Table of Contents

I have a variable rate mortgage with Natwest but can I change to a new deal?

I owe £31,000 which I have to repay over the next five years and ten months. That’s an interest rate of 6.04 per cent, but it will come down after the Bank of England’s latest cut in the base rate.

I earn £3000 a month so I’ve been paying too much. Would it be better if I keep the tracker or fix it? Password

SCROLL DOWN TO FIND OUT HOW TO ASK DAVID HIS MORTGAGE QUESTION

Mortgage Help: In our weekly column, broker David Hollingworth, associate director at L&C Mortgages, answers your questions about homeownership and real estate issues.

David Hollingworth responds: The decision to opt for a variable or fixed rate has historically been one of the most important decisions a borrower must make.

However, this dilemma barely emerged when the base rate plummeted to ultra-low levels after the financial crisis and remained there until interest rates began to rise in late 2021.

For much of the past 10 to 15 years, the outlook for interest rates was so benign and rates were so low that the use of variable and tracking rates was sharply reduced.

There was little chance of further reductions and follow-up rates were often only equal to or even higher than fixed rates.

> What’s next for mortgage rates?

That position is changing as interest rates have risen sharply in recent years.

Rising interest rates typically only underscore borrowers’ natural inclination to lock in a fixed rate, and the threat of higher monthly payments tends to make borrowers prefer the safe harbor of a fix.

Mortgage Rate Outlook

Now that rates have changed again following the August cut, more borrowers are likely to wonder whether a variable-rate mortgage might be a good option.

The difficulty is that, as you are discovering, the fees for a tracker are currently higher than what you might find with a flat rate.

Fixed rates will change depending on what markets expect to happen with interest rates, while tracker rates will react once interest rates have changed.

It is impossible to know exactly how interest rate movements will play out and we have seen market predictions fluctuate substantially over time as sentiment changes.

However, the current expectation is that the base rate could be cut again before the end of the year, before continuing to decline gently into next year.

We’re not sure if that will be fast enough to offset and overcome the fare difference you might pay with a fixed rate.

Five-year fixed rates are now available below 4 percent, although they usually carry an origination fee and, due to the size of your mortgage, it is important to keep fees to a minimum.

Still, they will still be around 1.5 percent lower than their current tracking rate of 5.79 percent.

Track and change

Natwest imposes early repayment charges (ERCs) on its trackers, which you would incur if you switched to a different lender.

The track and switch option allows tracked borrowers to move to one of Natwest’s fixed rate options without having to pay a penalty, even during the term of the agreement.

Natwest individualises product transfer options for each client but you or your adviser will be able to see the rates available for a solution.

That will help you assess the spread between the tracker and a fixed deal and whether you think rates will fall quickly enough to make the tracker a better option.

> How to remortgage your home: a guide to finding the best deal

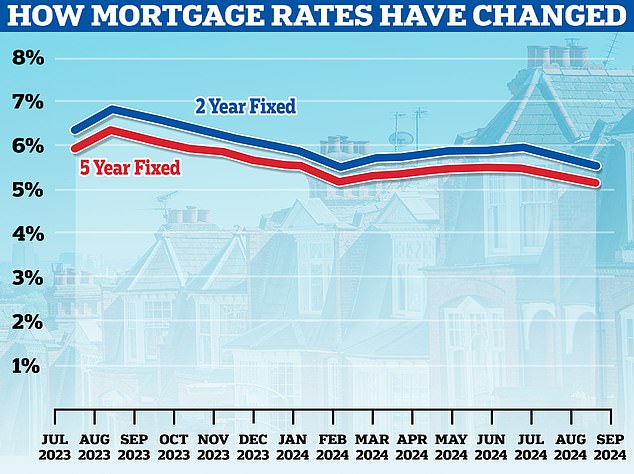

Falling: Mortgage rates are falling and lenders anticipate interest rate cuts

In addition to this, there is the risk of unforeseen events that could lead to an increase in rates.

It would also be helpful to know how much time is left on your current tracker.

Since time is short, you should avoid accepting a deal that leaves you stuck with a standard variable rate.

Natwest’s current eligibility for product transfers would require you to have £10,000 remaining, at least 27 months remaining on your mortgage and any new products to be finalised before the term comes to an end.

Paying

Keeping up overpayments could make the entire term academic. Natwest is one of the most generous lenders, allowing up to 20 per cent a year in overpayments without penalty, so you could be on your way to paying off the mortgage sooner.

With a relatively small remaining balance, the interest rate won’t have as big an impact as it would on a more substantial loan.

The difference between monthly payments of £31,000 over five years at a rate of 5.79 per cent and 4.29 per cent would be just around £21.

Therefore, you may want to focus more on aligning the product you choose and its functionality with your target date for paying off your mortgage.

No one wants to pay more interest than they need to, but based on current market expectations, the difference between a two-year fixed-rate loan and a two-year tracker-rate loan could be relatively small, and your substantial overpayments should only help to reduce the impact on the rate.

> Best Mortgage Rates for First-Time Buyers: How Long Should You Lock Them In?

Navigate the mortgage labyrinth

Some links in this article may be affiliate links. If you click on them we may earn a small commission. This helps us fund This Is Money and keep it free to use. We do not write articles to promote products. We do not allow any commercial relationships to affect our editorial independence.