Approaches to making a decision. There are 28 days left to invest your tax-free Isa (individual savings account) allowance.

In the next tax year, investors will be tempted by the Big British Isa, which allows an extra £5,000 worth of UK shares on top of the existing £20,000 allowance.

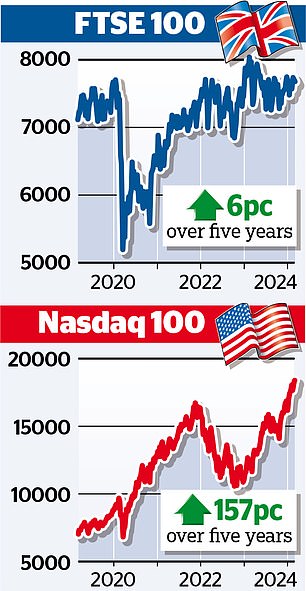

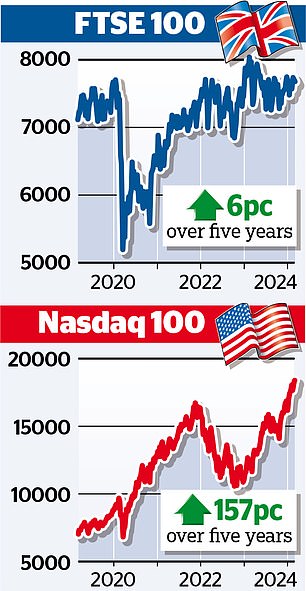

However, few details are available at this time. And for those who want to invest this year’s allocation, there are some difficult decisions regarding the US, which has more world-leading companies than any other market. Investors looking at the US are likely to be torn between fear of missing out and fear of buying at the peak.

There are strong arguments for “feeling the fear and doing it anyway”, as Susan Jeffers, the American self-help author, advises. Gerrit Smit, manager of the Stonehage Fleming Global Best Ideas Equity fund, owner of American technology giants Alphabet and Microsoft, says: “There is more risk in not investing in the United States than in investing.”

“The nation has the best entrepreneurs in the world and an economy that is most likely to remain resilient under current conditions.”

Flying the flag: Investors looking at the United States will likely be torn between fear of missing out and fear of buying at the peak.

As Bestinvest’s Jason Hollands points out, U.S. markets tend to thrive in presidential election years: “In the 19 elections since the end of World War II, the S&P 500 has returned positive returns on all but two occasions.” , which were in 2000 when the dotcom bubble burst and 2008, at the height of the global financial crisis.

But there are still jitters, following a 28 percent rise in the S&P 500 index over the past 12 months to 5,130.95. This is largely due to enthusiasm for the AI revolution, which has caused shares of the Magnificent Seven (Mag 7) tech giants to double or nearly triple over the past year.

The ‘Mag 7’ are Alphabet, Amazon, Apple, Meta, Microsoft, Tesla and semiconductor manufacturer Nvidia.

AI data center server specialist Super Micro Computer recently joined the S&P 500 following a 276 percent jump in its shares since early January.

This week Bank of America raised its S&P forecast to 5,400. But the Shiller Cape Index – a guide to future returns – is sending danger signals.

In this context, the American investors are Team Kolanovic or Team Kostin. Marko Kolanovic, the guru at JP Morgan Chase & Co, warns that a bubble is forming. David Kostin, his counterpart at rival investment bank Goldman Sachs, maintains that even the valuations of technology stocks “are supported by fundamentals.” If you’re on Kostin’s side and can afford to take a longer-term view, you should still be prepared for bouts of nervousness.

Donald Trump, if elected president in November, could try to limit the influence of Big Tech. Trade relations could become more problematic, with tariffs on imports, including those from China, being charged at 60 percent.

Hollands says: “It is difficult to know how these factors could affect stock markets, but they clearly inject a degree of uncertainty.”

‘The S&P 500 is trading at prices that are 21 times projected earnings for the next 12 months, or 33 percent above the 20-year average level of 15.8 times.

‘In terms of price-to-earnings ratio, S&P 500 companies trade at twice the ratio of those in the UK.

“Buying US shares means paying twice as much for their benefits as if you bought UK shares.”

The Bloomberg Magnificent Seven Total Return Index shows these stocks trading at 38 times earnings, suggesting a price pullback is likely. However, as Smit argues, the number of people expecting weakness to occur soon could send prices skyrocketing again. In light of this, you should develop a strategy for your American Isa adventure.

There is no obligation to commit the full £20,000 to this market. You could invest a portion or start a monthly contribution plan in a fund or trust. This is an excellent route for younger investors.

Renowned US and global investment funds such as Alliance, F&C and JP Morgan American have significant stakes in Mag 7.

Allianz Technology (of which I am the owner) and Polar Capital Technology focus on Big Tech.

But if you already own these trusts, diversification makes sense, since if interest rates fall, the rally could spread from technology to other industries.

Beneficiaries could include “wealthy boomer renaissance” stocks. The view is that this demographic will spend a lot on vacations and healthcare, including weight loss medications.

Shares of cruise operator Carnival and pharmaceutical group Eli Lilly have risen.

David Harrison, manager of the Rathbone Greenbank Global Sustainability Fund, says some healthcare stocks have been hit by concerns that weight-loss drugs could reduce the need for other treatments. And he adds: “These declines have been exaggerated.”

Funds that offer a wide range of exposure to the US include Premier Miton US Opportunities and the Invesco FTSE RAFI US 1000 ETF.

Take a deep breath and trust that these American-born companies can turn out to be exceptional.

Some links in this article may be affiliate links. If you click on them, we may earn a small commission. That helps us fund This Is Money and keep it free to use. We do not write articles to promote products. We do not allow any commercial relationship to affect our editorial independence.