<!–

<!–

<!– <!–

<!–

<!–

<!–

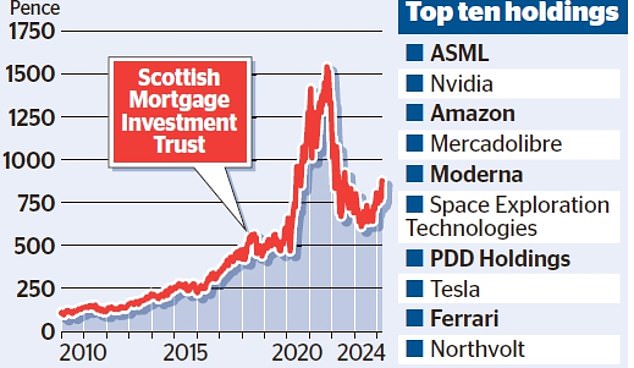

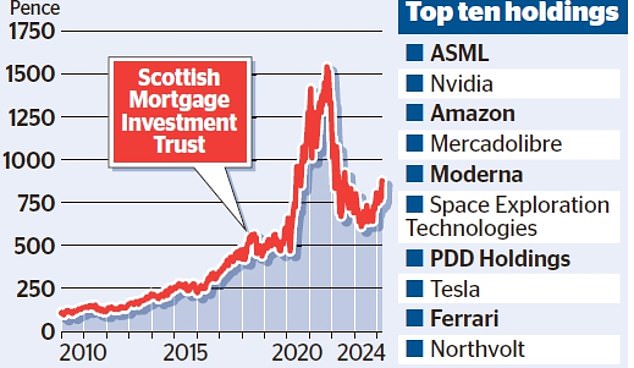

Scottish Mortgage Investment Trust (SMIT) was once the toast of the town, but its fall over the past two and a half years has upset many private and institutional investors.

SMIT is known for its stock selection led by star investment manager James Anderson, who left in 2022 after 21 years at the helm. SMIT was the source of funding for British investors seeking access to fast-growing global technology companies.

But since peaking in November 2021, shares have fallen by around 40 per cent to 875.8 pence as higher interest rates triggered a sell-off in technology shares.

There have been signs of recovery since the turn of the year, but share price weakness left the Edinburgh-based investment trust vulnerable, and Elliott Management struck last Friday.

The US hedge fund announced that it is now the company’s largest shareholder, with a 5 per cent stake worth around £600 million.

Vulnerable: Since peaking in November 2021, shares of Scottish Mortgage Investment Trust have fallen around 40% as higher interest rates caused a sell-off in technology shares

Elliott has been slowly building up the stake since late 2023, buying 0.5 percent of the trust’s shares as well as another 4.75 percent in equity swaps, crossing the 5 percent threshold on March 19.

The fund has a formidable reputation: an activist investor that has never been afraid to use hardball tactics to get what it wants.

Owned by Paul Singer, who founded the company in 1977, it built its reputation as an investor in distressed sovereign debt.

In Britain, Elliott has clashed with GSK – at one point launching a campaign to determine whether CEO Emma Walmsley was the right person to lead the pharmaceutical company – as well as energy company SSE and miner BHP.

Elliott also owns bookstore Waterstones and recently failed in a bid for electronics store Currys.

Elliott has history in Scotland, having set up the Dundee-based Alliance Trust more than a decade ago. It invested in 2010, criticizing the investment group’s poor performance, high costs and loss-making subsidiaries, including Alliance Trust Investments and online trading platform Alliance Trust Savings.

The campaign erupted into open war in 2015 with the ouster of CEO Katherine Garrett-Cox and resignation from the board.

Alliance, like SMIT, had a large retail base and after six years of turbulence finally agreed to buy out Elliott’s 19.75 percent stake.

An investment advisor did not rule out similar problems at SMIT and said: ‘These two who are now involved in SMIT each have a very different culture.

SMIT is part of the Scottish establishment, while Elliott is aggressive and proud of it.’

So far, the language between Elliott and Scottish Mortgage has been cordial, with the two management teams getting along.

Elliott partner Nabeel Bhanji said on Friday: ‘We are grateful for the dialogue we have had with the board and management of Scottish Mortgage over the past few months and look forward to continuing our engagement.’

Justin Dowley, chairman of SMIT, responded: “We have, as is often the case, been in contact with shareholders.”

But how long the discourse remains civil remains to be seen.

According to sources, Elliott wants SMIT to increase the valuation of its portfolio by selling parts of its investments.

Particular attention is paid to the company’s unlisted shares, which now make up 35 percent of the portfolio. Among them are Bytedance, the owner of Tik Tok, and Elon Musk’s Space X.

The fund’s growing interest in private companies has drawn criticism from analysts and investors alike and means the fund is at a continued discount to net asset value, despite the company saying earlier this month it would make £1 billion available for buybacks of treasury shares in the next two years.

Elliott believes the trust has undervalued these private assets and should reassure the market about their value by selling off parts of its holdings as companies such as space exploration technology company Space X make private share buybacks.

Neil Wilson, analyst at Markets.com, said: ‘The unquoted element of the portfolio has left them vulnerable. Elliott has noticed weak valuation and is targeting it.”