I am married, have no mortgage, have two adult children and am almost 60. I hope to retire at 65 as my work is under considerable pressure.

I currently have £235,000 in my pension pot, all parked in the standard fund, and have been working for the same employer since I was 22 – it’s a local family business. On top of that, I receive a full AOW pension.

Part of me thinks I’ve built up a pension pot that I can be proud of, but another part of me worries that I haven’t done enough, especially since my wife doesn’t have a huge pension pot or savings, but will have a full state to have. pension.

SCROLL DOWN TO FIND OUT HOW TO CREATE A QUESTION YOUR FINANCIAL PLANNING QUESTION

Pension payments: By increasing your pension contribution, you can save maximum for your pension

I pay 4 percent of my £62,000 salary and my employer also pays 4 percent.

I have a few small savings elsewhere, but most of our money is tied up in property and my company pension.

Can you reassure me and should I pay more into my pension?

Harvey Dorset from This is Money replies: Whether you have enough retirement savings largely depends on the lifestyle you hope to lead in retirement.

Without a mortgage and childcare weighing heavily on you, your expenses in retirement will depend on your plans for the future, with big costs like travel and passing on wealth to your children worth considering.

That said, it’s never too late to increase your pension contributions if you have enough money to do so.

If you are in a position where you have enough money set aside for a rainy day, or have lower expenses now that your adult children have left the nest and your mortgage is paid off, then your discretionary funds can be used more effectively. as part of your pension contribution, so that you benefit maximally from the benefits you receive from the government.

By adding more to your pension pot you can increase the amount of tax relief you can get. Additionally, your employer may have a policy of increasing its contributions to match yours.

Some employers also offer a salary sacrifice scheme that allows you to increase your pension contribution while still taking home more of your wages.

Fortunately, you and your wife both have full state pensions, which will both ease the pressure on your own pension pot, but with a planned retirement age of 65 you will have to survive solely on your private pension for at least a few years. pot. Someone who is now 59 will have to wait until 67 to receive their AOW benefit, as our AOW age guide explains.

I asked two experts for advice on what you can do to ensure your pension is where you need it.

Simon Stygall, financial planner at Flying Colours, answers: Arguably one of the most common concerns of people nearing retirement is, “Do I have enough?”

A conversation with a financial planner, along with cash flow modeling to consider the situation, often helps answer this question and identify areas for improvement.

Thinking about expenses will be a very important step in this process.

Bucket list: Simon Stygall says retirees often spend more ticking off their retirement goals

A typical trend for retirees is often slightly lower expenses in the months that follow as they adjust to retired life.

This is followed by higher spending as they tick off retirement goals like travel and vacations, with more stable spending as they move into retirement.

We find that expenses are rarely constant from the moment of retirement, and therefore it is very useful to have a plan to assess this.

It is also important to have a guaranteed income source(s) to cover the majority of essential retirement expenses.

Your expenses in retirement will likely be significantly lower than when you are working, because the mortgage has been paid off and the children have left home.

The fact that you and your partner are both entitled to a full AOW pension is good news. However, please note that the state pension age is currently 66 and will rise to 67 for those born after April 5, 1960.

Without other guaranteed sources of income until state pension age, you will have to find a way to make up for this shortfall.

This can be done in various ways, for example by using part of your pension provision to purchase an annuity with a fixed term until the state pension age, or by making flexible use of your pension during this period with a combination of tax-free money and income.

A typical trend for retirees is often slightly lower expenses in the months that follow as they adjust to retired life. This is followed by higher spending as retirement goals are ticked off

Simon Stygall – Flying Colours

The time between retirement and state pension entitlement often offers opportunities for tax efficiency, ensuring that your personal allowance is used by drawing income from your pension.

However, you still have a few years before you turn 65. So this could be a good opportunity to improve your position, depending on how much you can add to your pension.

As a higher rate taxpayer, if contributions to the pension are made from your take-home pay, you can claim back a higher rate tax credit on top of the basic rate tax credit collected by HMRC’s pension provider.

This means that every €100 paid into your pension will only cost you €60. It is also possible to reclaim tax relief at a higher rate that has not previously been claimed in the past four tax years.

If the contributions are paid before tax and the NI is deducted (often called salary sacrifice), you will have already received the tax savings, but also a saving on National Insurance contributions (NICs).

Here the employer in these types of schemes also saves an employer’s NICs, with some companies paying back some of it, or giving it all back to the employee.

It’s also worth checking whether your employer will increase contributions if you decide to increase yours.

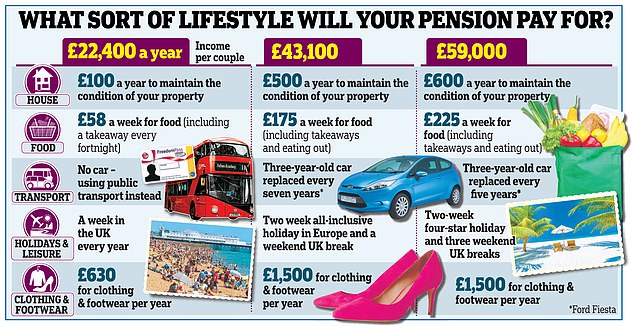

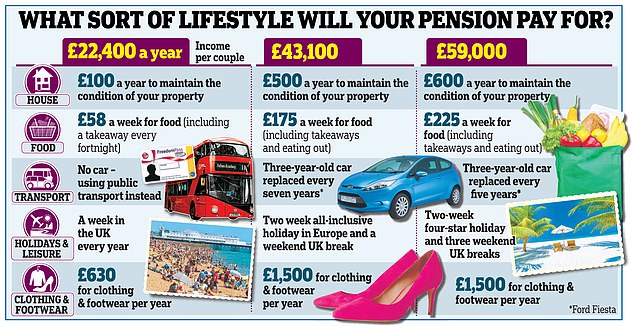

The Pension and Lifetime Savings Association produces figures for the costs of different pensions: basic, average and comfortable

Rule of thumb: Shelley McCarthy says taking 4 percent of your pension per year is sustainable

Shelley McCarthy, chartered financial planner and wealth manager at Informed Choice responds: Whether you have saved enough for your retirement depends on what you want to do after retirement.

What will your lifestyle be like? How much will this cost? Are there other ambitions, such as helping children onto the property ladder?

The average private pension wealth in Britain is £111,700, based on information from the ONS as of March 2020.

It has also been suggested that a married couple needs an income of £43,000 to have a moderate standard of living in retirement.

I also don’t know your exact age, so I’m not sure at what age you will start receiving your state pension, but there will probably be a gap between retirement at age 65 and receipt of the state pension.

The state pension for the 2024/25 tax year is £221.20 per week, providing an income of £11,502.40 per year.

Between you and your wife this could mean £23,004.80 per year.

When it comes to your pension pot, you have a number of options for how you will generate income in the future.

You can withdraw up to 25 percent of your pension pot tax-free. If you do not need a lump sum payment, you can take this in installments.

You can get an income from your pension.

A general rule of thumb is that an income of around 4 percent per year is probably sustainable. Based on your current pot, this could generate £9,400 per year.

Another option is to buy an annuity. This provides a guaranteed income for life. Currently the best rates on the market for a 65 year old are:

One-time life, payment level, 5-year warranty – 7.48 percent

One Life, RPI Escalation, 5 Year Warranty – 4.89 percent

One-time life, 3 percent escalation, 5 year warranty – 5.36 percent

Joint living, 50 percent widows, level, no guarantee – 6.87 percent

Joint living, 50 percent widows, 3 percent escalation, no guarantee – 4.83 percent

An annuity dies with you. So if you do not have a widow’s benefit, you do not have to pay anything to your wife upon your death. If you have health problems, you may be entitled to a higher annuity rate.

Annuity rates may be higher or lower at the time of retirement. If you assume equal income, its value will be eroded over time by inflation.

Based on your current pension pot, assuming you took 25 per cent tax-free (£58,750), the remaining fund could provide an income of between £8,513 and £13,183 per year.

Purely from a tax perspective: if you can afford to pay extra pension contributions, you can avoid paying a higher tax rate.

If you could pay an extra net £7,400 per year into your pension you would significantly reduce the income tax burden on your current income and bring your income below £50,270.

This way you get €9,250 fully invested in your pension, instead of €5,550 net.

If you rely on the equity in your home to provide additional income, you should be comfortable with downsizing in the future or even releasing equity by taking out some type of equity release/lifetime mortgage.

Neither may be tasty options.

Some links in this article may be affiliate links. If you click on it, we may earn a small commission. That helps us fund This Is Money and keep it free to use. We do not write articles to promote products. We do not allow a commercial relationship to compromise our editorial independence.