An Australian mother has spoken out after falling victim to a Facebook hacker who drained thousands of dollars from her small business bank account.

Justine, co-owner of a baby clothing brand. Pip and Lenny, found himself with just $1.71 in the company’s coffers after a hacker stole the rest.

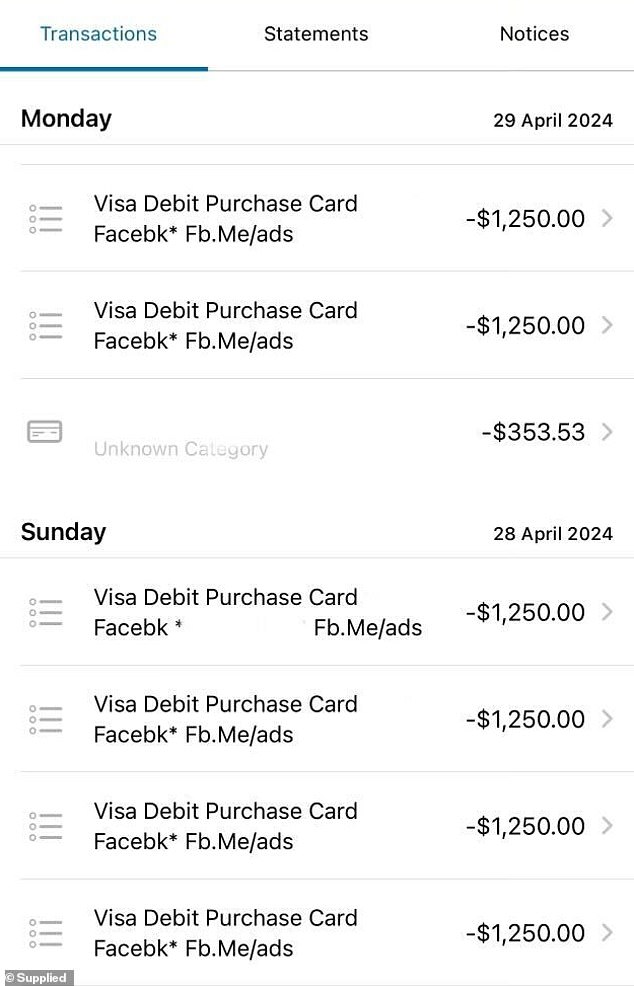

The surprise came when ANZ Bank notified the mother of four about 10 strange withdrawals from the account.

Each transaction was for $1,250, amounting to $10,000.

‘Every dollar, gone. We didn’t realize it could happen. “It’s been devastating to be honest,” Justine told WhatsNew2Day Australia.

He said the hackers gained access to his personal Facebook account, which was linked to his credit card.

Exploiting this access, the hackers funneled the funds to advertise their own dubious business on Facebook.

“They’ve been creating a lot of ads to advertise their own business, and that’s how the money was spent,” Justine said.

Justine (seen here with her family) may have to close the baby clothing business she co-owns due to a Facebook hacker attack.

The hackers managed to drain thousands of dollars from his trading account.

Baffled by the breach despite having strong two-factor authentication and no suspicious activity on her account, Justine said: “I honestly have no idea how it happened.”

He also said he never clicks on suspicious links and is diligent about his cybersecurity.

Justine said if the money is not recovered, she and her business partner may have to close their clothing company.

‘This business is our livelihood. We have four children each, eight children between us, and we work at it non-stop, day after day.

“It’s been a devastating blow to our business,” Justine said.

“Being out of funds means we can no longer get stock into our store, we can’t pay our bills, we can’t pay our own mortgages because ultimately that’s where we get paid from.”

Adelaide’s mother Justine (right) is pictured with her business partner Bec (left)

While the couple have been “in touch” with people on Facebook, the company has not yet confirmed whether it will cancel the ads and refund them.

However, a worker from Meta, Facebook’s parent company, managed to locate the thief.

‘A follower gave us a direct email from someone who works at Facebook and it’s been amazing. She said she found the hacker and his email address.

“So we really keep everything guaranteed to get the money back.”

Justine thanked customers for supporting her brand (products pictured) during the difficult time.

Now Justine is investigating how they can better protect their business in the future, while issuing a warning to Australians.

“Just make sure you have two-factor authentication set up and have different passwords for all your personal and business accounts,” Justine said.

“One thing we’ve learned from this is to have a bank account set up just for your Facebook ads, so there are only a few funds compared to your main account.”

Like Facebook, ANZ has offered to investigate the fraud.

Justine said she was overwhelmed by the support she received from her clients after the scam.

“A lot of people have been placing orders and we feel very honored.”

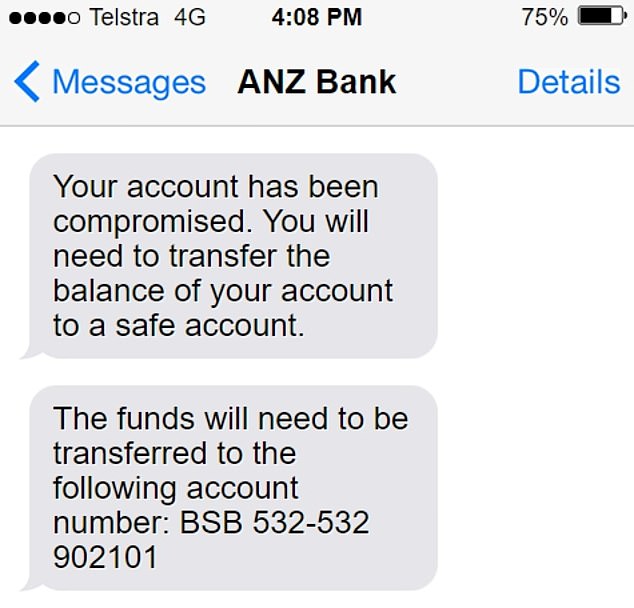

Early last year, businessman Paul Trefry issued a warning about a sophisticated text message scam targeting ANZ customers, after he was scammed out of $130,000.

The criminals sent a text message to Mr Trefry from the same number used by ANZ Bank. It appeared in the same message thread as legitimate text messages from the bank, which made him think it wasn’t a scam.

The text message warned that his account had been compromised and that he needed to transfer his money to a new “more secure” account, which turned out to be the criminals’.

“I run a business and not having a business credit card makes things very difficult, so the second option was better for me,” he said.

Over the next four days, Trefry sent $130,000 to the account managed by the scammers.

Early last year, businessman Paul Trefry issued a warning about a sophisticated text message scam targeting ANZ customers, after he was scammed out of $130,000.

ANZ recovered some of the money but Mr Trefry (pictured) was still $85,000 out of pocket

ANZ’s fraud team did not contact Trefry about his strange transfers until a week after receiving the false alert. At that time, he had already lost $130,000.

“They asked me about a transfer of $17,500 to one account and I said, ‘Well, guys, I’m just following your instructions,’ and they said, ‘No, we wouldn’t give you instructions to transfer money to different accounts.'” ‘.

‘…He (the ANZ representative) said, ‘look, it’s a very elaborate scam these guys have been running, and they copy the ANZ protocol to a tee, unfortunately, there won’t be much we can do for you. ‘.’

He called on ANZ to do more to alert its customers to current scams.

“They have a responsibility to their customers to notify them about these types of things,” he said.

‘They’ve known it for a long time.

“It’s easy to send a text message to your customers that this service has been compromised and check the text messages before doing anything.”

ANZ recovered some of the money, but Mr Trefry was still left with $85,000 out of pocket.

WhatsNew2Day Australia has contacted Meta for comment.