Table of Contents

Ahead of the budget, rumors are swirling that the Chancellor may finally take action on phasing out child benefits.

The High Income Charge for Child Benefit (HICBC) was introduced a decade ago and has been criticized for unnecessary bureaucracy and placing an additional burden on parents.

The charge effectively claws back child benefit for households where the highest earner has an income over £50,000, and withdraws it entirely when they earn over £60,000.

Caught in the web: More and more parents are falling under the scope of high-income child benefit thanks to frozen thresholds

Not increasing the amount at which parents start paying the rate in line with inflation means parents are missing out on child benefit payments and paying higher marginal tax rates.

We explain why the amount of child benefit is so controversial and what the Chancellor could do to help parents in the spring budget.

What is the child benefit high income charge?

Child benefit is paid monthly to anyone who cares for a child under 16 years of age, or under 20 years of age if they continue to study full-time.

If you earn less than £50,000 a year you can claim full child benefit, which is currently £24 a week and £15.90 for additional children.

However, if you or your partner have an individual income of more than £50,000, you will have to pay back some or all of it.

Two people who cohabit, as well as those who are married or form a civil union, are considered partners for these purposes.

The High Income Child Benefit Charge (HICBC) was introduced in January 2013 and is designed to recover child benefit for people on high incomes.

Unlike other taxes, it is based on household income rather than individual income, so the highest earner in a couple will be responsible for paying the fee.

The threshold was set at £50,000 adjusted net income, which is the total taxable income before personal allowances and certain tax reliefs. You can deduct pension contributions, Gift Aid donations and any losses suffered in business or property.

The more you earn above £50,000, the more you’ll pay back, as you’ll pay 1 per cent of every £100 received above the threshold.

Once you reach £60,000 a year you will have to pay back 100 per cent of the charge, meaning you won’t receive any benefits.

To pay the fee it is necessary to register for self-assessment and complete a tax return each year.

You can use the Government Child Benefit Tax Calculator to see how much you have to pay back.

Why is the amount of child benefit so controversial?

Since the HICBC was introduced there has been concern about the increase in the number of taxpayers required to pay the charge.

While wages and the cost of living have increased, the threshold has remained at £50,000. Like the freeze on income tax thresholds, which has pushed more people into higher tax brackets, the high income charge now acts as a “hidden tax”.

According to the IFS, just over a quarter of households with children are now affected by the charge, and this figure could rise to 31 per cent in 2025-26 if the freeze continues.

Effects: Critics say the HICBC discourages some parents from applying for pay increases because it could eliminate the child benefit altogether.

According to the ONS, the average disposable household income after tax for a non-retired household was just over £34,000 in the 2022 tax year.

“For single-earner households, this equates to an adjusted net income of more than £46,000,” says accountancy firm RSM.

“Even a subinflationary pay rise in the period from the end of 2022 could cause that taxpayer’s adjusted net income to exceed £50,000 and result in them incurring HICBC in 2023.”

HICBC’s income threshold includes all income, so if you earn £45,000 but receive a bonus or receive income from a property you rent or interest on your savings, you could exceed the £50,000 threshold.

Another issue is the impact on single-income households. The HICBC is based on an individual’s income, not total household income.

It means that a person alone, or with a non-earning partner, with an adjusted net income of £60,000 faces a charge equal to all child benefit received by the household in that tax year. However, a couple earning £49,500 each would not incur any charges.

There has also been concern about the number of taxpayers who have been charged penalties for not registering, because their taxes are only handled through the PAYE system.

What are the marginal tax rates parents face?

There are a growing number of families with children who now have to pay HICBC, even though they technically have no higher income.

Since 2021/22, the highest rate threshold has been £50,270 and is expected to be frozen until 2027/28, meaning some basic rate taxpayers now face the charge.

In fact, when the policy was initially proposed, the point at which child benefit would be phased out was linked to the highest rate threshold – £43,875. It was later raised to £50,000, more generous than the original policy.

If the £50,000 threshold for HICBC had increased with inflation it would be £67,000, and if it had increased with average salaries it would be £71,774, according to Hargreaves Lansdown.

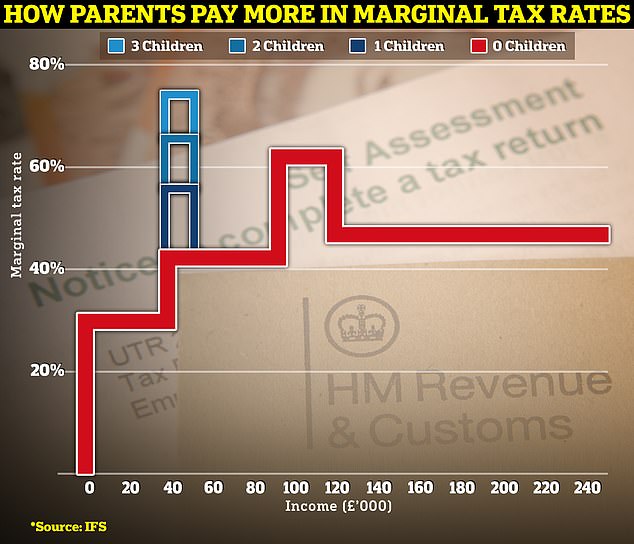

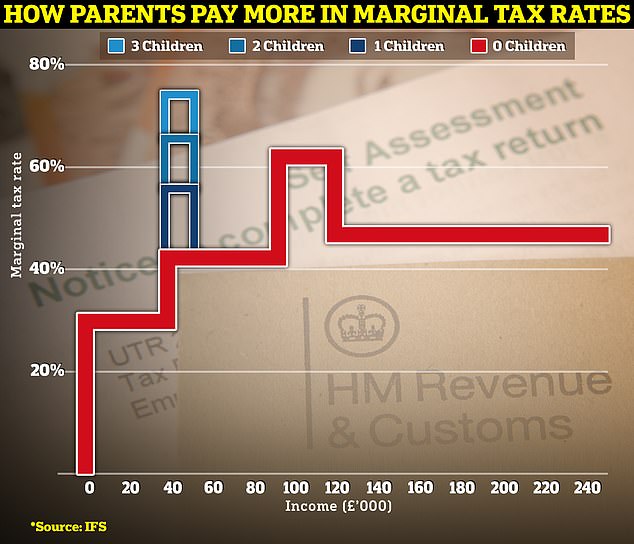

Currently, the marginal rate for taxpayers earning between £12,570 and £50,000 is 32 per cent, which rises to 42 per cent between £50,000 and £100,000.

However, parents with one child pay a marginal rate of 54 per cent if they earn between £50,000 and £60,000, which rises to 63 per cent if they have two children.

This figure increases to 71 percent for parents with three children.

Two parents could earn £99,999 between them and receive the full benefit without paying this marginal tax rate, provided they each earn less than the £50,000 threshold.

What could the Chancellor do in the Budget?

Last summer, the Treasury said it would allow HICBC to be collected through PAYE, removing the need to file a self-assessment tax return.

The Chancellor is now under increasing pressure to completely change how the child benefit phase-out works.

The Association of Tax Technicians (ATT) called for a review ahead of the Budget, suggesting the threshold be adjusted to reflect inflation and track the rate into the future.

‘At a minimum, the HICBC threshold should match the highest rate income tax threshold, to align with the original intent when it was first proposed. This would also have beneficial consequences for tax simplification.’

Jeremy Hunt recently acknowledged the rules are “unfair” and said he would change them in next week’s Budget “if it is affordable to do so”.

The Resolution Foundation estimates that raising the threshold from £50,000 to £70,000 would cost £2 billion and abolishing it entirely would cost £4 billion.

By comparison, a 1p cut to income tax would cost £7.3bn, according to the Institute for Fiscal Studies.

Jonathan Hickman, tax partner at BDO, said: “Raising the threshold may be a partial solution, but as the threshold at which individuals also start paying a higher rate of tax is very similar (£50,270), it could be implement broader tax changes to help taxpayers in this demographic.” for example, a possible increase in the base rate band.’

The Treasury could also examine current rules on tax-free childcare. Currently, once someone earns £100,000 or more, eligibility is removed, as are some entitlements to publicly funded childcare places.

This may mean that a parent with two children would be better off earning £99,999 and running their nursery tax-free than earning more than £100,000.

How has it caused problems for state pensions?

The problems with HICBC have even caused chaos in state pensions. More and more families are choosing not to claim child benefit without realizing it could cost them tens of thousands of pounds in retirement.

This is because many households do not realize that they are losing credits towards their state pension by not claiming payment of child benefit.

When they realize it late, they are allowed to roll back the credits for three months, but they permanently lose the right to the rest.

Parents can apply for child benefit but tick a box to opt out of payments, meaning they will only receive state pension credits. However, many do not know this and assume that they should not make a claim since they do not qualify to receive the money.

This is Money and our columnist, former Pensions Minister Steve Webb, have long campaigned against the Government, which unfairly condemns many mums and dads to a worse retirement for innocent mistakes in child benefits.

Some links in this article may be affiliate links. If you click on them, we may earn a small commission. That helps us fund This Is Money and keep it free to use. We do not write articles to promote products. We do not allow any commercial relationship to affect our editorial independence.