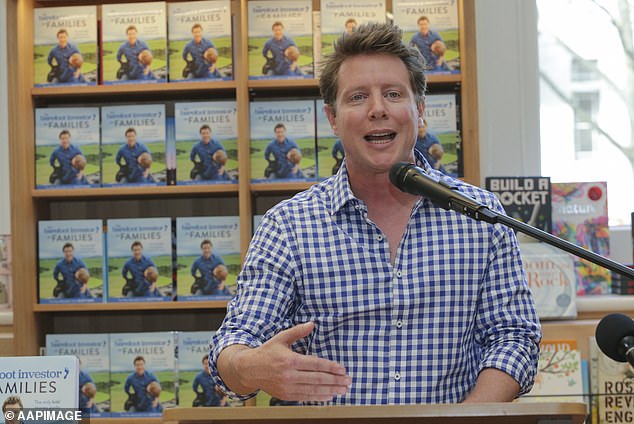

Barefoot investor Scott Pape has some brutal advice for those suffering from mortgage stress: You may need to sell your homes.

The financial guru echoed Reserve Bank Governor Michele Bullock’s warning that “the small number of borrowers who cannot make ends meet” may “ultimately make the difficult decision to sell their homes.”

Mr Pape said he expected interest rates to remain “consistently higher” than they have been in recent years because the Reserve Bank “is focused on eliminating… entrenched inflation”.

The cash rate is currently at 4.35 percent, the level it has been at since November last year.

“Too many people (and journalists!) have anchored their expectations on ultra-low interest rates,” he wrote in his column for News Ltd.

“It is time for us to raise anchor and sail into the sea of sustained higher interest rates.”

In his higher-rate environment, Mr. Pape said some people simply couldn’t afford the home loans they had taken out.

“If I had a dollar for every time I told people struggling financially to consider selling their home, I could rent a house in Ouyen (for a week),” he wrote.

Barefoot investor Scott Pape has brutal advice for those suffering from mortgage stress: You may need to sell your homes

In backing the Reserve Bank, Mr Pape attacked Treasurer Jim Chalmers.

“In recent weeks the Treasurer has shown a bit of a brighter side towards the Reserve Bank, complaining that they are ‘wrecking the economy’ with their decision not to cut interest rates,” Pape wrote.

Mr Pape noted that the US, UK and New Zealand had raised rates more than Australia, even though that was hurting their economies.

He compared the Reserve Bank’s actions to a doctor removing “a cancerous melanoma” in the form of inflation, although he agreed with Dr Chalmers that interest rates were damaging the economy.

However, like a doctor removing a melanoma, the temporary pain of higher rates was in the service of achieving a greater good, so Ms. Bullock had had the “audacity” to admit the pain she was going to cause.

However, political “image consultant” Dr Chalmers could not make such an admission, especially as the election approached, Pape said.

He advised those who suffer from “heart palpitations” at the thought of higher interest rates that it is time to get a “financial checkup.”

In his higher-rate environment, Mr. Pape said some people simply couldn’t afford the home loans they had taken out.

Earlier this month, Ms Bullock said a rate cut was unlikely over the next six months.

“I understand that this is not what people want to hear,” he told reporters.

‘I know there are many households and small businesses that are struggling with current interest rates; many people are struggling and we are very aware of that.

“We cannot allow inflation to get out of control: it affects everyone, particularly those on lower incomes, so we must stay on track to bring it down.”