Mortgage rates have fallen to their lowest level in 15 months, but one expert warns that a bigger drop is needed to revive the frozen housing market.

The “Oracle of Wall Street,” Meredith Whitney, has said rates must fall below 6 percent.

Once rates are within the 5 percent range, buyers tend to feel encouraged that it is worth taking the plunge.

Whitney, who earned his nickname after predicting the global financial crisis, said home prices also need to fall by a tenth for there to be a material difference in affordability.

Mortgage rates at decades-high levels and record home prices mean the average home loan payment this year is double what it was in 2000, he said.

Meredith Whitney said mortgage rates need to reach 6 percent or less to revive the frozen market

The average 30-year fixed-rate mortgage fell to 6.47 percent this week, according to Freddie Mac figures as of Aug. 8.

This was the biggest drop so far this year, down from 6.73 percent the previous week.

Rates are now the lowest since mid-May last year.

An expected interest rate cut by the Federal Reserve in September is likely to push them lower still.

High rates have kept buyers on the sidelines. They have also kept Potential sellers put properties on the market.

Millions of Americans are locked into lower rates on their existing loans and don’t want to be forced into a more expensive mortgage if they move home.

“Mortgage rates fell this week to their lowest level in more than a year due to a likely overreaction to a poor jobs report and financial market turmoil for an economy that remains on solid footing,” said Sam Khater, chief economist at Freddie Mac.

‘Falling mortgage rates increase the purchasing power of potential homebuyers and should begin to spark their interest in purchasing a home.’

While this decline is welcome, Whitney, CEO of Meredith Whitney Advisory Group, warns that a bigger shift is needed to achieve real change in the market.

“If mortgage rates fall below 6 per cent, you will see an increase in both home equity generation and home sales,” he told DailyMail.com.

“When volume starts to come into the market, prices will drop and the cycle will perpetuate.”

Prices need to come down at least 10 percent along with mortgage rates to make the market affordable for new home buyers, he said.

In recent years, the housing market has become increasingly unaffordable for millions of Americans.

Since 2020, mortgage rates have more than doubled, Whitney said, and median home prices have risen 33 percent.

This has translated into a 101 percent increase in monthly capital and interest costs for new homeowners.

In some cases, this would mean that homeowners’ payments would continue to increase even if they bought a cheaper home.

‘With wage growth at just 22.6 percent, it’s no wonder hopeful homebuyers continue to stay on the sidelines.

‘Even when buyers have the necessary down payment, the monthly costs of homeownership are out of reach for many potential buyers.’

However, once the housing market starts to unlock, she predicts that house prices will begin a period of decline, but this could take several months or longer.

“Meanwhile, modest declines in mortgage rates may make second mortgages and home equity lines of credit more attractive to increasingly cash-strapped homeowners,” Whitney added.

For the first time in 15 years, struggling consumers are starting to tap into the equity in their homes, he said.

A home equity loan, also known as a home equity installment loan or second mortgage, allows homeowners to borrow against the equity in their property.

The equity you have in a property is the difference between its market value and the outstanding balance on your mortgage.

According to Redfin, the total value of the US housing market has grown by 6.6 percent over the past 12 months. Homes have gained a whopping $3.1 trillion in value to a record $49.6 trillion.

The average 30-year fixed-rate mortgage fell to 6.47 percent this week, according to Freddie Mac figures as of Aug. 8.

“If mortgage rates fall below 6 percent, you’ll see an increase in both home equity generation and home sales,” Meredith Whitney said.

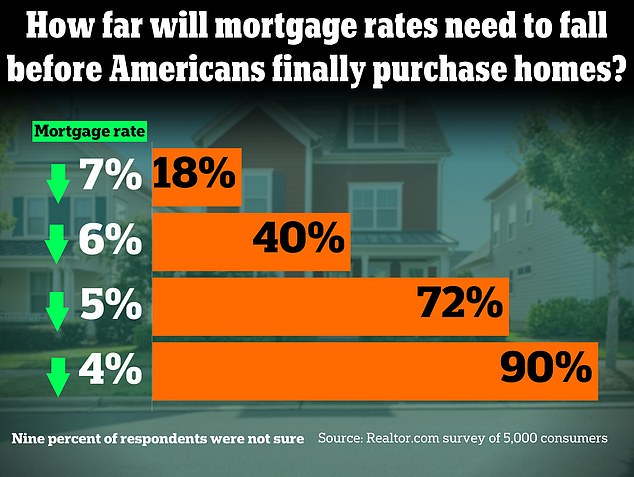

About 72 percent of the 5,000 potential home buyers said it would be possible to buy a home if mortgage rates fell below 5 percent.

“Lower mortgage rates increase the purchasing power of potential homebuyers,” said Sam Khater, chief economist at Freddie Mac.

Whitney previously said the Fed would need to cut rates by 75 to 100 basis points to have a real impact on mortgage rates.

This would reduce interest rates to below 4 percent, from the current level of between 5.25 percent and 5.5 percent.

Following an aggressive rate hike campaign, the central bank has kept rates at this level – the highest in 23 years – since July 2023.

This, in turn, has helped keep mortgage rates high.

Benchmark borrowing costs do not directly affect mortgage rates, but home loan costs will fall when banks believe a future cut is likely.

Mortgage rates follow the pattern of 10-year Treasury bond yields, which are determined by a variety of factors including inflation, economic growth and the Federal Reserve funds rate.

A weak jobs report on August 2 and a stock market plunge on August 5 mean markets are pricing in a rate cut in September, but economists are unsure how big that cut will be.

Whitney’s comments come after a study earlier this year found that the majority of prospective homebuyers are waiting for rates to drop even further (below 5 percent) to move forward with a home purchase.

A real estate agent.com survey A study of 5,000 Americans conducted last November, when rates were above 7 percent, found that only 18 percent of people were expecting rates to fall below 7 percent.

About 22 percent said they would buy a home if rates fell below 6 percent, it found.

But once rates dropped below 5 percent, then 72 percent of people said it would be feasible to consider buying a property.