Australian home borrowers are now being told they will have to wait until next year for any interest rate relief.

ANZ Bank has revised its forecasts for the Reserve Bank to lower rates in February 2025 rather than November this year, as inflation moderates at a slower pace than previously forecast.

The Reserve Bank is likely to leave the cash rate at a 12-year high of 4.35 per cent on Tuesday, following a two-day board meeting that began on Monday.

ANZ broke ranks last week to push back the planned start date for rate cuts to February 2025.

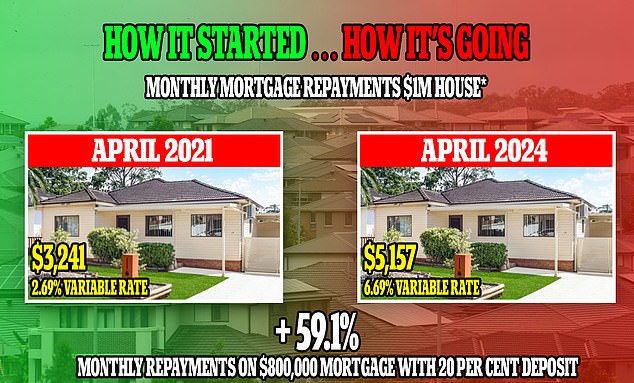

The most aggressive rate increases in a generation have already caused monthly variable mortgage payments to increase 68 percent over the past two years.

But Australia appears less likely to soon follow the European Central Bank’s lead in cutting rates.

On Friday, ANZ became the first major bank to forecast a delay to rate cuts in Australia, with Commonwealth Bank, Westpac and NAB still expecting the easing cycle to begin in November.

While heading in the right direction, higher-than-expected inflation data in the March quarter and in April, where it rose to 3.6 per cent from 3.5 per cent, suggests rate cuts are still some way off. .

Ahead of the June meeting, CBA Australian economics chief Gareth Aird said the board should have a “simple decision” on its hands, with all key economic data in line with the RBA’s own forecasts.

As well as national accounts, employment and inflation data for the March quarter, the RBA board also has to digest state and federal budgets and the workplace arbiter’s annual minimum and award decision since its last meeting in May .

The latter is unlikely to change the situation, Aird said, as the Fair Work Commission’s 3.75 per cent increase aligns perfectly with the RBA’s expected trajectory for wage growth across the workforce. .

Energy bill relief and other cost-of-living measures in state and federal budgets have economists wondering about their inflationary impact, however recent comments from RBA Governor Michele Bullock suggest the central bank would “analyze” the specific impacts on inflation.

The post-meeting statement and press conference with Ms Bullock will be closely scrutinized for clues about where interest rates could be headed and how the central bank views the state of the economy.

Lately, the RBA has been leaving its options open on moves up or down rates, preferring not to “rule anything in or out”.

ANZ economists expected the board to stick with that line, but anticipated it would highlight a stronger-than-expected consumer sector.

Australian borrowers are now paying 59 per cent more for their mortgages than they were three years ago, and financial markets now expect even more rate rises in 2024.

The June meeting will dominate the economic calendar, although a speech by a central bank official, payments policy chief Ellis Connolly, is also scheduled for Tuesday.

Some economic data will also be released, including job ads data from ANZ and Indeed on Monday and Judo Bank Purchasing Managers Indexes on Friday.

Stocks on Wall Street closed lower on Friday after the US Federal Reserve reduced its projected rate cuts from three to one by the end of the year. This ended a four-day streak of record closings, but there were gains in Adobe and other technology stocks.

The S&P 500 lost 1.48 points, or 0.03 percent, to close at 5,432.26, while the Nasdaq Composite gained 24.20 points, or 0.14 percent, to 17,688.88. . The Dow Jones Industrial Average fell 57.50 points, or 0.14 percent, to 38,591.49.

Australian futures fell 17,000 points, or 0.22 percent, to 19,868.

The benchmark S&P/ASX200 index closed down 25.4 points, or 0.33 per cent, at 7,724.3 on Friday, giving back most of Thursday’s gains.

For the week, the ASX200 lost 135.7 points, or 1.73 per cent, after gaining 158 points, or 2.06 per cent, last week.