Carmakers have warned that their “attractive offers” on electric vehicles aimed at stimulating waning demand are “unsustainable” and have said the next government must intervene to boost private sales.

It comes as sales of electric vehicles to the general public fell another 2 per cent in May, despite brands offering significant discounts in showrooms.

To the frustration of the automotive trade body, Conservative ministers have remained firm in their position on not helping to ease the burden with new purchase incentives and charging subsidies for electric vehicles due to their reluctance to make taxpayers fund the market.

As such, this year’s stagnant appetite has left several manufacturers well below the required thresholds set out in the zero-emission vehicle (ZEV) mandate introduced by the Government, putting them at risk of significant fines to end of 2024.

Automakers say current discounts offered on electric vehicles to stimulate demand are “unsustainable” and have again called on the government to step in with new incentives in the wake of declining private sales.

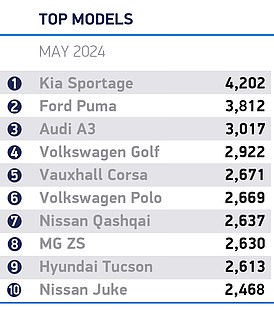

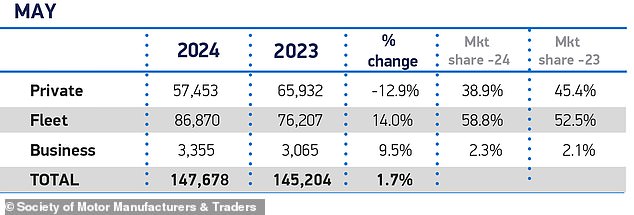

Official statistics from the Society of Motor Manufacturers and Traders show that 147,678 new cars of all fuel types were registered in Britain last month, an increase of 1.7 per cent on the same month in 2023.

This cemented a 22nd consecutive month of growth for the sector and marked the best May performance since 2021.

That said, enrollment remains about 20 percent below 2019 pre-pandemic levels.

Auto sales in May were up from the previous two years, but remain about 20% below pre-pandemic levels.

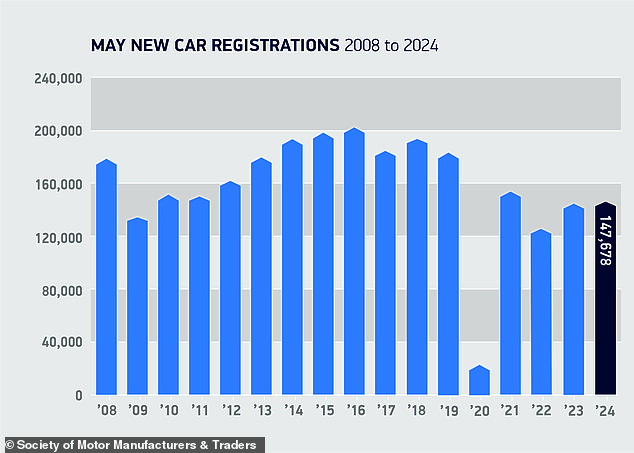

Large fleets are boosting registrations of all cars, including electric vehicles, masking a drop in consumer demand for new engines.

While these figures suggest a buoyant consumer market for new models, the data reveals that it is fleets that are driving the growth, accounting for almost three in five (59 percent) registrations last month.

This came against a backdrop of declining new car sales to private buyers, falling 14 percent year-on-year with just 57,453 dealer purchases.

In a ray of hope for manufacturers, private sales of electric vehicles have declined less than the overall market average, falling just 2 percent over the same period.

In fact, electric car registrations in May grew 6.2 percent to 26,031, again thanks almost entirely to an increase in fleet demand that continues to drive market growth for greener vehicles.

Electric vehicle purchases by large fleets rose 10.7 percent as they continue to benefit from lucrative tax breaks on electric car purchases.

With fleet demand strong, electric vehicles accounted for 17.6 per cent of all new models hitting British roads last month, up from 16.9 per cent a year earlier.

The SMMT says consumers are enjoying a “plethora of new electric models” at deeply discounted prices, but manufacturers cannot sustain this scale of support alone.

Despite this improvement, the figure is still somewhat short of the 22 percent market share needed to meet the binding targets of the ZEV mandate.

“With a selection of more than 100 electric vehicle models now available and a host of attractive offers, manufacturers are dedicated to driving change, but achieving the targets will require further support,” the SMMT said.

The industry body has been calling for incentives such as temporarily halving VAT on electric vehicles purchased to encourage more buyers at a time when investment in the sector has been growing.

However, Conservative ministers have been reluctant to ask UK taxpayers to help cover the cost of purchasing electric vehicles.

They are also not too concerned about the decline in private sales of electric cars. This is because they are aware that a large number of drivers use salary sacrifice schemes in their workplaces to obtain low-cost electric vehicles, and these vehicles are registered as fleet buyers and not private purchases.

Instead of offering subsidies for electric vehicle sales, the government has pinned its hopes on the ZEV mandate to force automakers to lower their prices and bring more affordable battery-powered vehicles to market.

The current Government has pinned its hopes on the ZEV mandate forcing manufacturers to lower their prices to meet binding sales targets and avoid fines.

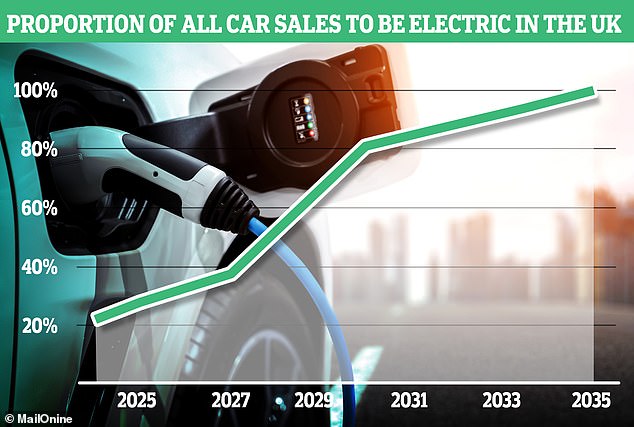

Under the mandate’s rules, at least 22 per cent of new cars sold by every major manufacturer in the UK in 2024 must have zero tailpipe emissions, which ultimately means battery-electric models.

The threshold will increase annually until it reaches 100 per cent in 2035, when the sale of new petrol and diesel cars and vans will be banned in the UK.

Manufacturers risk a £15,000 fine for every polluting vehicle sold above the limit, but Department for Transport ministers are convinced all major car manufacturers will avoid fines by 2024 if they take advantage of other available options, including purchasing ZEV credits from dedicated EV manufacturers (such as Tesla and Polestar) or committing to increasing their share of EV sales in further years between now and 2035.

Under the ZEV mandate rules, major automakers must sell a 22% share of electric vehicles by 2024, and an increasing share annually thereafter. Failure to meet these targets will result in heavy fines per vehicle below the threshold.

But the SMMT warns it cannot continue selling electric vehicles at deeply discounted prices and is demanding more support to achieve the government’s clean air targets.

Mike Hawes, chief executive of the trade body, said: ‘As Britain prepares for next month’s general election, the new car market continues to hold steady as large fleets sustain growth, offsetting weakening private retail demand.

“Consumers are enjoying a host of new electric models and some very attractive deals, but manufacturers cannot sustain this scale of support on their own indefinitely.

“Its success so far should be a signal to the next government that a faster and fairer transition requires carrots, not just sticks.”

Auto Trader, the country’s largest online car sales platform, warned earlier this week that a lack of cheap used electric vehicles is slowing Britain’s transition to greener transport.

Commenting on the latest sales figures published on Wednesday, Ian Plummer, its commercial director, said: “The new car market remains sluggish and retail demand has waned, as a shortage of affordable new car models means fewer options for consumers, even though fleet buyers underpin the market.

‘Rising new car prices since 2019 mean even high-volume brands are suffering as the mid-market empties.

“The proportion of new models on sale under £20,000 over the past five years has fallen from 17 per cent to just 4 per cent, underlining the pressure on affordability.”

Jamie Hamilton, automotive partner and head of electric vehicles at Deloitte, suggested that Electric vehicles “don’t seem to make sense for consumers unless they can charge their cars at home overnight.”

He added: ‘As a result, it is necessary to promote the creation of more publicly available charging stations.

Some links in this article may be affiliate links. If you click on them, we may earn a small commission. That helps us fund This Is Money and keep it free to use. We do not write articles to promote products. We do not allow any commercial relationship to affect our editorial independence.