some anomalies. First, it has a small stake in British startup Petalite, an electric vehicle charging company.

Jillings says the (unlisted) stake gives the trust exposure to a key trend (the energy transition) that is difficult and expensive to access in emerging markets such as China and South Korea.

In addition, a large part of its holdings in Vietnam are obtained through the VinaCapital Vietnam Opportunity trust, which is listed in London.

Total annual charges are 1.4 per cent and the income it pays to shareholders equates to around 3.9 per cent annually. Its stock exchange identification code is BD45S967, and its ticker symbol UEM.