Rightmove has reported a rise in larger homes being put up for sale in the past week as sellers look to cash in on buyers who can afford larger mortgages as rates fall.

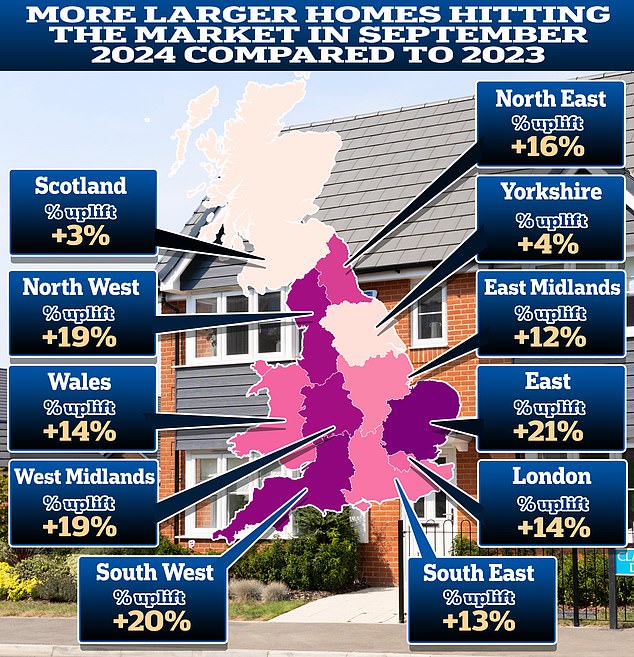

Britain’s largest property portal has revealed that the number of larger detached homes (four bedrooms or more) coming on to the market is now 15 per cent higher than the same period last year.

Meanwhile, estate agents said buy-to-let landlords are trying to sell in a last-ditch attempt to avoid a possible capital gains tax rise by Labour, or a fresh assault on their rental profits.

Richard Franklin, of Franklin Gallimore estate agents in Tenbury Wells, West Midlands, told the Royal Institute of Chartered Surveyors’ monthly report: “The trend of buy-to-let investors selling up for fear of a more draconian CGT regime continues.”

Sales: The number of four-bedroom single-family homes and all homes with five bedrooms or more coming to market is now 15 percent higher than the same period last year

Early September typically sees an influx of properties coming onto the market as Britons return from their summer holidays and look to move before Christmas.

Before September, the glut of homes on the market was driven by smaller homes of two bedrooms or less, and less by larger homes, according to Rightmove.

However, there was a sudden surge in the last week that caused this trend to reverse.

The trend towards larger homes coming on to the market for sale is most noticeable in the East of England, where there were 21 per cent more homes with four or more bedrooms coming on to the market in the last week compared with the same period last year.

In the Southwest, there were also 20 percent more larger homes coming to the market this September than last year.

Rightmove property expert Tim Bannister believes falling mortgage rates are likely behind the surge in offers for larger homes

Mortgage rate cuts have been most pronounced for those with larger deposits, who would normally be more active in this larger housing sector.

The lowest five-year fixed mortgage rate has fallen from 4.28 percent at the beginning of July to 3.77 percent today.

Bannister said: ‘Over the course of this year, we have generally seen more activity at the top end compared to last year as investors in this sector have been hit by record mortgage rates and reduced availability of homes to choose from.

‘Since the base rate cuts, the trend we were seeing is more smaller, mass-market homes coming on the market for sale, but just in the last week or so we’ve seen a surge of activity at the top end again.

‘Some of the lowest mortgage rates since before the mini-budget are now available for those with a large deposit.’

Another factor is growing speculation surrounding an increase in capital gains tax (CGT) in the Autumn Statement on 30 October.

CGT is the tax paid on profits made during the time someone owns an asset.

This could mean that landlords and second home owners of larger properties in particular could be hit by any rise in CGT, which may lead some to withdraw their money now.

Currently, homeowners and second-home owners who pay higher tax rates face a 24 percent tax rate on the profit they make when selling a property.

There are fears that CGT could be brought into line with income tax, which could mean CGT rates rising to 40 per cent for higher rate taxpayers or even 45 per cent for additional rate taxpayers.

> Best Mortgage Rates for First-Time Buyers: How Long Should You Lock Them In?

Is it about to rise? Capital gains tax (CGT) can be charged on any profit someone makes from an asset

In the latest market research carried out by the Royal Institute of Chartered Surveyors (Rics), a number of estate agents and surveyors point to increases in CGT as a possible cause of this sell-off.

Nigel Stone, of Nigel Stone Surveyors in Llanarth, Wales, says council tax is also a concern for second home owners, with examples of councils now doubling or tripling council tax for second homes in some localities.

“We are seeing an increase in properties coming onto the market due to the increase in council tax payments for second homes,” Stone said.

Will the real estate market take off in the fall?

There has been a positive turnaround in the UK property market, boosted by the recent fall in interest rates, according to the latest Rics survey.

Its members reported increased interest from buyers and an uptick in sales, and industry professionals anticipate that prices will rise in the final months of the year.

This month’s report showed that Rics members are feeling more optimistic than ever since October 2022.

Tom Bill, head of UK residential research at Knight Frank, said: ‘This is set to be the strongest autumn market in three years, with transaction volumes and prices driven higher by falling mortgage rates.

‘There is still uncertainty surrounding tax increases in the Budget, but financial markets are expecting almost six more rate cuts over the next year, which would further reduce borrowing costs and boost demand after the relative decline in activity over the past two years.’

Some links in this article may be affiliate links. If you click on them we may earn a small commission. This helps us fund This Is Money and keep it free to use. We do not write articles to promote products. We do not allow any commercial relationships to affect our editorial independence.