Table of Contents

If you want to feel reassured about the world’s prospects over the next decade, it’s probably not a good idea to talk to Alec Cutler.

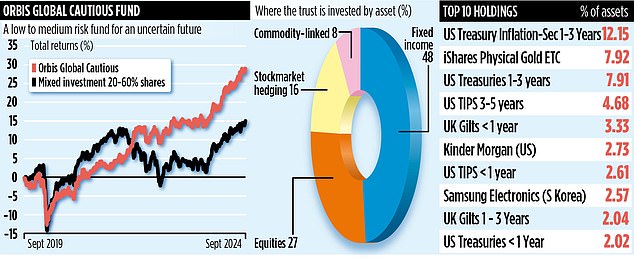

Alec, who has been co-manager of the Orbis Global Cautious Fund since 2019, sees a litany of dangers on the horizon.

But if you’re looking for some security for what lies ahead, its £111m fund is designed to offer investors just that.

It invests in debt issued by governments around the world, as well as in some of the largest companies, and aims to produce solid returns while assuming only small to medium risk.

And right now, Alec and his team are redoubling their efforts to reduce the risk. “The outlook for the world is hugely uncertain,” he says.

“We’ve had relative peace for 30 years, so people have started to think that this is normal. But if we look back over the past 3,000 years, 30 years of peace is pretty much the most we can get.”

Geopolitical disruptions are not his only fear. Alec is also concerned about the scale of spending by governments in developed countries.

“The United States spends $1.2 trillion a year servicing its debt,” he says.

“That’s double his annual defense budget. Three years ago, it was $500 billion. The vast majority of his spending is nondiscretionary, so he can’t cut it easily.”

High inflation also tops Alec’s list of concerns. He believes it will remain stubbornly high due to a number of factors, including the move towards net zero, which he believes will add costs to businesses. The rise of workforce power could also contribute to this, he says.

How to prepare for these clouds gathering on the horizon? One element is U.S. government-issued debt with built-in inflation protection.

So-called U.S. Treasury Inflation-Protected Securities (TIPS) pay a guaranteed sum above inflation: TIPS that promise to pay 3 percentage points above inflation would pay 6.5 percent if inflation were 3.5 percent.

The US Federal Reserve cut interest rates last week for the first time in four years, in a clear sign that it believes the battle to control inflation has worked. Alec is reassured that it doesn’t matter whether the Fed is right or wrong: the portfolio is protected either way.

The fund also uses hedging products against the risk of loss of value of the US dollar, since it makes no sense to guarantee an income in dollars if it depreciates in real terms.

Gold, both physical and mined, is another component designed to protect us against the difficult times ahead.

Gold is often used as a store of value when inflation rises. Gold exposure currently accounts for around 12% of the fund, up from 8% two years ago.

He also invests in stocks of companies that Alec and his team consider comparatively safe.

The UK market offers a wealth of these, he says. “We’re seeing some wonderful opportunities. There are world-class companies like Keller Construction, BAE Systems and Balfour Beatty. Some are at very low valuations.”

He cites Keller Construction, which builds the foundations for skyscrapers, bridges and tunnels.

As such, he tends to be one of the first to receive payment, thus taking on some of the least risk.

“We were able to buy it at only five times earnings because it was so undervalued,” says Alec.

Similarly, the combined value of the cash on Balfour Beatty’s balance sheet and the infrastructure it owns is worth more than its market capitalization.

Orbis has turned a £100 investment into £126 in three years and £130 in five. It has outperformed its benchmark portfolio of 20-60% equities (with the remainder in fixed income) over one, three and five years.

It has a performance fee of 0.77 percent and its stock identification code is BJ02KT7.

DIY INVESTMENT PLATFORMS

AJ Bell

AJ Bell

Easy investment and ready-to-use portfolios

Hargreaves Lansdown

Hargreaves Lansdown

Free investment ideas and fund trading

interactive investor

interactive investor

Flat rate investing from £4.99 per month

Saxo

Saxo

Get £200 back in trading commissions

Trade 212

Trade 212

Free treatment and no commissions per account

Affiliate links: If you purchase a product This is Money may earn a commission. These offers are chosen by our editorial team as we believe they are worth highlighting. This does not affect our editorial independence.