NovoNordisk is testing the compound CagriSema, composed of semaglutide and cagrilintide

Drugmakers are capitalizing on the success of innovative anti-obesity drugs with plans to launch 13 additional treatments in the coming years.

Starting this year, the number of new anti-obesity drugs coming to market will begin to increase, reaching a projected peak in 2027 with four new launches that year alone.

Pharmaceutical giant Novo Nordisk, the company behind Wegovy and Ozempic, hopes to launch six products in the next five years.

Leading the pack of new drugs will be CagriSema, a combination of the key ingredient in Wegovy and Ozempic with another drug, cagrilinitide.

Novo’s main competitor, Eli Lilly, maker of Mounjaro and Zepbound, and a handful of other companies are expected to follow suit to meet the staggering demand driven by record obesity rates in the United States.

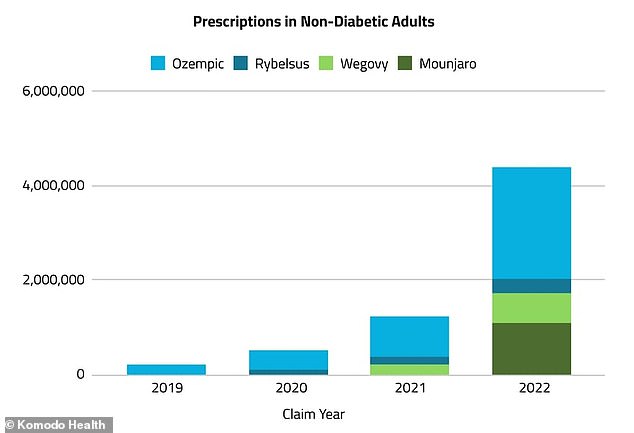

The chart shows that in 2022, more than 5 million prescriptions for anti-obesity drugs for weight loss were issued, compared to just over 230,000 in 2019. A more recent analysis showed that more than nine million prescriptions for anti-obesity drugs were issued. Wegovy and other injectable medications used for weight loss. in the last three months of 2022

The weight loss drug market is expanding rapidly, with a projected value of $100 billion by 2030.

Jasper Morley, pharmaceutical analyst at GlobalData, said: “Recent successful launches have demonstrated the viability of obesity drugs.

“Based on the growing patient population, it is very likely that several companies manufacturing these latest starters will make large profits for their efforts.”

Novo’s CagriSema is expected to hit the market in 2025 and will likely achieve $7.4 billion in sales by 2029.

In addition to beginning phase three trials for CagriSema, Novo has begun phase two trials of another drug, INV-202, as well as an ultrasound therapy with GE.

Meanwhile, Lilly partnered with a Chinese company called Innovent Biologics on a drug called mazdutide. Chinese regulators are currently reviewing it for approval there.

And the South Korean pharmaceutical company Hanmi Pharmaceutical and the German company Boehringer Ingelheim are developing their own.

Ozempic and Wegovy have ushered in a rapidly expanding field of obesity drugs, with pharmaceutical companies large and small eager to cash in on the huge windfall from weight-loss drugs.

Other drug candidates in mid-stage development for obesity include Viking Therapeutics’ VK2735, Structure Therapeutics’ GSBR-1290 and Altimmune’s pemvidutide, Pfizer’s danuglipron, Amgen’s AMG133, also known as MariTide, and CT-996 and CT-388 from Roche.

A 2023 NBC News analysis found that more than nine million prescriptions for Wegovy and other injectable medications used for weight loss were distributed during the last three months of 2022 alone.

JPMorgan researchers estimate that number will rise, with 30 million people expected to take GLP-1 drugs by 2030, or about 9 percent of the U.S. population.

Obesity is a major public health crisis in the US; An estimated two in three adults qualify as overweight or obese, around 172 million people, and a third have crossed the line to be firmly in the obese category.

Demand for obesity drugs like Wegovy has been high since it was approved for weight loss in 2021.

But production has struggled to keep up with demand, meaning many people who could benefit from the drugs and have prescriptions for them can’t get them.

In many cases, doctors have been prescribing Ozempic and Mounjaro “off-label” to people looking to lose weight but who do not have type 2 diabetes (which is what they were initially intended to treat), contributing to the shortages.

Celebrities have also driven demand for drugs with shocking weight loss transformations, but not everyone qualified as overweight and therefore did not need to take them.

This, in addition to the public’s clamor for drugs to look like their favorite stars, has also led to massive spikes in demand that have outpaced manufacturing.