About two months after Americans posted wild videos stoking the money they made from the Chase bank problem, some of them are being slapped with federal lawsuits.

JPMorgan Chase, the largest bank in the United States, has begun suing people who took advantage of a momentary glitch in its system that allowed them to illegally withdraw money from ATMs using fake checks.

The ‘infinite money trick’, as many began to call it, became a viral trend on social media in late August and early September. Bank customers reported seeing excess money in their account balance and were able to obtain cash from ATMs before their checks cleared.

JPMorgan quickly recouped these ill-gotten gains, prompting an influx of terrified opportunists who suffered the consequences of their bank balances being thousands of dollars negative.

One of the most serious cases, according to a lawsuit filed in Texas, involves a Houston man who used a masked accomplice to deposit a fake $335,000 check into an ATM. JPMorgan claims this man still owes $290,939.47.

In short, the Chase Bank problem involved people depositing checks worth more than what they had in their checking account. The ruling allowed them to withdraw wads of cash before the fraudulent checks bounced.

“On August 29, 2024, a masked man deposited a check into the defendant’s Chase bank account in the amount of $335,000,” the bank said in the Texas filing. “After the check was deposited, the defendant began withdrawing the vast majority of the ill-gotten funds.”

JPMorgan filed another lawsuit in California accusing a man of sending two fraudulent checks to his bank account, one worth $59,223.45 and the other worth $56,840.10.

The bank claims they are owed more than $90,000.

In a third case, filed in Florida, JPMorgan said another fraudulent check scheme cost them more than $141,000.

JPMorgan, the largest US bank by assets, began investigating thousands of cases of people who took advantage of the ‘currency glitch’, but the bank has not disclosed its total losses. CNBC reported.

Most of the cases being examined are for much smaller amounts of money that were stolen, according to people with knowledge of the situation CNBC spoke to.

One of the most recognizable videos to emerge from this short-lived trend showed a man walking out of a Chase branch in Yonkers, New York, and cheering as he displayed a wad of cash.

Later in the video, they stroll through the streets with hundred dollar bills in their hands and their Chase debit cards in their mouths.

In each of these cases, JPMorgan claimed that they approached the alleged thieves, but did not refund their money for the bad checks.

According to three complaints seen by DailyMail.com, Chase is demanding the return of the stolen funds with interest and overdraft fees. The bank also wants to receive attorneys’ fees.

“Fraud is a crime that affects everyone and undermines trust in the banking system,” JPMorgan spokesperson Drew Pusateri told CNBC. “We are investigating these cases and actively cooperating with authorities to ensure that if anyone commits fraud against Chase and its customers, they are held accountable.”

DailyMail.com has approached JPMorgan for comment.

In the days after the social media craze in which people cheered outside Chase branches with wads of cash, experts and regular people alike were quick to tell ATM hacks that they were in for trouble. hard to wake up

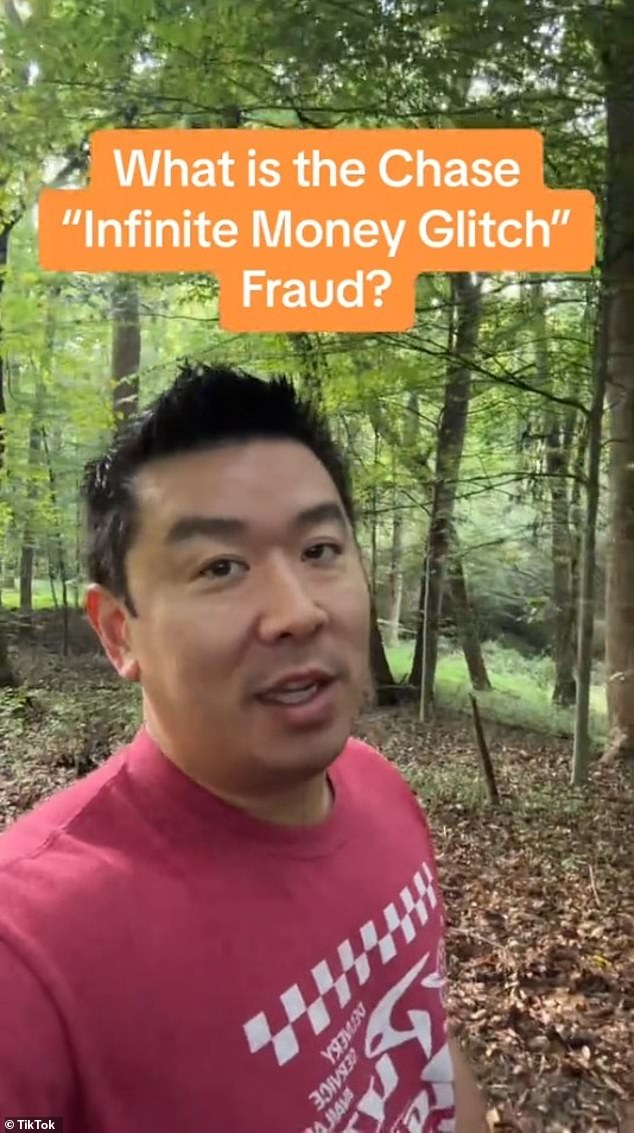

Jim Wang, a popular financial educator on TikTok, posted his own take on the Chase fail mania and warned people that they will face serious consequences for what they have done.

Jim Wang, a popular financial educator on TikTok, posted his own take on the Chase fail mania and warned people that they will face serious consequences for what they have done.

Multiple images and videos emerged of dozens of people lining up outside Chase bank branches, allegedly hoping to exploit the money issue.

‘In the case of this “glitch,” it was simply check fraud. “You’ll be in big trouble if you do something like this,” he said.

“Just because money shows up in your account doesn’t mean it’s literally yours,” he said. “If you spend it and are forced to pay it back, you will have to find a way to pay it back.”

One of the most recognizable videos to emerge from this short-lived trend showed a man walking out of a Chase branch in Yonkers, New York, and cheering as he displayed a wad of cash.

Three of his friends surrounded him as they all celebrated their ill-gotten gains.

Then they cruise the streets hanging from their car with hundred-dollar bills in their hands and smiling with their Chase debit cards in their mouths.

Other videos showed dozens of people lining up outside Chase branches, allegedly hoping to exploit the alleged flaw.

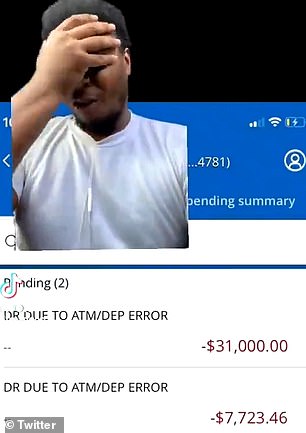

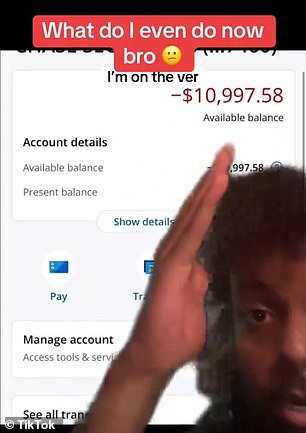

Both people showed their negative account balances after they allegedly participated in the Chase money problem.

The euphoria was short-lived, however, as people began sharing screenshots of their Chase accounts with frighteningly large negative balances.

A visibly distraught man showed pending deductions from his account balance, one for $31,000 and another for more than $7,000. Both were due to an ATM or deposit error.

‘Fuck, man,’ he said while rubbing his face. “They actually told me to tap, that the next day it was supposed to be deleted, but look at my account.”

Another person showed that their account was almost $11,000 in the red after participating in the trend.

Although JPMorgan has so far filed three lawsuits in federal court, check fraud can also be prosecuted at the state level.

The maximum penalty for large thefts of money from financial institutions is a fine of $1 million and 30 years in prison.