Thousands of tenants have demanded rental laws be changed after their real estate agents tried to sign them up for rent payment apps that charge fees.

More than 7,000 tenants have signed an online petition to stop estate agencies from forcing them to pay rent through third-party apps that often include a surcharge.

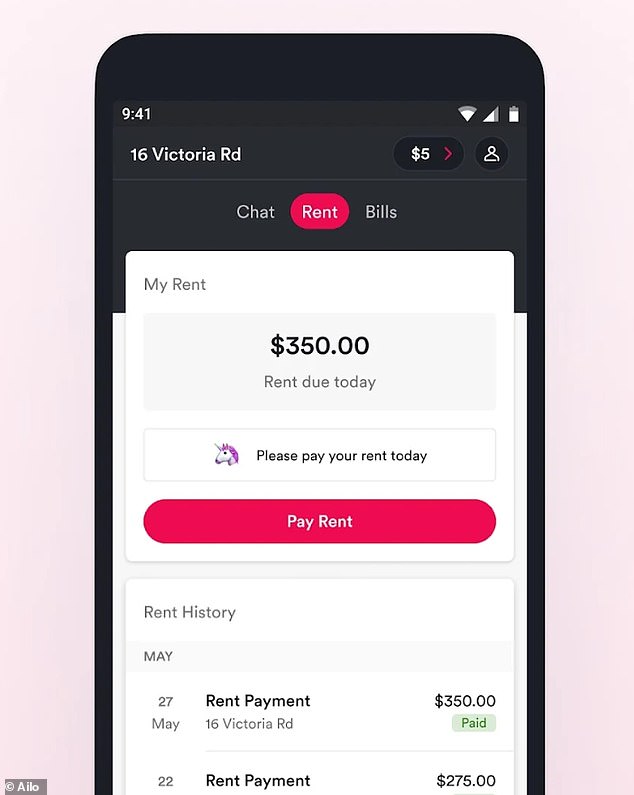

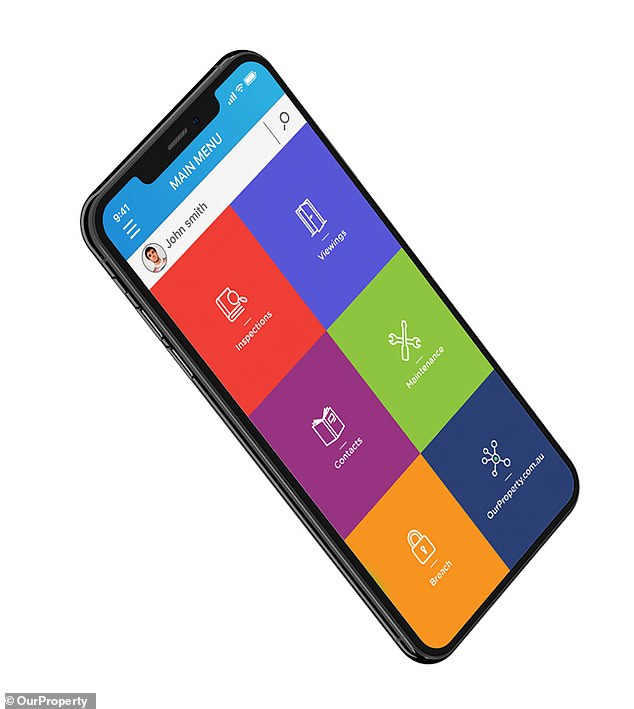

Applications such as Ailo and OurTenant have gradually established themselves as the preferred way for tenants to pay rent, but both carry direct debit surcharges.

Ailo was founded by Ray White’s grandson, Ben White, who denied that his app forces tenants to pay hundreds of dollars in additional fees per year.

Mr. White he told 9News 40 percent of tenants who use their app do so without paying additional fees, but Sarah, a tenant who uses the platform, said avoiding fees is burdensome and unnecessarily tedious.

More than 7,000 tenants have signed a petition to stop estate agencies from insisting on using apps like Ailo (pictured) to pay their rent.

Sarah, who rents through Ray White in New South Wales, pays $900 a month for rent and in-app direct debit charges additional fees of $9 a month or $54 with a credit card.

Sarah, who rents through Ray White, was told by her real estate agent that she needed to start paying rent through the Ailo app in July 2023.

He said it was “ridiculous” that he was not given other options at the time and that trying to avoid paying additional fees is “unnecessarily difficult and time-consuming.”

“As a renter you always feel helpless, even without a housing crisis that makes things infinitely worse,” he said.

NSW rental laws require tenants to have at least one free option to pay their rent, which Ailo does via one-time bank transfers that take days to process.

“It takes two days to process the payment and I have to leave the rent money in my bank account for the two days waiting for the app to process the payment,” Sarah continued.

“This is yet another way of trying to get more money from you in the form of fees to pay the rent.”

By contrast, direct debit through the app carries a surcharge of 0.25 percent on a bank account or 1.5 percent on a Visa or Mastercard.

Sarah’s rent is $900 per month, which would mean she would pay an extra $9 a month if she debited it from her bank account or an extra $54 if she used her credit card.

A spokesman for Ray White denied forcing tenants to adopt the Ailo app and said Ailo was independent of the estate agency.

They added that there are multiple ways to pay in the app and that their help section explains each of them clearly.

“There are sections in the Help section of the platform that set out the different payment options and how tenants can pay with free or other methods if they choose to use them,” the spokesperson said.

“As far as we know, Ailo has the most payment options for tenants and offers the most ways for tenants to pay rent without having to pay a fee.”

Warren, from Queensland, was told by his real estate agent that he had to start using OurTenant to pay his rent, but he refused and complained to the Office of Fair Trading.

NSW Tenants Union chief executive Leo Patterson Ross said the rental crisis made tenants less likely to defend themselves against their agents.

Warren, from Queensland, rents through LJ Hooker and recalled that in 2021 his estate agency sent him an email saying the only way to pay rent in the future would be to use the OurTenant app.

OurTenant offers a free direct debit option, but credit card payments incur a 1.95 percent fee.

Queensland rental laws require both the tenant and the real estate agent to reach an agreement before making any changes regarding payment options, as Warren told her agent.

Her agent insisted the change be made, but Warren visited the Queensland Office of Fair Trading, which confirmed she did not have to use the app.

A spokesman for LJ Hooker said all of his The offices are independently owned and operated and it was up to the owner to decide which payment option was best.

“Our offices use various technologies to effectively manage rental properties,” they said.

“We understand that these solutions offer tenants multiple payment methods, including a free method to pay rent, in accordance with the different laws of each state and territory.”

Leo Patterson Ross, chief executive of the New South Wales Tenants’ Union, said protections for tenants were not strong enough and too ambiguous for most people to properly understand.

Situations like Sarah and Warren’s were made worse by the rental crisis, which has made tenants less likely to advocate for themselves, he added.

Ross said the way to fix the problem is to change the law so tenants know more clearly when they are being pressured.

Daily Mail Australia has contacted Ray White, LJ Hooker, Ailo and OurTenant for comment.