Table of Contents

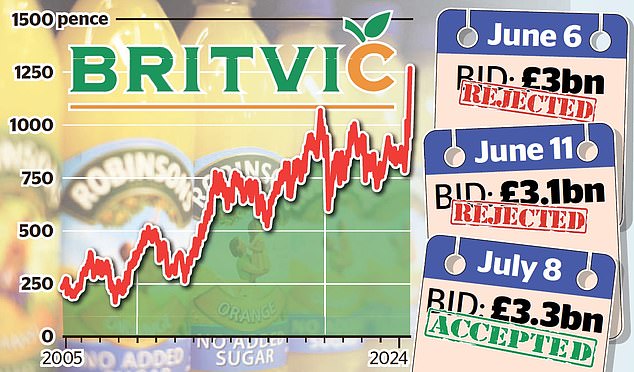

Britvic has become the latest British company to fall into foreign hands after accepting a £3.3bn takeover offer from Carlsberg.

The drinks group, which owns Robinsons squash and Tango soft drink, backed a £13.15-a-share offer from the Danish brewer in a deal likely to lead to job cuts in Britain.

The offer comprises £12.90 in cash per Britvic share and a special dividend of 25p.

The companies will be merged under an expanded group called Carlsberg Britvic.

Jobs threat: Britvic, owner of Robinsons squash and Tango soft drink, backed a £13.15-a-share bid from Carlsberg

Britvic has rejected two previous offers from Carlsberg worth £12 and £12.50 per share.

The FTSE 250 group said last month that both proposals “significantly undervalued” the business.

But the latest offer won the backing of Britvic’s board and shares rose 4.5 per cent to a record high of 1,264 pence. However, analysts suggested Carlsberg was buying Britvic on the cheap.

“In our view, Britvic shareholders should expect a better offer,” said Andrew Ford of brokerage Peel Hunt.

Britvic’s history dates back to the 1930s, when an Essex chemist began producing soft drinks.

One of its best-known brands is Robinsons, which had an 86-year sponsorship partnership with the Wimbledon tennis tournament that ended in 2022.

Britvic also has a deal with Pepsi that gives it exclusive rights to distribute and sell brands such as 7up, Pepsi Max and Lipton Iced Tea until 2040.

Carlsberg, which has sold beer in the UK since 1868, distributes Pepsi drinks in Norway and Switzerland.

Carlsberg chief executive Jacob Aarup-Andersen told the Mail the takeover was a “vote of confidence in the UK economy” but warned the group would also consider job cuts.

He suggested these would mainly affect management positions as well as jobs associated with being a listed company, something Britvic will no longer be following the acquisition, having listed on the stock exchange in November 2005. Britvic employs around 1,700 people in the UK.

The acquisition follows a string of takeovers so far this year, including packaging group DS Smith, telecoms testing firm Spirent Communications and transport firm Wincanton, among others, which have all fallen to foreign bidders.

Cybersecurity group Darktrace also backed a £4.2bn takeover by US private equity firm Thoma Bravo.

But miner Anglo American, retailer Currys and insurer Direct Line have all rejected the offers. A takeover by Carlsberg will need the backing of 75 percent of Britvic investors in a shareholder vote.

Susannah Streeter, an analyst at Hargreaves Lansdown, said: “The deal will give Carlsberg the opportunity to expand its global partnership with PepsiCo.”

DIY INVESTMENT PLATFORMS

AJ Bell

AJ Bell

Easy investment and ready-to-use portfolios

Hargreaves Lansdown

Hargreaves Lansdown

Free investment ideas and fund trading

interactive investor

interactive investor

Flat rate investing from £4.99 per month

eToro

eToro

Stock Investing: Community of Over 30 Million

Trade 212

Trade 212

Free and commission-free stock trading per account

Affiliate links: If you purchase a product This is Money may earn a commission. These offers are chosen by our editorial team as we believe they are worth highlighting. This does not affect our editorial independence.

Compare the best investment account for you