A couple earning $200,000 a year can’t afford a home in Nevada as fierce competition and skyrocketing prices continue to drive away millennials, potentially affecting the presidential election in the key state.

Kashmir Martin, 31, and her husband are almost ready to give up on their dreams of owning a home and have decided to delay having a baby until they can, they said. NBC News.

Martin alone earns $140,000 a year working as an accounting manager for a mining company and her husband earns about $65,000 as a sound technician. Their budget for a home is a whopping $550,000.

“On paper, I appear to be making more money, I’m doing better,” she told the outlet. “But I feel less financially secure than I did in 2015, when I was a freshman college graduate and a first-year accountant.”

They’ve been looking for years to move into a home in the Old Northwest or Old Southwest neighborhoods in Reno, Nevada, but can’t find options for less than $3,000 a month and may require extensive renovations that they can’t afford.

Kashmir Martin, 31, and her husband are on the verge of giving up on their dreams of owning a home and have decided to postpone the arrival of a baby until they can afford it. Although she is earning more money, she feels “less financially secure than she did in 2015”.

Martin alone earns $140,000 a year working as an accounting manager for a mining company and her husband earns about $65,000 as a sound technician. Their budget for a home is a whopping $550,000.

“On paper, I appear to be making more money, I’m doing better,” Kashmir (pictured with her husband) admitted, before adding: “I just don’t foresee prices going down.”

In Washoe County, single-family homes have increased 46 percent since 2019, averaging just under $600,000, according to the County Assessor’s Office.

Those struggling to find affordable housing are leaning toward Democratic and third-party presidential options, who are promoting housing policies.

Martin and her husband currently live in a townhouse that costs $2,300 a month. If she were to buy a property of similar value, she estimates the mortgage would cost her $3,700 a month.

The stress of buying a home has led her to support presidential candidates who support unions, like presumptive Democratic nominee Kamala Harris, who didn’t eat a grape until she was 20 to support boycotts in her home state of California.

Martin prefers these candidates because he believes they will help raise wages, which will lead to more people being able to afford housing.

“From the federal level, anything that can help raise wages and get people into good, well-paying jobs is going to help things,” he said. “I just don’t see prices going down.”

The current vice president has advocated for more affordable housing, as well as granting a tax credit to first-time homebuyers. She has also advocated for limits on rents.

Republican candidate Donald Trump said he would reduce housing costs by encouraging the construction of new units in US suburbs, where land is cheaper.

“Working class people are being pushed out of the housing market, rents are sky-high and there are a lot of abuses that have not been stopped,” Ted Pappageorge, secretary of the Nevada Culinary Workers Union, told NBC News.

“I think the political class is not taking on the problem aggressively enough. We see some proposals from Democrats on housing, but they need to be much more aggressive.”

Philip Chavez recently purchased a home for $470,000, which brings his monthly payment to $3,700. He spends about half of his salary on his mortgage and has to stretch the rest of his budget to support his family.

In Washoe County, where Martin and her husband are looking to buy, single-family homes are up 46 percent from 2019, with the median price just under $600,000 — above her budget. The stress of buying a home has led her to support union-friendly presidential candidates, like presumptive Democratic nominee Kamala Harris, who didn’t eat a grape until she was 20 to support boycotts.

“I’m praying that rates come down so I can try to refinance quickly, because it’s a big payment,” she told NBC News. “I’m going to have a little bit of shortages here and there, but, you know, I’ll eat less or something. We’ll figure it out.”

He doesn’t believe the Republican Party will improve the economy, but he does have a personal connection to Harris, who participated in the UAW picket line with him and his colleagues in 2019.

“If we want to have a country like we have today or improve it, we’re not going to do it by voting Republican,” he said. “Trickle-down economics doesn’t work because it depends on one benevolent person to trickle it down to others, and that’s not the world we live in.”

Housing is a major issue in Reno, which needed an additional 21,000 affordable housing units to meet demands in 2022, according to state housing reportsThey will add 4,300 more units in the next seven years.

The number of homeless people has increased by four percent this year and more than 3,000 low-income residents are on a waiting list to receive federally funded housing vouchers, NBC News reported.

The Food Bank of Northern Nevada has also seen an increase in clients as high housing prices and a terrible job market make it difficult for Americans to get by. They are serving 15 percent more people since last year and nearly 35 percent over the past two years, NBC News reported.

“People have to pay rent, so they’re not buying as much food or they don’t have the money to buy it, and that’s what we’re seeing a lot of,” Jocelyn Lantrip, the food bank’s director of marketing and communications, told NBC News.

Add to that the fact that many California residents have left their homes and settled in the Reno area, receiving cash offers and higher salaries, and prices are also rising significantly, leaving people like Martin unable to even afford his childhood home.

Housing is a major issue in Reno, which needed 21,000 additional affordable housing units to meet demand in 2022, according to state housing reports. They will add 4,300 more units over the next seven years.

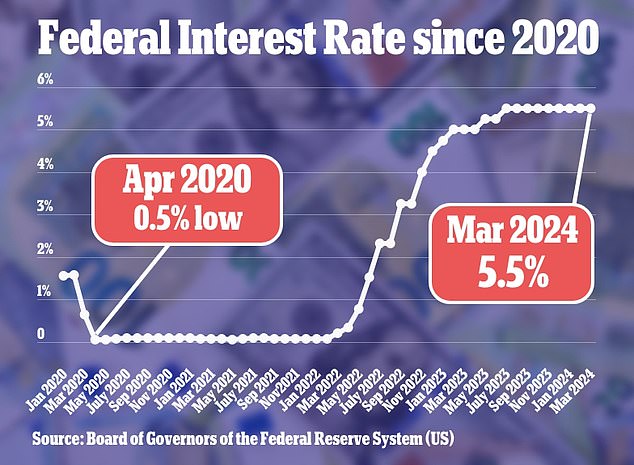

Pictured: Federal mortgage rates from January 2020 to March 2024

“I’ve taken all the steps I thought I should take to be able to do better than my parents,” he told NBC News. “But I feel like I’m not moving forward. If anything, I’m falling a little bit behind.”

Her parents, who worked as teachers and casino employees, bought the house decades ago, but at the 7.5 percent interest rate Martin was offered, she can’t afford it, even on her $140,000 salary.

The average monthly mortgage rate in the county is about $3,000 a month, nearly double since 2019. To be able to afford a home, with a 20 percent down payment, a household would need to earn more than $100,000 a year.

The median household income is just $80,000, according to NBC News.

And it’s not just in Reno where first-time homebuyers are having a hard time getting established. Owning a home has become nearly impossible for many Americans across the country, and the situation isn’t going to improve anytime soon, according to the NBC News Homebuyer Index.

Home prices rose 6.4 percent compared with last year, according to the S&P CoreLogic Case-Shiller index. San Diego, Chicago and Detroit were the hardest hit cities.

Tenants are also struggling, with many paying more than 30 percent of their income on rent and utilities, Harvard University’s Joint Center for Housing Studies said.