- iPhone sales fell 10 percent year-on-year in the first quarter of this year.

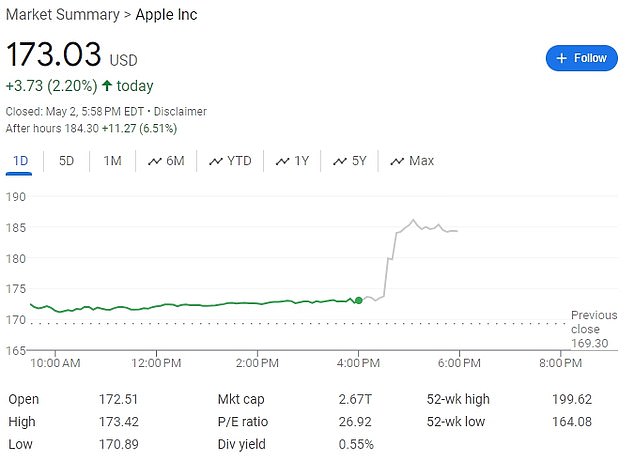

- But the stock rose when it announced it would buy back $110 billion in shares.

- Sales fell 4 percent to $90.8 billion for the three months ending in March.

Apple on Thursday revealed its biggest quarterly drop in iPhone sales since the start of the Covid-19 pandemic, deepening a decline that is increasing pressure on the technology company.

iPhone sales fell 10 percent year-over-year during the three months ended March 31, the latest sign of weakness in a product that generates most of Apple’s revenue.

It marked the biggest drop in iPhone sales since the third quarter of 2020, when production bottlenecks caused by factory closures during the pandemic caused a delay in the launch of that year’s model.

However, despite this drop, Apple shares rose 7 percent in extended trading.

This was because the company announced that its board had authorized $110 billion in share buybacks, a 22 percent increase from last year’s authorization of $90 billion.

It is the largest buyback in history, ahead of Apple’s previous buybacks, according to data from Birinyi Associates reported by CNBC.

iPhone sales fell 10 percent year-over-year during the three months ended March 31, the latest sign of weakness in a product that generates most of Apple’s revenue.

Buybacks help boost stock prices by rewarding investors with cash simply for holding company shares.

The iPhone’s 10 percent drop – to $45.96 billion – was the main reason Apple’s revenue in the latest quarter fell 4 percent from last year, to $90.8 billion.

Marked the fifth consecutive quarter that Apple’s revenue decreased compared to the previous year.

The company’s earnings in the latest quarter were $23.64 billion, or $1.53 per share, a 2 percent drop from last year.

But the tech giant’s revenue and earnings per share were slightly above analysts’ projections, according to FactSet Research.

Apple shares have fallen 10 percent so far this year, erasing about $300 billion in shareholder wealth.

Part of the reason for the drop in iPhone sales was due to a huge increase in sales during the same three-month period in 2023, when Apple made $5 billion in delayed iPhone 14 sales caused by delays in shipments. shipments caused by the pandemic.

“If you remove that $5 billion from last year’s results, we would have grown this quarter year over year,” Apple CEO Tim Cook told CNBC.

“And that’s how we see it internally from the performance of the company.”

“If you remove that $5 billion from last year’s results, we would have grown this quarter year over year,” Apple CEO Tim Cook told CNBC.

Apple shares rose 7 percent in extended trading following the announcement that it would buy back $110 billion in shares.

Mac sales rose 4 percent to $7.45 billion, Apple announced.

Cook said sales were boosted by new MacBook Air models that launched with an improved chip in March.

So-called “Other Products,” which is how the company reports sales of its Apple Watch and AirPods headphones, fell 10 percent year-over-year in the first quarter to $7.9 billion.

In the first quarter of this year, Apple launched the Vision Pro virtual reality headset, its first major new category in several years, but the device is expected to sell in low quantities compared to other popular products.

“We’re just scratching the surface, so we couldn’t be more excited about our opportunity there,” Cook told CNBC.