Table of Contents

The European Central Bank cut interest rates again today in response to falling inflation and faltering economic output.

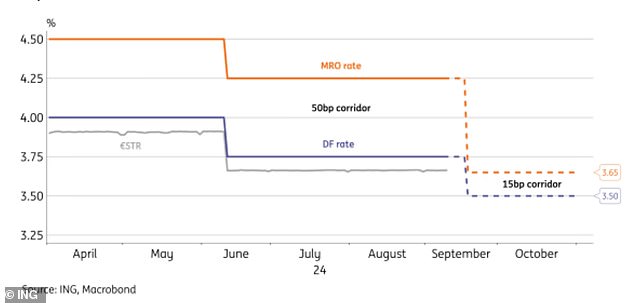

The ECB followed up its June cut with a 25 basis point reduction in its key deposit rate to 3.5 percent, a much-hyped move that was followed by a slight downgrade of the bank’s projections for the eurozone economy.

It now expects it to grow by just 0.8 percent in 2024, followed by expansion of 1.3 and 1.5 percent in 2025 and 2026 respectively.

Eurozone growth has slowed this year as successive ECB interest rate hikes have taken effect, while consumer price inflation across the bloc has eased from 4.3 percent in September last year to 2.2 percent last month.

Money markets are looking to ECB President Christine Lagarde for clues on the direction of interest rates when she speaks later today.

The ECB expects headline inflation to stand at 2.5, 2.2 and 1.9 percent for 2024, 2025 and 2026 respectively, unchanged from its last projections in June.

Before the decision, markets had been pricing in two more 25-basis-point rate cuts to 3 percent by year-end.

The ECB’s commentary offered few clues about the future direction of monetary policy, but stressed that decisions will be made on a meeting-by-meeting basis.

He warned that “domestic inflation remains high” but noted that “pressures on labor costs are moderating and earnings are partially cushioning the impact of higher wages on inflation.”

Money markets are looking to ECB President Christine Lagarde for clues on the direction of interest rates when she speaks later today.

Michael Field, European markets strategist at Morningstar, said: ‘Macroeconomic data since the June rate cut has supported ECB actions.

‘Inflation has fluctuated but has ultimately fallen to a level very close to the central bank’s target, while economic growth has remained positive but benign.

“The risk of the economy overheating due to further rate cuts appears low, so economists’ expectations for another rate cut before the end of the year are highly likely. The ECB’s pattern of cut, follow and repeat is likely to continue.”

The ECB lowers its main deposit rate to 3.5%

What will happen to interest rates?

Next week, the Bank of England and the US Federal Reserve will also make decisions on the direction of interest rates.

A sharp drop in oil prices suggests markets believe a resurgence of global inflationary pressures is unlikely and central banks may continue to ease monetary policy.

The Fed is expected to cut its main rate by 25 basis points or 50 basis points after data showed U.S. inflation fell to 2.5 percent in August from 2.9 percent in July, beating forecasts.

Markets are much less confident that the BoE will follow suit, despite disappointing economic growth figures released earlier this week.

Traders are currently pricing in two more BoE cuts of 25 basis points each by the end of this year, taking the base rate from its current level of 5 percent to 4.5 percent.

However, the cuts are expected to come at the bank’s meetings in November and December.

Susannah Streeter, head of money and markets at Hargreaves Lansdown, said: ‘Although economic growth is clearly slowing, partly because high interest rates are taking their toll, policymakers still appear willing to err on the side of caution and keep rates unchanged.

‘Although the once-red-hot labor market is on the way to cooling, with regular wage growth (excluding bonuses) having fallen to 5.1 percent, it could still be weeks rather than days before borrowing costs come down.

‘The pace of wage growth remains more than double the pace of consumer price growth, and there are still some fears that these high wage costs could translate into higher prices for goods and services.’

‘Much will likely depend on the August CPI, which will be released just one day before the big interest rate decision.’

DIY INVESTMENT PLATFORMS

AJ Bell

AJ Bell

Easy investment and ready-to-use portfolios

Hargreaves Lansdown

Hargreaves Lansdown

Free investment ideas and fund trading

interactive investor

interactive investor

Flat rate investing from £4.99 per month

Saxo

Saxo

Get £200 back in trading commissions

Trade 212

Trade 212

Free treatment and no commissions per account

Affiliate links: If you purchase a product This is Money may earn a commission. These offers are chosen by our editorial team as we believe they are worth highlighting. This does not affect our editorial independence.