The Barefoot Investor has weighed in on one US economist’s gloomy forecast that 2024 will bring the “biggest economic crisis of our lifetime.”

A concerned reader asked Scott Pape what he thought about the terrifying prediction shared by Harry Dent on Channel Nine’s Today show in January.

Dent, who specializes in studying markets and generational consumer spending, warned the Australian property sector could see more than a decade’s worth of gains wiped out and the Australian Stock Exchange could experience a “50 per cent drop”.

‘Is there any truth to economist Harry Dent’s latest dire warning about the doom of Australian shares and property?’ Concerned reader Jenny wrote to Pape on Monday.

The Barefoot Investor called the prediction “bizarre” before claiming Australia was doing better than might be expected.

Scott Pape (pictured with wife Liz), better known as Barefoot Investor, was asked in his weekly Australian economy newsletter about the terrifying prediction of a massive crisis.

Dent, who specializes in studying markets and generational consumer spending, warned the Australian property sector could see more than a decade’s worth of gains wiped out and the Australian Stock Exchange could experience a “50 per cent drop.” (archive image).

‘So I saw Harry on the Today show. He predicted that “2024 will bring the biggest crisis of our lifetimes” and suggested the value of both Australian shares and property could more than halve this year,” Pape said.

“It was frankly… strange.”

Pape noted that “the people at Today are supposed to be journalists, but the most shocking question they asked wasn’t even a question.”

“The only thing the interviewer said (with a chuckle) was, ‘Gee, that’s a little depressing,'” he said.

Pape said if he had been on the show he would have questioned Mr Dent and asked: “Harry, you have been incorrectly predicting that property prices in Australia will crash for years.”

‘You said they would be reduced by… 55 percent in 2009, 65 percent in 2011, 55 percent in 2014, 50 percent in 2016, 40 percent in 2018 and 40 percent in 2020.

“You have been completely wrong for so long, why should we believe you today?”

The Barefoot Investor estimated that Mr. Dent “would certainly have a well-rehearsed rebuttal that would sow enough doubt in the minds of the viewers eating his cornflakes to allow him to evade that question.”

“Then I would continue with my final question: ‘Harry, if you have all the answers, why don’t you start an investment fund and make billions from your predictions?’

Pape answered this question himself, saying that “once upon a time (Mr. Dent)” had an investment fund.

“Except it was a fiasco: it supposedly lost 80 percent of its assets before it merged and went out of business,” he said.

Dent warned that in 2024 the good economic times would come to a screeching halt.

“My biggest concern, and I’ve been warning Australians about this for years, is that we have one of the biggest property bubbles, second only to China,” he told Today.

“And then I would be more concerned about real estate and I would look at my real estate as an Australian and say, look, if I go back to about 2012… how much would my house or my office building or whatever I have be worth?”

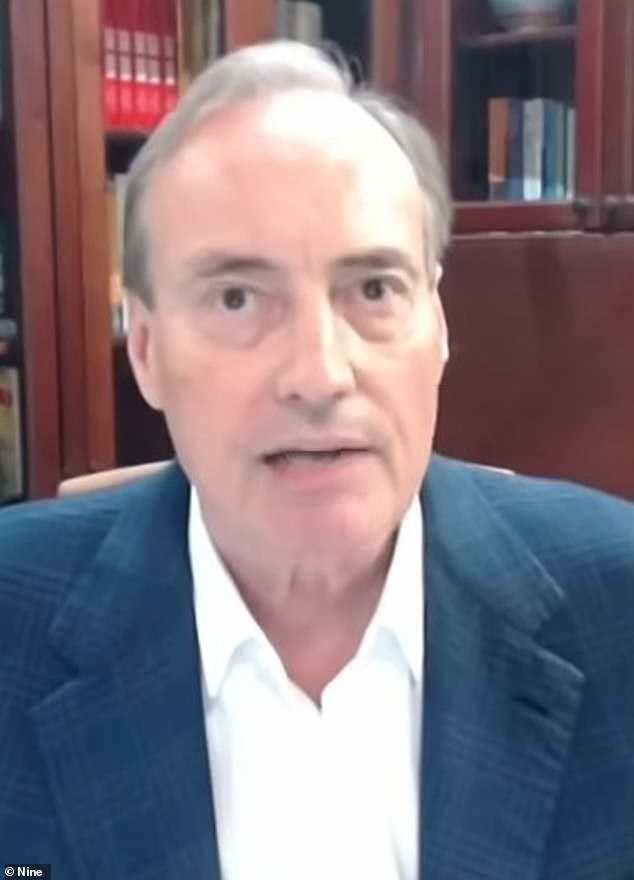

Pape was asked: “Is there any truth to economist Harry Dent’s latest dire warning about the doom of Australian shares and property?” Mr. Dent appears in the photo.

‘And that’s probably the best sign of how much you could lose. And unfortunately, I think there will be more than most people think.”

Dent said a massive drop was inevitable as “no one has seen markets this good.” I have studied them since actions began in the late 18th century.

Dent said Australians need to “protect (themselves) for the next year or two”.

“We started having this decline in 2022, that was the first wave of decline, but again with all this stimulus, we tried to accelerate it and hit new highs in stocks, I think that’s over now and we’re headed down again.” .’

But he did say Australia would emerge from the huge crisis better than most other countries.

‘I think the real danger here is mainly 2024 and probably into 2025, and then we will have the next boom led by Asia and, in the developed world, Australia.

‘I don’t think the United States will ever see real estate or stocks at these levels again. “Australia will see a much better recovery from this.”