- Fintel spent £13.5m on buyouts in 2023 and plans more deals this year

<!–

<!–

<!– <!–

<!–

<!–

<!–

Matt Timmins, Co-CEO of Fintel

Fintel is looking for buyout opportunities in the mortgage and general insurance market in 2024, after AIM-All Share made six acquisitions in just over a year.

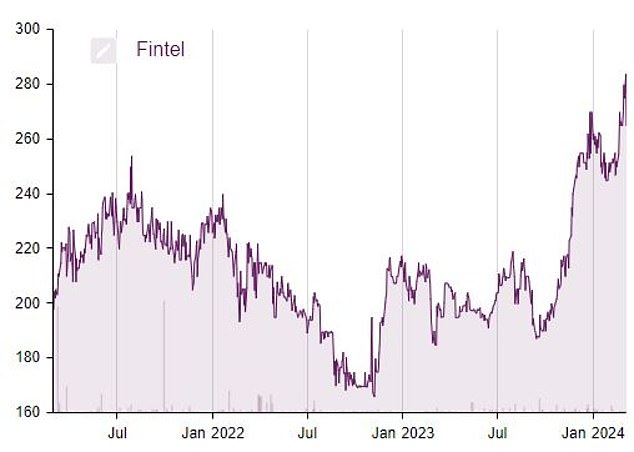

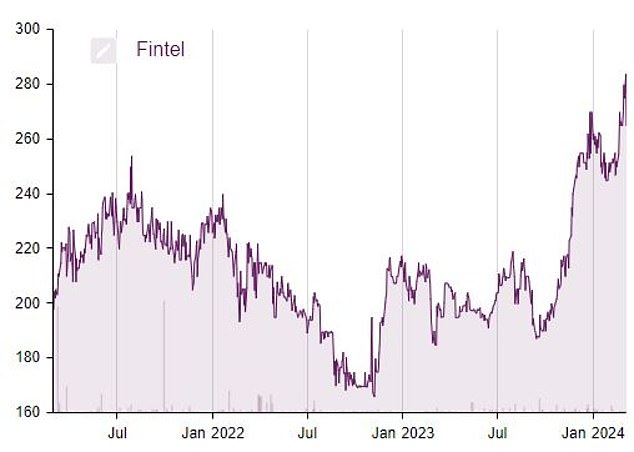

The British financial technology company, which provides technology and support to financial advisers and wealth managers, has made acquisitions a key part of its growth strategy, helping its shares rise by around 50% over the past year. last year.

Fintel spent £13.5m on buybacks in its 2023 financial year, generating combined core revenues of £1.5m for the period, before buying Synaptic Software for £3.5m sterling and Owen James Events for an undisclosed amount shortly after.

The company also spent around £4.5 million during the year on organic investment, which, combined with its heavy spending on M&A, contributed to a 13.5 per cent fall in statutory profit before loss at £14.4 million.

But co-chief executive Matt Timmins told This is Money that Fintel “maintains an active pipeline of M&A opportunities”, with the group targeting businesses and sectors offering some scale.

He added: “(We are looking at) companies that provide support services to financial intermediaries who bring a specific technology or solution.

“We are particularly interested here in the mortgage market and the general insurance market, as well as companies that bring with them data and intellectual property.

“We have an active pipeline with a mix of transactions. There are a number of them that are roughly the same size and scale as we created in 2023, as well as large-scale opportunities.

Neil Stevens, co-CEO of Fintel

Listed on the London Junior Market in 2018, the group’s market capitalization was approximately £286 million and Fintel shares are around 70 percent during this period.

Its main brands are SimplyBiz, a regulatory support business, and Defaqto, which sells technology and data to advisors and wealth managers.

Timmins has previously expressed frustration with the growth experience of a London-listed company, which can lead to undervaluation, poor share price performance and low liquidity.

Fintel performed in line with market expectations last year, with core revenue up 0.3 per cent to £56.6 million and adjusted profit up 5.6 per cent. hundred to £20.5 million.

This enabled the group to announce an annual dividend of 3.45 pence, up 6 per cent year-on-year and ahead of forecasts.

Investec analysts raised Fintel’s target price by 18 per cent to 320 pence following the results.

Investec said: “The strategic and financial achievements in FY23 give us confidence in the group’s ability to deliver on its ambitions, delivering digital and data-driven solutions to the retail financial services market.

Timmins described Fintel’s performance in 2023 as “resilient… given the state of the mortgage market” last year, when transactions fell following lower availability and affordability of mortgages.

But co-CEO Neil Stevens said the mortgage market looks set to turn into a tailwind this year as interest rates fall and many Britons are forced to remortgage.

He said: “This year, 1.6 million fixed-term mortgage contracts are coming to an end, representing 1.6 million households who need to make a decision.

“Around 80 per cent of all mortgages now go through independent professional brokers. Whatever the (housing) purchase market, there is a high demand for professional advice.

“Rates are going to be more favorable and the product market is competitive – those are the fundamentals that will drive a strong mortgage market.”

“So we need to have better technology, better data, better systems to help advisors research the market, determine loan accessibility and eligibility criteria, and facilitate that process.”

Fintel shares started to gain momentum over the past year