This week’s financial panic isn’t just raising fears about people’s savings, investments and job prospects.

Trends from past economic crises show that when markets take a downturn, it can wreak havoc on the health of ordinary Americans for years.

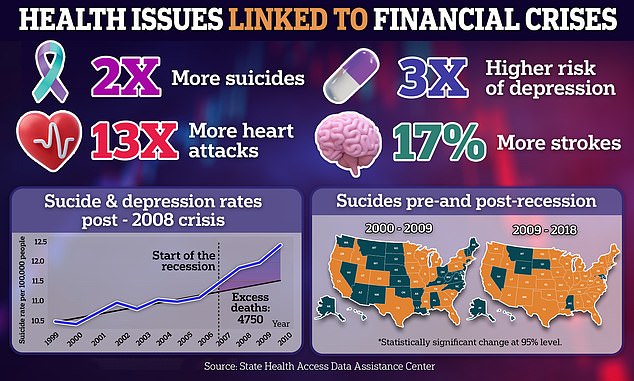

Increases in suicides, alcohol and drug abuse, heart attacks, strokes and birth complications typically follow when the United States sinks into a recession.

And this seems increasingly likely to become reality following the latest wave of economic uncertainty.

Research has pointed to increases in a wide range of negative health outcomes linked to financial stress, which became apparent after the 2008 economic crisis.

Goldman Sachs economists over the weekend raised the probability that the US economy will enter a recession in the next 12 months from 15 to 25 percent.

Fears of a US recession, sparked by data showing unemployment was unexpectedly rising, fuelled a sell-off in global stock markets on Monday.

The link between health and recessions is well established by now, and it affects more than just Wall Street bankers.

The indirect effects of a recession in terms of unemployment, declining wages, rising debt and higher housing costs wreak havoc on the daily lives of all Americans.

The last time the United States was in recession was after the 2008 financial crisis.

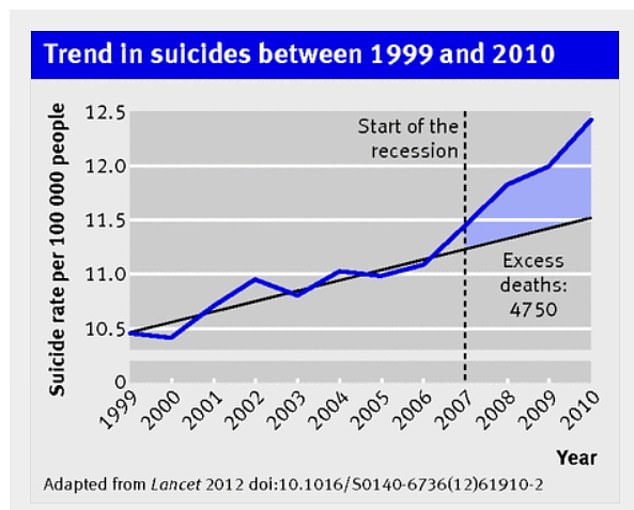

In 2009, there were about 5,000 more suicides than would be expected in an average year, an increase of about 15 percent.

And suicides continued to rise in the years that followed.

Between 2000 and 2009, only 22 states had large increases in suicide rates.

But between 2009 and 2018, 41 states saw their suicide rates rise significantly, with the District of Columbia experiencing The largest increase of 70 percent.

Overall, research has shown that financial problems characterized by unemployment, difficulty finding work, credit card and other forms of debt, and low income can make a person 20 times more likely to take his or her own life.

It can also increase the likelihood that a person will drink heavily or use drugs to cope with the devastating emotional toll that debt, unemployment and lost wages can take.

In addition to increasing the likelihood of depression and even suicidal thoughts, chronic stress linked to financial crises can increase the risk of heart attack or stroke.

Deaths from cirrhosis of the liver related to excessive alcohol consumption increased by almost 14 percent in 2009 compared to 2006, from 4.4 deaths per 100,000 people, to about five deaths per 100,000 people in 2009.

And today, with fentanyl causing record overdose deaths, experts like licensed therapist Colleen Marshall are worried that a growing sense of hopelessness and depression could drive those rates even higher.

Ms Marshall, a therapist at the Two Chairs therapy group in California, told DailyMail.com: “The Great Depression crisis was historically linked to a significant increase in suicidality, in people’s despair. And 2008 makes sense – there was a link there.

“History repeats itself,” he said.

“I would look at it like this: If the factors that led to the 2008 spike (in suicide deaths) and the 1929 spike are similar to what we’re seeing today historically, then you can extrapolate that we would likely see a similar impact in another recession.”

The same trends have been observed in other parts of the world. During the 1997 economic crisis in Japan, South Korea and Hong Kong, there were an estimated 10,000 additional suicides between 1997 and 1998.

Reports on the Great Depression show that suicide rates also skyrocketed during that time. In 1929, there were 17 suicides per 100,000 people. By 1932, this figure had risen to 21.3 suicides per 100,000 people, an increase of about 25 percent, according to economist John Kenneth Galbraith.

According to Marshall, anyone can experience the kind of deep despair that can lead to a lethal act of self-harm, but the average American can suffer the effects of a recession more acutely.

From unemployment and the inability to find work to the threat of homelessness, Ms Marshall said a financial crisis is always “a real risk factor and trigger” for depression and suicidal behaviour.

Even if it doesn’t end in suicide, a financial crisis has a strong link to depression, and can affect a high-powered executive as severely as an average citizen, Marshall said.

“For someone who is ousted as CEO of a major Fortune 500 company, it could be the same kind of ego blow that would also lead to despair.”

But it’s not just depression and suicide rates that could rise.

Constant worry about one’s finances and ability to support oneself or one’s family can lead to chronic stress, which has a major influence on a person’s risk for chronic diseases, such as high blood pressure and stroke.

A 2018 study looked at 106 people with a heart attack who went to a Johannesburg hospital. The study found that patients who experienced significant financial stress had a 13 times higher risk of suffering a heart attack compared to those with minimal or no financial stress.

Among the after-effects of the 2008 crisis was a drastic increase in heart problems.

Between 2010 and 2015, the U.S. counties that suffered the most in terms of job loss, homelessness and debt saw a large increase in heart disease death rates from 122 to 127.6 deaths per 100,000 people.

Dr. Sameed Khatana, a cardiovascular researcher at the University of Pennsylvania, said: “The big economic trends that we can read about in the newspaper — things like recessions and job losses — really have an impact on certain communities and the cardiovascular health of the people who live in those communities.”

The financial crisis has also been linked to an increase in strokes.

Researchers in Ireland, where the 2008 economic crisis hit hard, reported that stroke deaths between 2007 and 2010 rose by about 17 percent compared with the period before the crisis.

Money problems are also related to insomnia. Three-quarters of Americans have lost sleep over fears of an economic recession.

Dr. Susheel Patil, a sleep medicine physician and spokesperson for the American Academy of Sleep Medicine saying‘Persistent, anxious thoughts can make it difficult to fall asleep and affect sleep quality, so it’s understandable that a significant number of Americans are losing sleep during this period of economic instability, inflation, and job market insecurity.’

Chronic stress about money also increases a person’s risk of experiencing dementia later in life, as does that of pregnant women. chances of giving birth prematurely a low birth weight baby.

The relentless assault of financial stress on mental and physical well-being is well documented.

Thinking about it triggers the body’s stress response by releasing cortisol and adrenaline.

Chronic activation of these hormones in chronic stress leads to high blood pressure, immune system problems, and inflammation that increase the chances of a long list of cardiac and neurological problems.

In addition to the physiological effects of stress, financial instability impedes a person’s ability to live in a safe and stable environment, afford healthy, health-promoting foods, and seek support in the form of stress therapy.

TO Review 2023 A study of 98 papers focusing on their overall impact on mental health concluded that an increase in unemployment following a financial crisis “was shown to predict the prevalence of anxiety and depression among the general population.”

The review also found that even among people who were employed, “negative impacts associated with working in the private sector, having a lower income, a bank loan, a heavier workload, seeing reductions in company profits or losses in the stock market, being older or being ‘bullied’ at work can all lead to increases in mental illness.”

Current fears of a recession are not unfounded. Following a disappointing jobs report, the Federal Reserve’s failure to cut interest rates and Monday’s sell-off in stocks, economists at Goldman Sachs raised the probability of a recession in the next year from 15 percent to 25 percent.