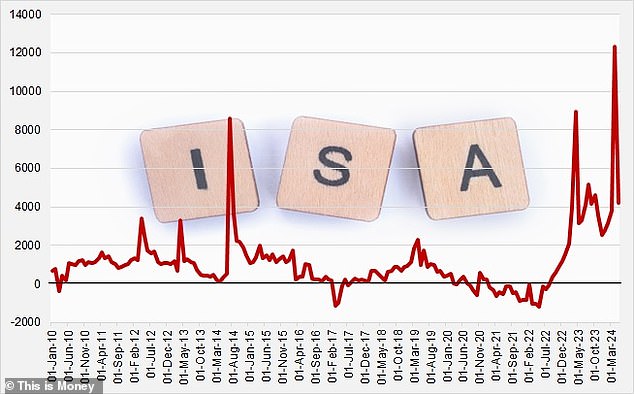

Savers have continued their rush to cash Isas, with £4.2bn invested in tax-free accounts in May, new data from the Bank of England shows.

This comes after savers stashed away a record £12.3bn in April and HMRC estimated last week that savers face a collective tax bill of more than £10bn this financial year for breaching Personal Savings Allowances.

May’s sum is a record for the month since Isas began in their current form 25 years ago and means that, in total, early bird savers have stashed away £16.5bn in cash Isas in just two months.

Every April, savers receive a new annual allowance of £20,000 for the financial year, and it seems Isas are proving more popular than ever.

Flying high: The amount of money flowing into tax-free accounts has skyrocketed in recent years

Analysis of Bank of England data by This is Money shows that £3.1bn was invested in tax-free savings accounts (ISAs) in May 2023. In May 2022, that figure was -£1.1bn, as more savers took money out of accounts tax-free than they put in.

More ISA cash was also withdrawn than deposited in May 2021, showing just how far the change has come.

In fact, between January 2023 and May 2024, £73.5bn has entered cash ISAs.

By comparison, between January 2021 and May 2022, £8.8bn of money was withdrawn (meaning more savers took cash out than put it in) from tax-free accounts, highlighting just how far the pendulum has swung.

AJ Bell’s Laith Khalaf says part of the new wave of appeal of Isa wrappers is that savers know taxes will rise regardless of who wins the election and are taking evasive action.

He added: “While for much of the election campaign Labour has denied it will raise taxes and the Conservatives have promised to cut them, one message that has come through loud and clear is that frozen tax thresholds mean we will all pay more and more income tax over the next four years.

OBR estimates show that collectively we will pay around £20 to £25 billion a year more as a result of the personal allowance freeze and higher rate threshold.

‘The budget watchdog also estimates that the freeze will result in 3.2 million people paying tax, while creating 2.1 million more taxpayers with higher rates and 350,000 more taxpayers with additional rates.

“So we can probably continue to expect Isas to play a leading role in the financial plans of anyone who wants to save for their future.”

Rise: While 2021 and 2022 saw net outflows from cash Isas, their popularity has soared since January 2023.

Data from HMRC last week suggested that extra rate taxpayers make up the majority of those who will pay tax on savings interest.

While basic rate taxpayers receive a cushion of £1,000 and higher rate taxpayers £500 on what they can earn in interest before the PSA kicks in, additional rate taxpayers have no PSA.

The taxman says that of the £10.4bn it expects to receive in savings interest tax, £1.14bn will come from basic rate taxpayers, £2.4bn will come from higher rate taxpayers and £6.8bn will come from taxpayers with additional rate.

As more people are pushed into tax bands with higher rates, the PES in turn shrinks.

There are also many savings accounts that currently pay more than 5 percent, meaning defaulting on the PSA has become much easier than in previous years.

For example, at a rate of 0.75 per cent, a basic rate taxpayer would need a deposit of £133,000 to exceed the £1,000 PSA.

At a rate of 5.2 per cent, £19,231 would breach the allowance. For higher rate taxpayers, around £10,000 would exceed the limit at a rate of 5.2 per cent.

You can calculate how much it would take you over the limit by using the This is Money savings calculator.

Cash Isas have also been in the Resolution Foundation’s crosshairs. Earlier this year, it argued for a lifetime limit of £100,000.

But This is Money editor Lee Boyce maintains that ISAs are a simple, well-understood and successful way to save.